The United Kingdom became the first country to roll out the COVID-19 vaccine developed by Pfizer & BioNTech. Investors saw the weaker-than-expected November jobs data as positive for equities since it could compel Washington lawmakers to approve additional pandemic aid. All four U. S. stock benchmarks, including the S&P 500, closed the week at record highs.

Pfizer (PFE) and BioNTech (BNTX) became the first COVID-19 vaccine developers to get the green light for use in a Western country. The United Kingdom approved its vaccine for widespread use. The elderly in care homes and medical workers will get the vaccine first.

The Labor Department reported the economy added 245,000 non-farm jobs in November, lower than economists’ forecast of 469,000 jobs. Job creation in November was the slowest in six months. Slowing job growth raised investor’s expectations of Congress approving a new fiscal relief bill to help revive the coronavirus-hit economy.

Last week, a bipartisan group of senators unveiled a $900 billion stimulus package. The package includes $288 billion in small business funding for the Paycheck Protection Program and $160 billion in state & local government funding. It, however, excludes another round of $1,200 stimulus checks. Neither House Speaker Pelosi nor Senate Majority Leader McConnell appeared to be in favor of this package.

All four commonly followed U. S. stock indexes, namely, the Dow Jones Industrial Average, the S&P 500, the Nasdaq Composite Index, and the Russell 2000, closed the week at record highs. The four indexes closed at a record on the same day last on January 22, 2018.

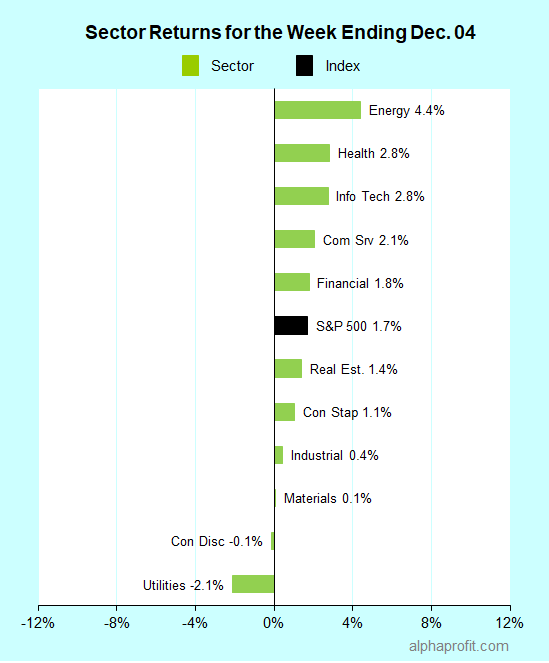

For the week ending December 4, the S&P 500 (SPY) rose 1.7%.

Nine of the 11 sectors gained.

Energy (XLE), health care (XLV), and information technology (XLK) led the S&P 500.

Utilities (XLU), consumer discretionary (XLY), and materials (XLB) lagged the benchmark.

The number of advancing stocks in the S&P 500 exceeded the number of decliners by a 8-to-3 ratio.

The S&P 500’s top 10 winners included companies from the energy and information technology sectors. The energy sector accounted for four of the winners.

1. Energy:

The Organization of the Petroleum Exporting Countries & Russia overcame discord and agreed to a modest production increase of 500,000 barrels per day starting in January. OPEC & Russia also agreed to meet monthly in early 2021 to discuss the supply-demand balance.

Shares of oil refiner HollyFrontier (HFC) gained 15% to claim the top spot among the S&P 500 winners for the week. Energy services firm TechnipFMC(FTI), along with oil & gas producers Devon Energy (DVN) and Occidental Petroleum (OXY), rose double-digits to be the other top 10 winners.

The momentum in energy stocks continued from November. TechnipFMC, Devon Energy, and Occidental Petroleum were among the top five gainers of the S&P 500 in November. HollyFrontier announced plans to boost investments to expand its renewables portfolio.

2. Information Technology:

Shares of memory chip maker Micron Technology (MU) were up 14%. Micron upped its guidance for fiscal first-quarter sales, EPS, and gross margin, prompting several analysts to boost their share price targets. Memory chip production at Micron’s plant in Taiwan was impacted by a power shutdown last week. Investors believed this supply shortage would drive memory chip prices higher.

Shares of Micron’s competitor Western Digital (WDC) gained 13%, riding on Micron’s coattails.

NetApp (NTAP) was the third entry from the information technology sector in the top 10 list. Its shares rose 13%. The cloud data service and data management company beat analysts’ fiscal second-quarter EPS forecasts by 43%. NetApp’s revenues grew 3.3% year-over-year, topping analysts’ forecasts.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Casino operator Wynn Resorts (WYNN) +12%

- Regional bank Zions Bancorporation (ZION) +12%

- Life insurer Lincoln National (LNC) +11%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- ARK Genomic Revolution ETF (ARKG) +13%

- Global X Uranium ETF (URA) +11%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT) +10%

- VanEck Vectors Oil Services ETF (OIH) +9%

- Alerian MLP ETF (AMLP) +9%

Looking ahead to the week of December 7

Stimulus talks, vaccine approvals, and bond yields are likely to be in the limelight this week. Unfavorable developments on any of these fronts can prompt investors to take profits. Following their big runup, small-cap stocks are, technically speaking, ‘overbought’ and could be more vulnerable.

* Stimulus discussions are likely to dominate markets this week after a bipartisan senator group pushed its $900 billion proposal last week. Congress also has to come up with a funding scheme by Friday to prevent the government from running out of money. Meanwhile, Senate Majority Leader McConnell remains opposed to large stimulus packages. Wall Street is looking for a stimulus package of at least $900 billion.

* A Food & Drug Administration advisory committee meets on December 10 to review Pfizer & BioNTech’s application for emergency use authorization of their COVID-19 vaccine. Investors will also be closely following the vaccine rollout in U. K. after Pfizer lowered its forecast for the number of doses it plans to ship in 2020 due to supply chain constraints.

* The yield on the 10-year Treasury bond closed at 0.97%, just shy of the 1% mark. This benchmark bond yielded over 1% last on March 19. The 10-year Treasury yield may well breach 1% this week if stimulus talks gain traction, maintaining hopes of economic recovery. Inflation data are due as well this week. Stock investors may not like to see a sharp increase in bond yields.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023