The Federal Reserve unveiled a new framework allowing inflation to exceed its goal for some time. The daily count of new COVID19 cases continued to decline amidst progress in battling the pandemic. The S&P 500 topped 3,500 for the first time.

The Federal Reserve announced its new monetary policy of average inflation targeting. The central bank would let inflation run moderately above its 2% target for some time instead of proactively limiting it. The new framework could allow the Fed to keep interest rates lower for a long time.

The daily count of new COVID19 cases in the U. S. continued to fall. Data compiled by Johns Hopkins University showed the 5-day average dropped to 46,150 last week from a high of 77,250 in mid-July. The U. S. FDA approved Abbott’s (ABT) rapid COVID19 antigen test and the use of convalescent plasma as a treatment option.

The S&P 500 extended its winning streak to five weeks and scaled the 3,500 milestone to set a new all-time high. While growth stocks fared better than value stocks in the large-cap universe, the converse was true among small-caps.

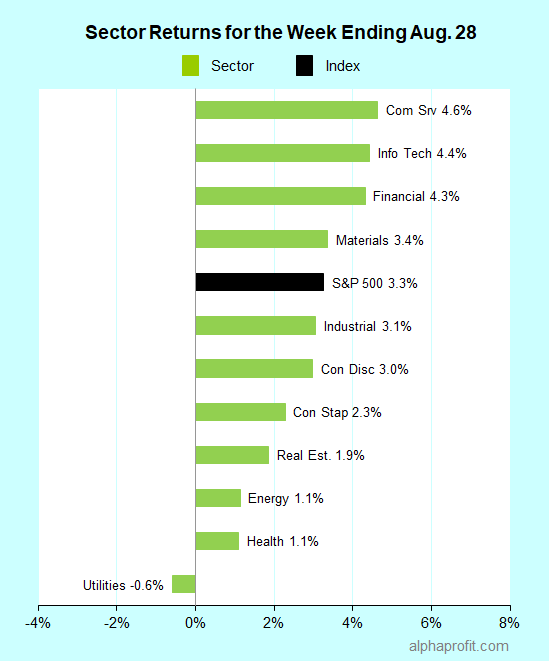

For the week ending August 28, the S&P 500 (SPY) rose 3.3%.

Ten of the 11 sectors gained with utilities (XLU) being the exception.

Communication services (XLC), information technology (XLK), and financials (XLF) led the S&P 500.

Utilities (XLU), healthcare (XLV), and energy (XLE) lagged the benchmark.

The number of advancing stocks in the S&P 500 beat decliners by a wide 9-to-2 ratio.

Twenty-five of the S&P 500 members advanced double-digits.

The S&P 500’s top 10 winners included software companies as well as retailers, airlines, and other ‘reopening plays’.

1. Software – salesforce.com (CRM) up 31%

salesforce.com (CRM) shares had a big week after the software company earned $1.44 per share in the second quarter, more than double analysts’ estimate. Revenues rose 29%. Upbeat revenue guidance for the current quarter coupled with the company’s imminent inclusion in the Dow Jones Industrial Average powered the gains.

iShares Expanded Tech-Software Sector ETF (IGV) and Global X Cloud Computing ETF (CLOU) were among the top ETFs last week, advancing over 7% each. The strong performance of Microsoft (MSFT), salesforce.com, Adobe (ADBE), and Workday (WDAY) shares supported the ETFs’ advance.

2. Retailers – Gap (GPS) up 22% and Kohl’s (KSS) up 15%

Apparel retailer Gap (GPS) reported a quarterly loss of $0.17 a share, lower than analysts’ $0.41 a share estimate. Gap topped revenue forecasts as the pandemic drove sales of casual clothing and face masks.

Kohl’s (KSS) shares rose on positive analyst comments expressing confidence in the department store’s capability to increase market share in the post-pandemic environment.

3. Airlines – Delta Air Lines (DAL) up 17% and Alaska Air (ALK) up 15%

Shares of Delta Air Lines (DAL) and Alaska Air (ALK) rose with those of other air carriers on declining daily COVID19 case count and positive developments in testing & treatment. The broad strength in airline shares lifted the U.S. Global Jets ETF (JETS) by 10% last week.

Other ‘reopening plays’ in entertainment and travel services popped on positive COVID19 news to round out the list of the S&P 500’s top 10 winners. They included:

- Live entertainment company Live Nation (LYV) up 15%

- Cruise lines Carnival (CCL), Royal Caribbean (RCL), and Norwegian (NCLH) up over 14% each

- Apparel maker PVH Corp. (PVH) up 14%

Looking ahead to the week of August 31

* On August 31, the Dow Jones Industrial Average gets reconstituted with Amgen (AMGN), Honeywell (HON), and salesforce.com (CRM) taking the place of Pfizer (PFE), Raytheon Technologies (RTX), and ExxonMobil (XOM). Apple (AAPL) shares split 4-to-1.

* The focus shifts to employment towards the end of the week. The Labor Department comes out with its August jobs report on Friday. According to Refinitiv, economists expect job creation to decline to 1.4 million jobs in August from 1.8 million in July.

* The upcoming week is a light one for earnings reports with six of the S&P 500 members reporting. Of them, semiconductor chipmaker Broadcom’s (AVGO) earnings report can impact the overall market. Outside the S&P 500, pandemic-era software darlings CrowdStrike Holdings (CRWD), DocuSign (DOCU), and Zoom Video Communications (ZM) report as well.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023