U.S. stocks managed to grind to new highs in the face of rising COVID cases. The passage of the infrastructure bill in the Senate and data suggesting moderation in inflation boosted investor confidence. Consumer sentiment, however, succumbed to the resurgence in COVID cases. The reflation trade was in full flow. Value stocks such as materials and financials led the advance.

The U.S. Senate passed a $1 trillion infrastructure package with broad bipartisan support. The package includes billions of dollars for upgrading transportation infrastructure, broadband internet, electric grids, and more. This package now needs to be passed by the House and signed into law by President Biden.

Consumer price data showed the inflation rate moderating in July. The Labor Department reported the consumer price index rose 0.5% in July after climbing 0.9% in June. The drop in month-to-month inflation eased concerns of runaway inflation. Further, core inflation excluding food and energy prices rose by 0.3% in July, a tad below economists’ forecast.

The University of Michigan reported a sharp drop in its consumer-sentiment index. U. S. consumer sentiment fell from 81.2 in July to 70.2 in August, the lowest since December 2011. The university attributed the drop in sentiment to the rapid rise in the COVID cases, dashing hopes of an imminent end to the pandemic.

The 10-year Treasury yield stayed higher for most of the week after the Senate passed the infrastructure bill and inflation lagged forecasts. The 10-year yield slipped after consumer sentiment showed a steep drop and closed the week essentially where it started at 1.29%.

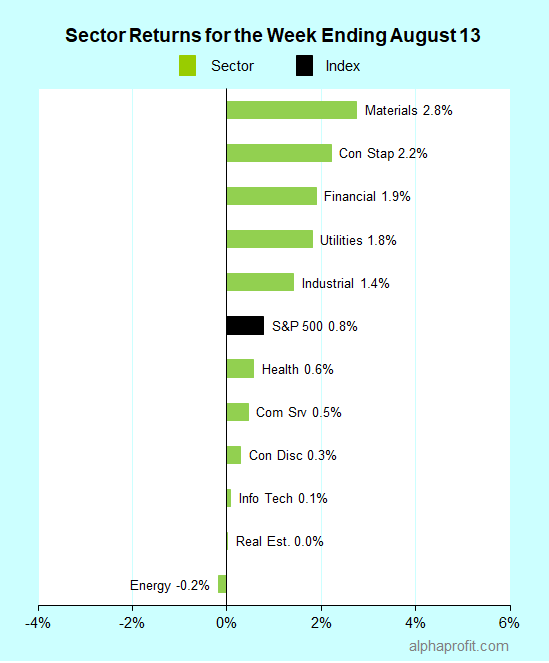

For the week ending August 13, the S&P 500 (SPY) rose 0.8%. Ten of the 11 sectors gained.

Materials (XLB), consumer staples (XLP), and financials (XLF) led the S&P 500, gaining 1.9% or more.

Energy (XLE), real estate (XLRE), and information technology (XLK) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 2-to-1 ratio.

The S&P 500’s top 10 winners included consumer discretionary, consumer staples, financial, health care, industrial, information technology, and materials companies.

1. Materials

Nucor Corp. (NUE) +20% – Shares of the steelmaker surged 20% to claims honors as the week’s top performer in the S&P 500. Investors bid Nucor shares higher after the Senate passed the $1 trillion infrastructure bill, bringing the legislation to increase spending on roads, bridges, and rail lines closer to reality. Nucor shares also got a lift from rising steel prices. The price of U. S. hot-rolled coil topped $1,900 per short ton, setting a new all-time high.

2. Health Care

Organon & Co. (OGN) +16% – The women’s health-focused spinoff from Merck reported earnings as an independent company for the first time. Organon beat analysts’ quarterly sales and EPS forecasts by 5% and 20%, respectively. The global healthcare company reaffirmed its full-year guidance and initiated a $0.28 a share quarterly dividend translating to a 3.2% yield.

Pfizer (PFE) +8% – Pfizer rallied as a member of the COVID vaccine makers group. The number of COVID cases continued to rise in the U. S. The FDA approved booster shots for immunocompromised individuals. Pfizer and Germany’s BioNTech (BNTX) are partners in the effort to develop & produce Comirnaty, an mRNA-based COVID vaccine.

3. Consumer Staples

Tyson Foods (TSN) +15% – The meat processor’s quarterly sales and EPS exceeded analysts’ forecasts by 8% and 62%, respectively. Tyson raised its full-year sales forecast, citing higher beef demand from restaurant re-openings.

Sysco Corp. (SYY) +7% – The food distributor swung to a profit from its prior-year loss as sales surged 82% from 2020’s COVID-impacted quarter. Sysco’s sales and EPS topped analysts’ forecasts. Citing robust July sales, Sysco raised its fiscal 2022 EPS guidance by 3%.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week also included:

- eCommerce marketplace operator eBay Inc. (EBAY) +13%

- Security software provider NortonLifeLock (NLOK) +10%

- Online arts & crafts retailer Etsy, Inc. (ETSY) +8%

- Railroad Kansas City Southern (KSU) +8%

- Diversified insurer American International Group (AIG)+7%

Top ETFs for the week

The following ETFs themes worked well: metals including platinum & copper, infrastructure spending, and robotics. The top ETFs for the week include:

- SPDR S&P Metals and Mining ETF (XME) +5.4%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT) +4.9%

- Global X U.S. Infrastructure Development ETF (PAVE) +3.6%

- Global X Robotics & Artificial Intelligence ETF (BOTZ) +3.1%

- Global X Copper Miners ETF (COPX) +3.1%

Top Fidelity Fund for the week

- Fidelity Agricultural Productivity (FARMX) +3.4%

Looking ahead to the week of August 16

Investors will look to the retail sector for insights on consumer health after consumer sentiment declined abruptly last week. The minutes of the July FOMC meeting can also be a market driver if it sheds light on the Fed’s tapering process. Investors are eyeing value stocks to see if they can extend their market leadership from the past week.

* Investors will look to economic data and retail sector earnings reports to assess the impact of the decline in consumer sentiment on consumer behavior. The Census Bureau releases the July retail sales report on Tuesday, with Dow Jones calling for a 0.2% decline. The week also includes earnings reports from several retailers, including Walmart, Home Depot, Lowe’s, Target, and Macy’s.

* The Federal Reserve releases the minutes of the July 27-28 FOMC meeting on Wednesday. Investors will scrutinize them for clues on the central bank’s plans to end its bond-buying program, also called the tapering process.

* Investors are watching if cyclical stocks can sustain their leadership from last week. While a rise in bond yields and a decline in COVID cases will support value stocks, economic data such as weekly jobless claims, industrial production, and the Empire State Manufacturing Index can likely play a role in sustaining the reflation trade.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023