The health and economic fallout from COVID-19 intensified last week. The number of daily new cases rose 15% week-over-week. Initial weekly jobless claims rose to their highest level as new lockdown restrictions weighed on businesses. Congress continued to wrangle over the elements of a new fiscal stimulus package.

The COVID-19 health toll worsened, with the nationwide count of daily new cases rising 15% from the previous week to 215,000. The total number of U. S. patients hospitalized for COVID-19 exceeded 110,000, a record. The number of daily new deaths from COVID-19 exceeded 3,000 to set a new record.

Economic data reflected the strain from new lockdown restrictions to stem the recent surge of the pandemic. As unemployment increased, initial weekly jobless claims surged to their highest level since September.

Despite the need for additional economic relief, lawmakers continued to wrangle over a new fiscal stimulus package. A bipartisan $908 billion pandemic package remained stuck in Congress as Senate Republicans pushed for a smaller relief bill. Congress, however, passed a one-week spending bill to keep the government open through December 18 and provide lawmakers more time for negotiating COVID-19 relief.

The U. S. FDA approved the COVID-19 vaccine developed by Pfizer and BioNTech after the stock market closed on Friday. The vaccine should roll out next week.

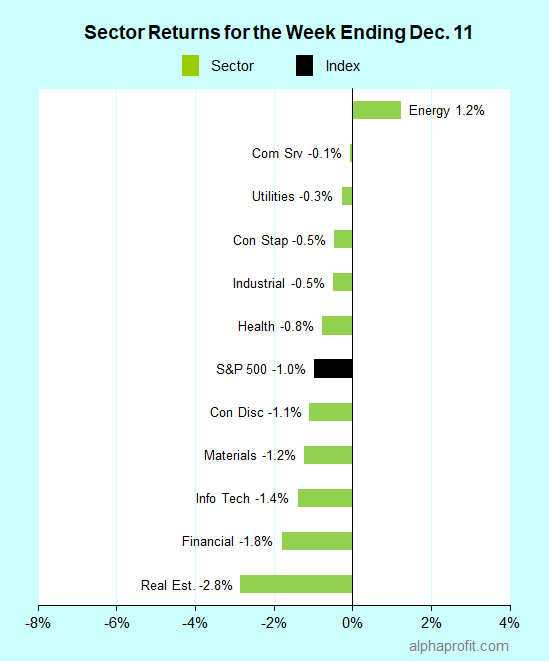

For the week ending December 11, the S&P 500 (SPY) fell 1.0%.

All sectors except energy lost ground.

In addition to energy (XLE), communication services (XLC) and utilities (XLU) held up better than the S&P 500.

Real Estate (XLRE), financials (XLF), and information technology (XLK) lost more than the benchmark.

The number of declining stocks in the S&P 500 trounced the number of advancers by a 5-to-2 ratio.

The S&P 500’s top 10 winners included companies from the communication services, industrials, and energy sectors. Positive business updates contributed to the gains in many winners.

1. Communication Services:

Disney (DIS) shares rose 14%, claiming the top spot among the S&P 500 winners for the week. The entertainment giant said its Disney+ streaming service has over 86 million subscribers. Disney also rolled out its streaming strategy, including a slate of new shows and forecasted Disney+ subscriber count to exceed 230 million subscribers by 2024.

Twitter (TWTR) shares were up 8%. The social media platform launched a mobile app allowing users to share tweets directly to Snap’s (SNAP) photo messaging app Snapchat. Twitter is also looking to integrate tweets with other social media, including Facebook’s (FB) Instagram.

2. Industrials:

Equifax (EFX) shares were up 13% after the credit bureau raised its revenue and EPS guidance for the fourth quarter by 8% and 24%, respectively. Needham reiterated its Buy recommendation on Equifax and upped its share price target by $10 to $210.

Shares of Nielsen Holdings (NLSN) gained 6% after the audience tracking firm raised its 2021 free cash flow guidance by nearly 3%. Nielsen also unveiled a new tracking approach, Nielsen One, debuting in 2022. The new method will combine live TV and on-demand services ratings.

3. Energy:

Energy stocks rose, supported by Morgan Stanley’s bullish outlook for oil prices. The brokerage firm forecasted a $5 a barrel increase in the price of Brent by the second half of 2021to $55 a barrel. Morgan Stanley called oil & gas producers potential outsized beneficiaries of ‘reopening’.

Shares of oil & gas producers Occidental Petroleum (OXY) rose 12%, while those of Diamondback Energy (FANG) and Apache (APA) were up 6% each after the broker upped its share price targets.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Online marketplace Etsy (ETSY) +10%

- Drugmaker Eli Lilly (LLY) +8%

- Software & technology services provider Tyler Technologies (TYL) +7%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Global X Uranium ETF (URA) +8%

- ARK Genomic Revolution ETF (ARKG) +7%

- ARK Innovation ETF (ARKK) +6%

- ALPS Medical Breakthroughs ETF (SBIO) +5%

- iShares MSCI Russia ETF (ERUS) +5%

Looking ahead to the week of December 14

The last working week before the Christmas holiday is a busy one. Events with market-moving potential include new pandemic relief, electoral college vote, Federal Reserve’s interest rate policy statement, and Brexit negotiations. Stock prices are likely to be most vulnerable to disappointment on new pandemic relief.

* Negotiations on the next pandemic relief package should continue in Congress. Neither the Republicans nor the Democrats appear willing to compromise on the stand on business liability protection and state & local government aid, respectively. Federal unemployment benefits and the eviction moratorium expire at the end of the month in case there is no agreement.

* The electoral college meets on Monday to vote for president and vice-president. Causing uncertainty, President Trump and his allies have refused to concede the 2020 election. Trump has said his efforts to challenge the election results are not over after the Supreme Court dismissed a lawsuit from Texas, seeking to throw out voting results from four swing states.

* The Federal Reserve holds its final interest rate policy meeting of 2020. There is some speculation among market participants that the Fed may shift the focus of its $80 billion monthly asset purchase to longer-dated notes and bonds to lower their yield.

* Other events that can move stock prices include the outcome of negotiations between Britain and the European Union on the post-Brexit trade deal and recommendations from the FDA expert panel after reviewing Moderna’s COVID-19 vaccine trial data.

* Electric car maker Tesla joins the S&P 500 on Friday. With nearly $600 billion in market capitalization, Tesla will likely be the seventh-largest S&P 500 member. The rebalancing can lead to volatility as index funds buy about $70 billion of Tesla shares and sell shares of other S&P 500 members.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023