Stocks sizzled as fears of the omicron virus variant shutting down the economy faded. Congress progressed towards avoiding a U. S. debt default. Investors maintained their composure in the face of the inflation rate measuring 6.8% in the past 12 months, a 39-year high.

Fears of the omicron coronavirus variant shutting down the economy eased in the early part of last week, fueling a broad rally in stocks.

Comments from President Biden’s Chief Medical Advisor on the omicron variant causing less severe illness than the delta variant helped assuage concerns. Further, Pfizer and BioNTech announced that a preliminary study found three doses of their vaccine provided a high level of protection against the variant.

The threat of the U. S. defaulting on its debt receded. The Senate cleared the path toward raising the debt ceiling.

The Labor Department reported that the consumer price index (CPI) rose 6.8% for the 12 months ending in November. The tally marginally exceeded the 6.7% forecasted by economists. It also marked the highest annual inflation rate since 1982.

Investors took this inflation data in stride as they fell short of worst-case scenarios feared by economists. Additionally, CPI components like used car prices, lodging rates, and airfares, which have risen sharply in recent months, rose less than expected.

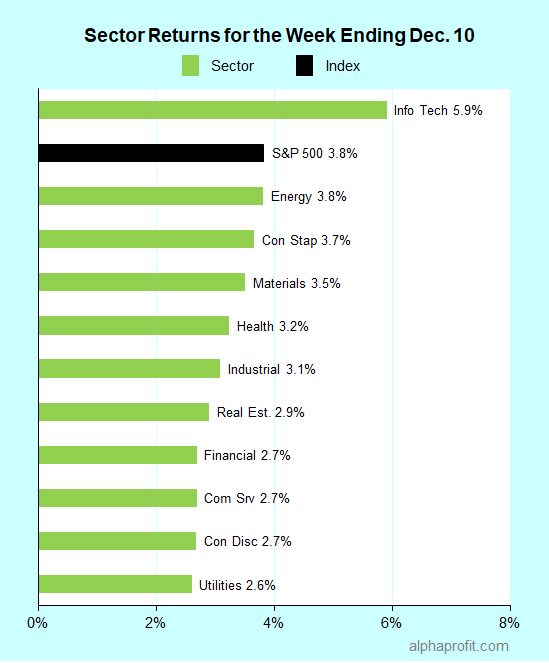

For the week ending December 10, the S&P 500 (SPY) rose 3.8%. All of the 11 sectors gained.

Market breadth was overwhelmingly positive. The number of advancing stocks in the S&P 500 lagged the number of decliners by over an 11-to-1 ratio.

Information technology (XLK) was the only sector to lead the S&P 500, gaining 5.9%. Energy (XLE) matched the benchmark’s gain.

Utilities (XLU), consumer discretionary (XLY), and communication services (XLC) lagged the benchmark gaining 2.7% or less.

The S&P 500’s top 10 winners included communication services, consumer discretionary, financials, health care, and information technology companies.

1. Consumer discretionary

Cruise operators were among the biggest winners last week as fears of the omicron coronavirus variant eased on comments from Dr. Fauci and Pfizer.

Gaining 18%, Norwegian Cruise Line (NCLH) was the top performer in the S&P 500 for the week. Royal Caribbean Cruises (RCL) and Carnival Corp. (CCL) ended the week 13% and 12% higher, respectively. Ticketmaster owner Live Nation Entertainment (LYV), a communications services sector member, joined this rally to gain 11%.

Automaker Ford Motor (F) gained 11%. The automaker expects to triple the output of its all-electric Mustang Mach-E SUV to over 200,000 units per year by 2023 after seeing high demand for its all-electric F-150 Lightning pickup truck.

2. Information Technology

Oracle (ORCL) +16% – The business software company added $10 billion to its share repurchase program topping analysts’ quarterly revenue and EPS estimates. Oracle expects cloud ERP to be a $20 billion business within five years.

Broadcom (AVGO) +13% – The semiconductor chipmaker reported fiscal fourth-quarter revenue and EPS above analysts’ forecasts. Broadcom issued an upbeat forecast expecting continued high demand from cloud computing customers.

Apple (AAPL) +11% – The iPhone and Apple Watch maker rallied from the buzz of next-generation Augmented Reality/Virtual Reality products and positive comments from Morgan Stanley.

3. Health care

Edwards Lifesciences (EW) +12% – The medical devices maker forecasted double-digit sales and EPS growth in 2022.

4. Financials

MarketAxess Holdings (MKTX) +11% – After falling over 40% since November 2020, the electronic trading platform provider rebounded after announcing November 2021 trading volume.

Top ETFs for the week

The following ETFs themes worked well: oil services and production, China Internet, carbon credits, healthcare providers. The top ETFs for the week include:

- VanEck Oil Services ETF (OIH) +9.5%

- KraneShares CSI China Internet ETF (KWEB) +8.5%

- KraneShares Global Carbon ETF (KRBN) +7.7%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +6.8%

- iShares U.S. Healthcare Providers ETF (IHF) +6.3%

Top Fidelity Fund for the week

- Fidelity Select Health Care Services Portfolio (FSHCX) +7.2%

Looking ahead to the week of December 13

The Federal Reserve is back in focus this week. Investors expect the FOMC to speed up the end of its bond-buying program after its December 14-15 meeting. Investors will be closely scrutinizing the Fed’s new interest rate forecast.

* The Federal Open Market Committee meets on Tuesday & Wednesday to discuss interest rate policy. In light of the continued rise in inflation, investors expect the Fed to taper faster than the $15 billion a month rate planned on November 3. The central bank also provides quarterly projections on the economy, inflation, and interest rates. The Fed’s outlook for the federal funds rate, i.e., dot-plot, may now show two interest rate hikes in 2022.

* The economic calendar includes data on inflation. The Labor Department reports the producer price index (PPI) on Tuesday. Briefing.com shows economists expect the PPI to increase 0.5% month-over-month in November, down from 0.6% in October. Retail sales come out on Wednesday.

* The Senate paved the way for Congress to increase the debt limit last week. The House and Senate now need to approve the higher debt limit by December 15, ensuring the United States does not default on its debt.

* The earnings calendar includes reports from a few widely followed companies, including software maker Adobe, IT service provider Accenture, and freight heavyweight FedEx.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023