Hopes of closure on COVID-19 emerged as the U. S. started rolling out the vaccine. Suffering from the virus, however, continued to increase. Republicans and Democrats appeared to move closer to approving new financial aid.

The U. S. began administering the COVID-19 vaccine developed by Pfizer & BioNTech early last week. Boosting vaccine supplies, the U. S. Food and Drug Administration approved Moderna’s vaccine by the end of the week. Moderna’s vaccine is expected to arrive in different states starting Monday.

Meanwhile, the coronavirus continued to take its toll. The 7-day average of daily new cases and the daily deaths in the U. S. remained above 200,000 and 2,500, respectively, through the week.

Economic data disappointed. Weekly jobless claims totaled 885,000 compared to economists’ 808,000 forecast. The decline in November retail sales exceeded expectations. The Federal Reserve promised to continue buying at least $120 billion of bonds each month to keep interest rates low and fight the recession.

Disappointing economic data brought Republicans and Democrats closer to approving new financial aid. Negotiations on the elements of the stimulus package continued through Friday. Congress and President Trump approved a two-day stopgap spending bill to prevent a partial government shutdown.

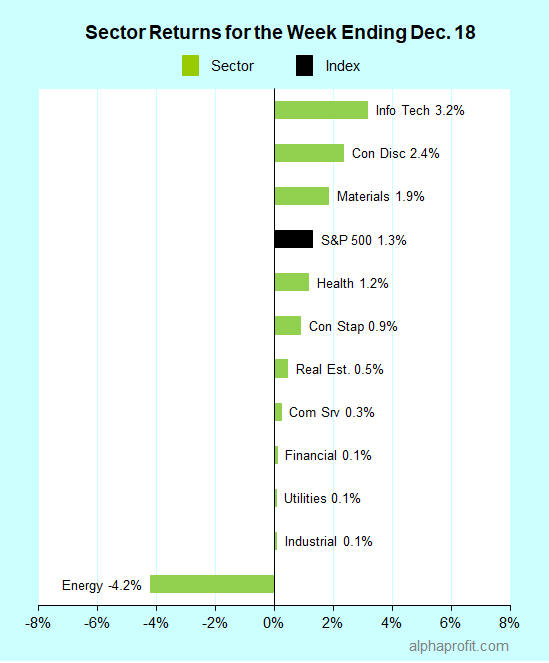

For the week ending December 18, the S&P 500 (SPY) rose 1.3%.

Ten of the 11 sectors gained.

Information technology (XLK), consumer discretionary (XLY), and materials (XLB) led the S&P 500.

Energy (XLE), industrials (XLI), and utilities (XLU) lagged the benchmark.

The number of advancing stocks in the S&P 500 trounced the number of decliners by a 5-to-3 ratio.

The S&P 500’s top 10 winners included companies from the health care, information technology, and consumer discretionary sectors.

1. Health Care

Alexion Pharmaceuticals (ALXN) shares rose 30%, claiming the top spot among the S&P 500 winners for the week. The biotech company received a $39 billion buyout offer from European pharma giant AstraZeneca (AZN).

Abiomed (ABMD) shares gained 14% after the medical devices company achieved two milestones in developing small-bore access for the Impella heart pump. Morgan Stanley raised its Abiomed share price target by 10% to $238.

2. Information Technology

Shares of enterprise and government security provider Fortinet (FTNT) rallied 14%. Cyber-security shares shot up after Russian hackers allegedly broke into the computer networks of several federal agencies.

Shares on online payment company PayPal (PYPL) were up 10%. With PayPal now processing bitcoin transactions, its shares took their cue from strength in bitcoin. Analysts at KeyBanc & Stephens raised their PayPal share price targets by 5-10%.

3. Consumer Discretionary

Lennar Corp. (LEN) shares rose 11% after the homebuilder topped analysts’ fiscal fourth-quarter sales and EPS forecasts by 8% and 9%, respectively. Sales, EPS, and new orders for fiscal 2020 were the highest in Lennar’s history.

Chipotle Mexican Grill (CMG) shares gained 9%. Stifel called the restaurant’s unit growth prospects ‘most compelling’ among peers. Applauding Chipotle’s efforts to build sales, Stifel raised its share rating to Buy and upped the price target by $100 to $1,500.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Online marketplace Etsy (ETSY) +12%

- Electronic design software supplier Cadence Design Systems (CDNS) +11%

- Drug delivery technology company Catalent (CTLT) +10%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Invesco Solar ETF (TAN) +15%

- Amplify Transformational Data Sharing ETF (BLOK) +12%

- iShares Global Clean Energy ETF (ICLN) +10%

- ETFMG Prime Junior Silver Miners ETF (SILJ) +10%

- First Trust NASDAQ Cybersecurity ETF (CIBR) +9%

Looking ahead to 2021

Some profit-taking may be in store with stocks technically overbought heading to the year-end. The decline is likely to be limited unless Congress fails to approve a new stimulus package or COVID-19 vaccines see negative surprises. The outcome of the Georgia Senate elections can move markets in early 2021.

* Congressional lawmakers are still negotiating the new financial aid package. As of Saturday evening, Federal Reserve lending programs are a sticking point. Led by Senator Toomey, the Republican proposal seeks to guarantee that the Federal Reserve cannot renew emergency lending programs for small businesses and state & local governments after January 1. Democrats oppose the provision since it limits the economic tools available to President-elect Biden before he takes office.

* The January 5, 2021 runoff Senate elections in Georgia have the potential to shift the balance of power in the U. S. Congress. Wall Street currently expects Republicans to win one or both of these elections. Republicans will then retain control of the Senate, and Democrats will control the House of Representatives. If Democrats win both runoff elections, each party will have 50 Senate seats. The Democrats will effectively take control of the Senate since Vice President-elect Harris holds the tie-breaking vote. The majority in both chambers of Congress can allow Democrats to implement larger stimulus and raise taxes.

* The economic and earnings calendars are relatively light through January 8, 2021, when the December 2020 job report is due. Meanwhile, weekly jobless claims and housing industry data are likely to garner attention. Micron Technology (MU), Constellation Brands (STZ), Cintas Corp. (CTAS), Walgreens Boots Alliance (WBA), and Paychex (PAYX) are among the S&P 500 members reporting.

Note: Christmas and New Year’s Day holidays shorten the remaining trading weeks in 2020. The stock market closes at 1:00 p.m. Eastern on December 24. The weekly e-letter will return to its regular schedule in 2021.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023