U. S. stocks ended lower for the week as fears over the spread of the coronavirus delta variant sapped investor enthusiasm. The possibility of the Federal Reserve tapering bond purchases soon also weighed on stocks. Such fears eased after Fed Governor Kaplan’s comments on having an open mind about monetary policy.

A sharp rise in U. S. COVID cases, hospitalizations, and deaths dampened investor enthusiasm. The 7-day average of daily new U. S. cases hovered around 140,000, up from about 85,000 at the beginning of August.

Abroad, several Asian nations implemented drastic measures to curb the resurgence of COVID-19 from the highly contagious delta variant.

Worries of the impact of the delta variant on commodity demand weighed on prices. Oil was among the casualties, losing 9% for the week.

The minutes of the July 27-28 Federal Open Market Committee meeting also pressured stocks. They showed the Federal Reserve is willing to reduce monthly bond purchases in 2021.

Comments from Dallas Federal Reserve Governor Kaplan cheered investors on Friday. In an interview with Fox Business Network, Kaplan called the delta variant “the big imponderable” in the economic outlook. Kaplan also said the delta variant has caused him to have an open mind about the path of monetary policy.

The “Buy the Dip” group of investors resurfaced on Friday, pushing stock prices higher. Growth stocks were in favor as the yield on the 10-year Treasury bond ended the week 0.04% lower.

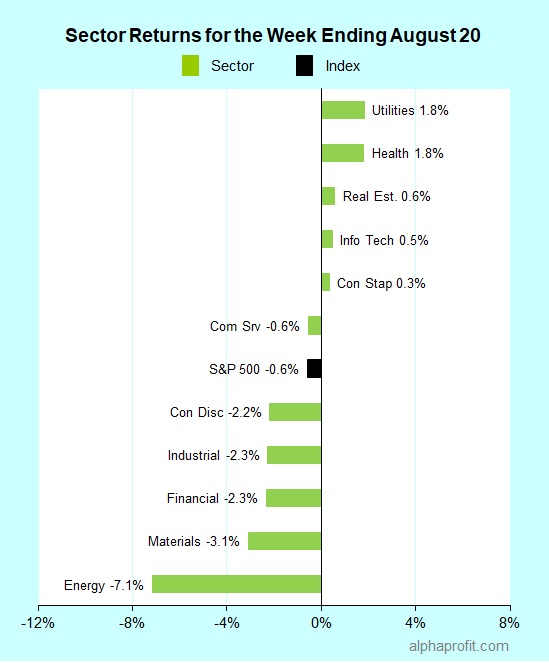

For the week ending August 20, the S&P 500 (SPY) fell 0.6%. Five of the 11 sectors gained.

Utilities (XLU), health care (XLV), and real estate (XLRE) bucked the S&P 500, gaining 0.6% or more.

Energy (XLE), materials (XLB), and financials (XLF) lagged the benchmark.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 9-to-16 ratio.

The S&P 500’s top 10 winners included communication services, consumer discretionary, consumer staples, health care, industrial, information technology, and materials companies.

1. Consumer Staples

Kroger (KR) +10% – The grocery store chain rose 10% to claims honors as the week’s top performer in the S&P 500. The shares rallied after Warren Buffett’s Berkshire Hathaway disclosed buying 11 million Kroger shares, upping its stake in the supermarket to 8.3%.

2. Consumer Discretionary

Lowe’s (LOW) +9% – The builder materials retailer upped its full-year financial outlook, attributed the higher projections to the potential for margin expansion and market share gains. Lowe’s topped analysts’ second-quarter sales & EPS expectations, despite a 2.2% drop in same-store sales.

Bath & Body Works, Inc. (BBWI) +9% – The spinoff from L Brands reported earnings as an independent company for the first time. Bath & Body Works beat analysts’ quarterly EPS forecast by nearly 30% after sales rose 36% from the year-ago quarter.

3. Health Care

Abiomed (ABMD) +8% – The U. S. FDA designated Abiomed’s Impella ECP heart pump a breakthrough device, implying priority for the device’s regulatory review.

Regeneron Pharmaceuticals (REGN) +6% – The Medicines and Healthcare products Regulatory Agency in the U. K. approved Regeneron’s COVID antibody cocktail for use in patients. The Governors of Florida and Texas also recommended the drug for treating patients with COVID.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week also included:

- Automation &testing software provider Synopsys (SNPS) +8%

- Packaging solutions provider Ball Corp. (BLL) +7%

- Entertainment service provider Netflix (NFLX) +6%

- Pest control services provider Rollins (ROL) +6%

- Medical device maker DexCom (DXCM) +6%

Top ETFs for the week

The following ETFs themes worked well: volatility futures, health care including medical devices & service providers, and utilities. The top ETFs for the week include:

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +5.6%

- iShares U.S. Medical Devices ETF (IHI) +2.0%

- iShares U.S. Healthcare Providers ETF (IHF) +2.0%

- Utilities Select Sector SPDR Fund (XLU) +1.8%

- Health Care Select Sector SPDR Fund (XLV) +1.8%

Top Fidelity Fund for the week

- Fidelity Select Medical Technology and Devices (FSMEX) +2.0%

Looking ahead to the week of August 23

The Federal Reserve’s efforts to reverse its easy money policy will be a dominant theme for markets this week, as central bankers gather in Jackson Hole, Wyoming. Investors also get data on inflation and the housing industry. Salesforece.com and Workday are among the companies reporting earnings this week.

* Federal Reserve officials gather for their annual symposium at Jackson Hole, Wyoming. The Fed Chairman’s speech on Friday is typically the highlight of the meeting. Several past Fed chairs have used this speech to communicate messages related to interest rate policy. Investors await Chairman Powell’s comments on the economic recovery from COVID and the impact of the coronavirus delta variant. They are waiting to see if the delta variant could delay the Fed’s timetable for reducing $120 billion in monthly bond purchases.

* The economic calendar includes inflation and housing data. The Federal Reserve’s preferred inflation measure, the personal consumption expenditures data, and the inflation index are due on Friday. Briefing.com expects PCE to rise 0.4% from June to July, a tad less than 0.5% from May to June. Existing and new home sales are due on Monday and Tuesday, respectively.

* A handful of keenly watched earnings reports post this week. They include software firms salesforce.com & Workday, medical devices maker Medtronic, retailers Dollar General & Best Buy, and homebuilder Toll Brothers.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023