Steadying COVID-19 case count helped stocks sensitive to the ‘reopening’ of the economy perform well last week. The stalemate in Washington on the new coronavirus stimulus package did not deter investors. Economic data gave a mixed picture.

The average daily count of new COVID-19 cases in the U. S. trended modestly lower last week to 54,900 from 56,100 the week before. Russian President Putin announced that an institute in Moscow has registered Sputnik-V as the first coronavirus vaccine in the world.

Washington lawmakers were unable to move forward with a coronavirus stimulus bill, despite the legal and logistical questions remaining on the executive orders announced by President Trump on Saturday, August 8. Further negotiations are unlikely before September 8 since the Senate is in recess and House Representatives have left for the month.

In economic data, weekly jobless claims surprised to the upside while retail sales did not. Initial weekly jobless claims for the week ending August 8 dropped to 963,000, better than economists’ 1.1 million estimate. This marked the lowest weekly jobless claims since mid-March. Retail sales rose 1.2% in July from June, lower than economists’ 1.9% forecast.

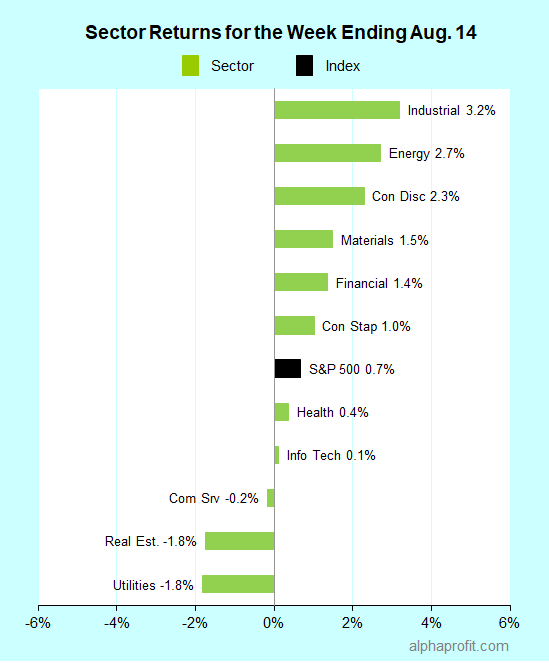

For the week ending August 14, the S&P 500 (SPY) rose 0.7%.

Eight of the 11 sectors gained.

Industrials (XLI), energy (XLE), and consumer discretionary (XLY) led the S&P 500.

Utilities (XLU), real estate (XLRE), and communication services (XLC) lagged the benchmark.

Advancing stocks in the S&P 500 outnumbered decliners by a wide 2-to-1 ratio.

As many as 10 of the S&P 500 members advanced double-digits.

For the second straight week, the S&P 500’s top 10 winners had a smaller market capitalization tilt. The median market cap of the top 10 winners was below $13 billion. Six of the top 10 winners were consumer discretionary stocks led by cruise operators and resort & casino operators.

1. Cruise operators – Royal Caribbean (RCL) up 16% and Norwegian Cruise Lines (NCLH) up 13%

Royal Caribbean (RCL) shares with a 16% gain were the S&P 500’s top performer last week. Although Royal Caribbean’s quarterly loss exceeded analysts’ estimate, investors focused on quarterly revenue of $176 million topping analysts’ $44 million forecast.

Shares of Norwegian Cruise Lines (NCLH) and Carnival Corp. (CCL) joined shares of Royal Caribbean in the rally. Carnival’s 9% gain fell short of the top 10 cut-off.

2. Resort & casino operators – Wynn Resorts (WYNN) and MGM Resorts International (MGM) up 15% each

Shares of casino operators Wynn Resorts (WYNN), MGM Resorts International (MGM), and Las Vegas Sands (LVS) shot up on optimism of gambling revenues rising soon.

The Chinese enclave of Macao allowed tourist visas from the city of Zhuhai in China and non-tourist visas from all mainland China provinces. All three companies have significant operations in Macao. Las Vegas Sands shares’ 9% gain made them the 11th best performer in the S&P 500.

Separately, Barry Diller’s IAC/InterActiveCorp. (IACI) announced a 12% stake in MGM Resorts, eyeing growth in online gaming.

3. Freight & logistics – FedEx (FDX) up 14%

FedEx (FDX) shares rose after Bernstein upgraded their rating from ‘Market Perform’ to ‘Outperform’. Bernstein noted FedEx’s improving parcel pricing and delivery margin from the rapid rise in e-commerce penetration.

Other double-digit gainers in the top 10 winners included:

- Halliburton (HAL) from the energy sector up 12%

- Ulta Beauty (ULTA) and Tapestry (TPR) from the consumer discretionary sector up 11% and 10%, respectively

- Corteva (CTVA) from the basic materials sector up 10%

- Simon Property Group (SPG) from the real estate sector up 10%

Looking ahead to the week of August 17

* Investors will get insights on the performance of retailers next week. Nine of 18 S&P 500 members reporting earnings are retailers. The list of reporting retailers includes Walmart (WMT), Home Depot (HD), Lowe’s (LOW), Target (TGT), and TJX Companies (TJX). Outside of the retailing group, semiconductor chipmaker NVIDIA (NVDA), cosmetics company Estee Lauder (EL), and farm equipment maker Deere (DE) step up to the earnings podium.

* Wall Street is watching to see if weekly jobless claims stay below 1 million for a second straight week. Economists forecast 990,000 in weekly jobless claims.

* In this relatively light week, minutes from the Fed’s last meeting along with housing starts and existing home sales data are likely to garner attention.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023