Investors feared the Federal Reserve would remove economic stimulus quicker than previously communicated. U. S. economic data and comments from Fed Chairman Powell caused these fears to escalate. Five states reported the omicron coronavirus variant. Congress once again averted a government shutdown with a short-term measure.

The Labor Department reported the unemployment rate dropped to a new pandemic low of 4.2% in November. Average hourly earnings increased 0.3%, implying an annual wage increase of 4.8%, the highest since March 2021. The Institute for Supply Management reported its service activity index rose to an all-time high of 69.1 in November.

Federal Reserve Chairman Powell’s remarks on potentially speeding up the central bank’s tapering process amid high inflation surprised investors. In his testimony to Congress on November 30, Powell said the central bank will consider reducing monthly bond purchases faster than the $15 billion-a-month schedule announced on November 3 when it meets on December 14-15.

Investors believed the Federal Reserve would cut bond purchases faster than previously expected, considering the above economic data and Powell’s comments. The yield on the 10-year Treasury bond tumbled 0.14% in response, flattening the yield curve. The 10-year Treasury bond yielded 1.34% at the end of the week.

Within a week of South Africa reporting the omicron coronavirus variant, the Centers for Disease Control and Prevention confirmed the first U. S. case in Northern California. The tally of states reporting the omicron variant grew to five by the end of the week.

Congress averted a partial government shutdown, funding the government with another short-term extension through February 18.

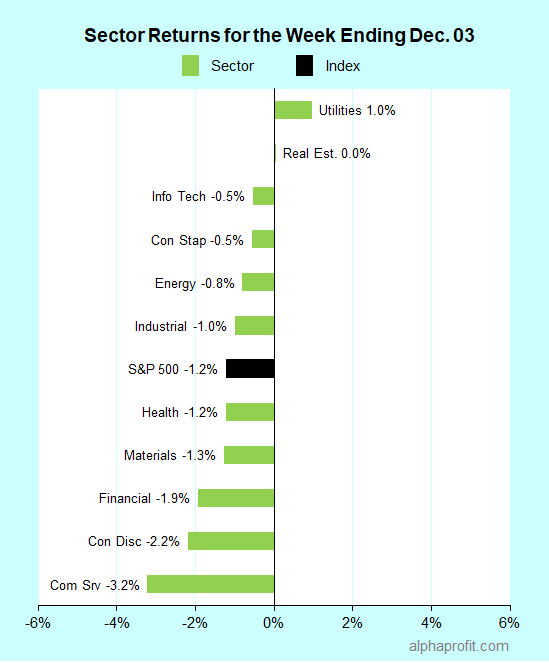

For the week ending December 3, the S&P 500 (SPY) fell 1.2%. Just two of the 11 sectors held above the flatline.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 1-to-2 ratio.

Utilities (XLU), real estate (XLRE), and information technology (XLK) held up better than the S&P 500, losing 0.5% or less.

Communication services (XLC), consumer discretionary (XLY), and financials (XLF) lagged the benchmark.

The S&P 500’s top 10 winners included consumer discretionary, financial, health care, information technology, and materials companies.

1. Health care

Vertex Pharmaceuticals (VRTX) +11% – The biotech store was the top performer in the S&P 500 for the week after its experimental drug for treating focal segmental glomerulosclerosis, a kidney disease, showed positive Phase 2 trial data.

2. Information Technology

Semiconductor and technology hardware companies performed well. Deloitte Global forecasted semiconductor chips to be in short supply through 2022. Chipmaker Marvell Technology, a non-S&P 500 company, topped analysts’ EPS forecast and raised current quarter guidance. The low valuation and dividends of technology hardware companies also attracted buying interest. The top 10 winners included:

HP Inc. (HPQ) +9% – JP Morgan raised the price target on the PC and printer maker shares to $38 from $32.

Microchip Technology (MCHP) +6% – The semiconductor chipmaker announced the expansion of its Gallium Nitride Radio Frequency power device portfolio. Jefferies raised the target price for Microchip shares to $109 from $98.

Hewlett Packard Enterprise (HPE) + 5% – The communication equipment maker earned $0.52 a share compared to analysts’ $0.48 a share forecast as gross margin widened by 2.3% to 33.0%.

3. Consumer Discretionary

Lennar Corp. (LEN) +5% – Falling bond yields and positive comments from Goldman Sachs lifted shares of the homebuilder. Goldman upgraded Lennar from Neutral to Buy and raised the price target to imply a 27% upside.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Application software provider PTC Inc. (PTC) +7%

- Disk drive manufacturer Seagate Technology (STX) +7%

- Money transfer company Western Union (WU) +5%

- Paint maker Sherwin-Williams (SHW) +6%

- Semiconductor chipmaker NXP Semiconductors (NXPI) +7%

Top ETFs for the week

The following ETFs themes worked well: volatility, Mexico, Russia, South Korea, long-term treasuries. The top ETFs for the week include:

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +6.9%

- iShares MSCI Mexico ETF (EWW) +5.6%

- VanEck Russia ETF (RSX) +4.2%

- iShares MSCI South Korea ETF (EWY) +3.9%

- Vanguard Extended Duration Treasury Index Fund ETF Shares (EDV) +3.4%

Top Fidelity Fund for the week

- Fidelity Long-Term Treasury Bond Index Fund (FNBGX) +2.4%

Looking ahead to the week of December 06

Investors are watching if the S&P 500 can find support at its 50-day moving average. Stocks are likely to remain volatile as investors focus on omicron variant-related news and inflation data. Earnings from the information technology sector and the outcome of Treasury auctions can move stocks.

* The S&P 500 closed last Friday at 4,538, just below its 50-day moving average (DMA) of 4,545. The chart patterns of several large-cap technology stocks that worked well during prior sell-offs in 2021 do not provide much confidence. Adobe and Facebook are already below their 50-DMAs, while AMZN, Alphabet, Amazon, and Microsoft threaten to fall below. The failure of the S&P 500 to hold its 50-DMA can attract more selling and further downside.

* Investors will remain alert to the latest information on whether the omicron variant is more transmissible and capable of causing severe illness compared to other variants. Investors also eagerly await data on the degree to which current vaccines offer protection against the variant.

* The week brings new data on inflation. Economists surveyed by Dow Jones expect the consumer price index to show a month-over-month increase of 0.6% in November, down from 0.9% in October. The forecast the CPI to increase 6.7% on a year-over-year basis in November, up from 6.2% in October.

* Information technology heavyweights Broadcom and Oracle and discount store Costco are among the S&P 500 reporting earnings this week.

* The Treasury auctions nearly $120 billion in 3-year, 10-year, and 30-year Treasury securities combined.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023