Wall Street rallied to push the S&P 500 index above 4,500 for the first time after Fed Chairman successfully avoided a taper tantrum. Powell said tapering of bond purchases is likely to begin this year while stressing tapering does not mean tightening. The nation’s top employers moved to mandate vaccinations for their employees after the U. S. FDA granted full approval for the Pfizer/BioNTech COVID-19 vaccine.

The past week was a good one for U. S. stocks. They rallied in the lead-up to Federal Reserve Chairman Powell’s speech at Jackson Hole, WY, on Friday. Investors bid up stock prices believing Powell would try to avoid a repeat of the 2013 taper tantrum. They viewed the central bank’s decision to hold the Jackson Hole event virtually as a signal the Fed sees a continued need to support the economy.

Chairman Powell did not disappoint investors. Powell said the Fed sees sufficient progress on inflation, but the labor market has not yet improved enough to start tapering monthly bond purchases. He added the Fed has “much ground to cover” to reach its goal of maximum employment. Powell emphasized that the tapering of bond purchases does not mean the central bank will automatically raise interest rates.

Economic data turned out as expected. The Commerce Department reported the personal consumption expenditures index rose 4.2% in the 12 months ending in July. While July marked the highest year-over-year increase in the PCE since 1991, the increase stemmed primarily from transitory factors. The University of Michigan’s consumer-sentiment index slipped as the spread of the coronavirus delta variant dented consumer optimism.

In other developments, the U. S. FDA granted full approval to the COVID-19 vaccine developed by Pfizer and BioNTech. Several of the nation’s leading employers moved to mandate vaccinations for at least some of their employees.

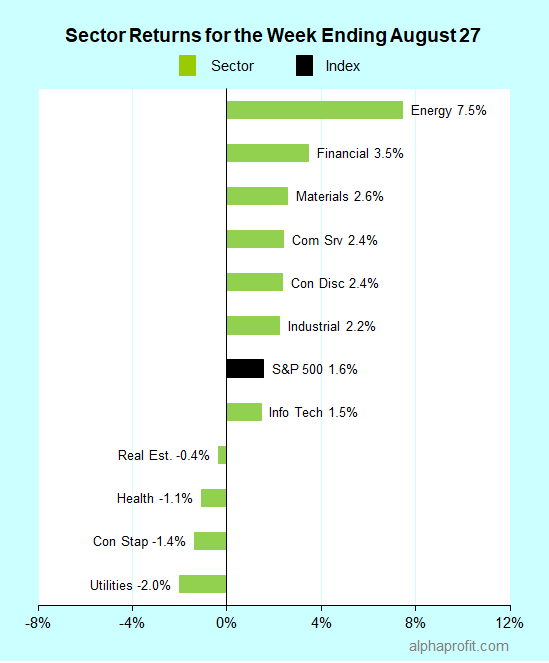

For the week ending August 27, the S&P 500 (SPY) rose 1.6%. Seven of the 11 sectors gained.

Energy (XLE), financials (XLF), and materials (XLB) led the benchmark gaining 2.6% or more.

Utilities (XLU), consumer staples (XLP), and health care (XLV) lagged the S&P 500.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 5-to-2 ratio.

The S&P 500’s top 10 winners list included an even split of consumer discretionary and energy companies.

1. Consumer Discretionary

Online gambling companies and casino operators featured prominently among the week’s top 10 winners. Online gambling company Penn National Gaming (PENN) rose 24% to claim honors as the week’s top performer in the S&P 500. Casino operators Caesars Entertainment (CZR), Las Vegas Sands (LVS), Wynn Resorts (WYNN), and MGM Resorts International (MGM) also figured in the list after gaining 13-22% each.

Online gambling shares perked up on brightening prospects amidst the start of the college football and NFL seasons. Influential investor Cathy Wood sparked interest by increasing the stake of ARK ETFs in digital sports entertainment & gaming company DraftKings. The Wall Street Journal reported Disney’s ESPN unit is seeking to license its brand to DraftKings and casino operator Caesars Entertainment (CZR) for at least $3 billion over several years. Separately, Caesars Entertainment announced its first sports betting partnership with the Fiesta Bowl organization.

Las Vegas Sands, Wynn, and MGM with operations in Macau surged after Macau’s government relaxed COVID-testing rules for visitors from mainland China.

2. Energy

The S&P 500 top 10 winner list included five energy companies. Three of them were oil & gas producers Apache (APA), Devon Energy (DVN), and Occidental Petroleum (OXY); they each gained between 17% and 18%. Energy services companies Baker Hughes (BKR) and Halliburton (HAL) rose 13% each, claiming the other two spots.

Oil had its best week since June 2020, advancing 10%. Expectations of OPEC+ reining the increase in production at the upcoming September 1 meeting due to concerns with the delta variant drove the advance. Nearly 60% of U. S. Gulf Coast oil production shut down ahead of Hurricane Ida, limiting oil supplies. A decline in the U. S. dollar also supported the gain in oil.

Top ETFs for the week

The following ETFs themes worked well: oil & gas production, copper & gold miners, Chinese Internet, and cybersecurity. The top ETFs for the week include:

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +14.0%

- Global X Copper Miners ETF (COPX) +10.4%

- KraneShares CSI China Internet ETF (KWEB) +9.6%

- Global X Cybersecurity ETF (BUG) +9.4%

- VanEck Vectors Junior Gold Miners ETF (GDXJ) +8.5%

Top Fidelity Fund for the week

- Fidelity Select Energy Service (FSESX) +12.8%

Looking ahead to the week of August 30

The Labor Department reports August jobs data at the end of the week. The oil market will closely watch Hurricane Ida that appears to be heading towards Louisiana. Broadcom, Zoom Video, and a handful of consumer staples companies report earnings this week.

* Investor’s focal point moves to the August jobs report this week since Fed Chairman Powell has emphasized the need for more strong job creation before the central bank would start to unwind its bond purchases. The report should provide insights into the impact of the delta variant on the job market. Economists surveyed by Dow Jones expect the economy to have created 750,000 jobs in August, pushing the unemployment rate lower to 5.2% from 5.4% in July. For comparison purposes, the economy added 943,000 jobs in July.

* Petroleum product prices rallied last week, partly on curtailed U. S. Gulf Coast production. Oil & gas producers shut down nearly 60% of their Gulf of Mexico production ahead of Hurricane Ida. The U. S. weather service forecasts Ida to hit Louisiana, home to many refineries.

* Wall Street will get a read on the ongoing semiconductor chip shortage, inflation, and the delta variant’s impact on return-to-office via earnings reports. Semiconductor chip maker Broadcom, consumer staples companies Brown-Forman, Campbell Soup, & Hormel, and communication services provider Zoom Video report their earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023