The S&P 500 closed last week at a record high. Investors were encouraged by the prospect of additional Congressional aid. S&P 500 companies stayed on track towards posting their first quarter of EPS growth after a gap of three quarters. The COVID vaccine administration program continues to make progress.

The S&P 500 closed the week at an all-time high, its tenth record close for 2021. The rally continued as investors rotated into cyclical and value stocks, expecting both economic growth and inflation to accelerate.

Lawmakers in Washington appeared to move closer to another economic relief bill. A House committee approved half of Biden’s relief plan, advancing $1,400 payments to millions of Americans. President Biden and Treasury Secretary Yellen met with CEOs of JPMorgan, Walmart, and Gap to discuss additional economic relief.

According to FactSet, S&P 500 companies are on track to post at least 2.9% growth in fourth-quarter EPS from the year-ago period. This marks the first positive year-over-year EPS comparison after the first quarter of 2020. It also sharply contrasts with analysts’ December 31, 2020 forecast for fourth-quarter EPS to contract 9.3%.

In COVID vaccine deployment, the U. S. is on track to exceed Biden’s goal of administering 100 million doses in his first 100 days in office. According to the Centers for Disease Control and Prevention, nearly 34.7 million Americans have received at least their first vaccine dose. Biden has said the U. S. will have an adequate supply of vaccines for 300 million Americans by end of July.

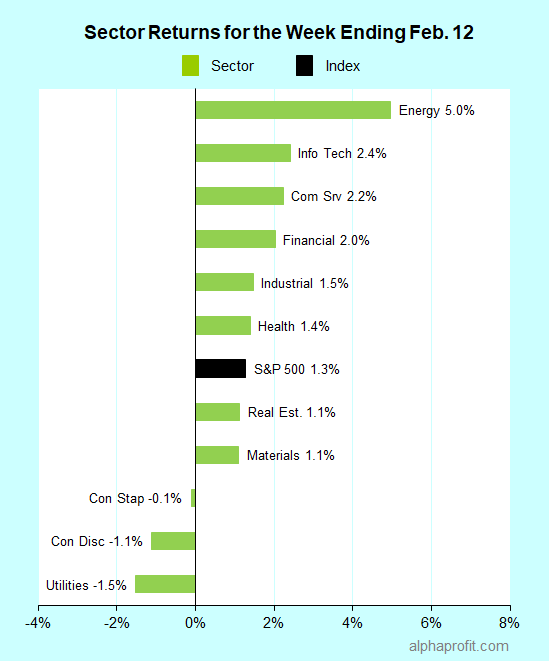

For the week ending February 12, the S&P 500 (SPY) rose 1.3%.

Eight of the 11 sectors gained.

Energy (XLE), information technology (XLK), and communication services (XLC) led the S&P 500.

Utilities (XLU), consumer discretionary (XLY), and consumer staples (XLP) declined.

Market breadth was strong. The number of advancing stocks in the S&P 500 beat the number of decliners by a 7-to-3 ratio.

Information technology companies accounted for four of the S&P 500’s top 10 winners. Communication services, consumer discretionary, health care, energy, and real estate companies were also among the other top 10 winners.

1. Communication Services

Shares of Twitter (TWTR) surged 27% to claim the top spot among the S&P 500’s winners for the week. The social media company posted strong fourth-quarter results with users, sales, and EPS rising 26%, 29%, and 23%, respectively. Twitter’s first-quarter sales guidance topped analysts’ forecast.

Live Nation (LYV) shares rose 13% after Berenberg raised its share price target by 28% to $88 a share. Berenberg expects the entertainment company to benefit from pent-up demand for live events.

2. Health Care

Illumina (ILMN) shares jumped 18% to claim the second spot among the S&P 500’s winners for the week. The gene sequencing firm beat analysts’ fourth-quarter sales and EPS forecasts by 6% and 11%, respectively. Illumina saw record orders including COVID-19 sequencing and forecasted 2021 revenue growth to exceed 17%.

3. Information Technology

Shares of Zebra Technologies (ZBRA) gained 17% after the beat analysts’ quarterly sales & EPS sales forecasts. The bar code scanner maker forecasted double-digit growth in sales for the first quarter and all of 2021.

Semiconductor equipment makers were notably strong. Applied Materials (AMAT), KLA Corp. (KLAC), and Lam Research (LRCX) gained 15-16% each. Automakers and consumer electronics companies have reported the availability of semiconductor chips to be in short supply. This shortage implies strong demand and pricing power semiconductor chips.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Apparel maker Hanesbrands (HBI) 17%

- Oil & gas producer Marathon Oil (MRO) 13%

- Shopping center REIT Simon Property Group (SPG) 13%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Amplify Transformational Data Sharing ETF (BLOK) 24%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT) 11%

- VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) 11%

- Invesco Dynamic Semiconductors ETF (PSI) 11%

- Global X Uranium ETF (URA) 9%

Looking ahead to the week of February 15

Trading this week is shortened by the observance of the President’s Day holiday on Monday, February 15. Investors’ attention will be on stimulus, inflation, and earnings this week. Stocks appear extended from sentiment, technical, and valuation perspectives and may be due for some consolidation.

* Investors will focus on stimulus bill-related developments to get a sense of the final amount approved. The opposition to President Biden’s $1.9 trillion plan has been less-than-expected. The bill is expected to come before Congress during the week of February 22 and could become law by the first week of March.

* Wall Street’s focus on inflation and interest rates is rising as the stimulus package becomes larger. Bond yields are trending higher as growth and inflation expectations rise. The 10-year Treasury’s yield closed at 1.21% last week, the highest since March 2020. This week, Wall Street will get a read on producer price inflation. Minutes from the last FOMC meeting should reveal Federal Reserve’s current view on inflation.

* The fourth-quarter earnings reporting season begins to taper. Applied Materials, CVS Health, Deere, and Walmart are among the larger companies reporting this week. Investors will also keep an eye on the House Financial Services Committee’s hearing on recent trading activity in GameStop and other heavily shorted stocks. The economic calendar is filled with data on the state of the housing industry.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023