Stocks reversed course after setting new records as interest rates rose. Data suggested some improvement in the economy amidst progress in COVID vaccination efforts and a drop in COVID case count. Investors rotated out of pandemic plays to reflation plays.

U.S. stock indexes surged to new highs at the beginning of the week on strong earnings, progress in vaccination rollouts, and hopes of the $1.9 trillion federal coronavirus relief package. The rally, however, stalled as economic data stoked inflation concerns and interest rates rose.

In economic data, retail sales surged an unexpectedly high 5.3% in January. IHS Markit’s flash reading of its U. S. purchasing managers index rose to 58.8 in February, the highest in almost six years. As economists upped their first-quarter GDP growth forecasts, the yield on the 10-year Treasury bond rose 0.145% for the week to end at 1.339%.

Treasury Secretary Yellen cited pain from the pandemic to support the case for an additional $1.9 trillion in stimulus despite some improvement in the economy.

Stocks in economically sensitive industries such as banking, energy, materials, and transportation rose from the ‘reflation trade’. Meanwhile, stay-at-home winners or pandemic plays such as large-cap growth stocks lost ground.

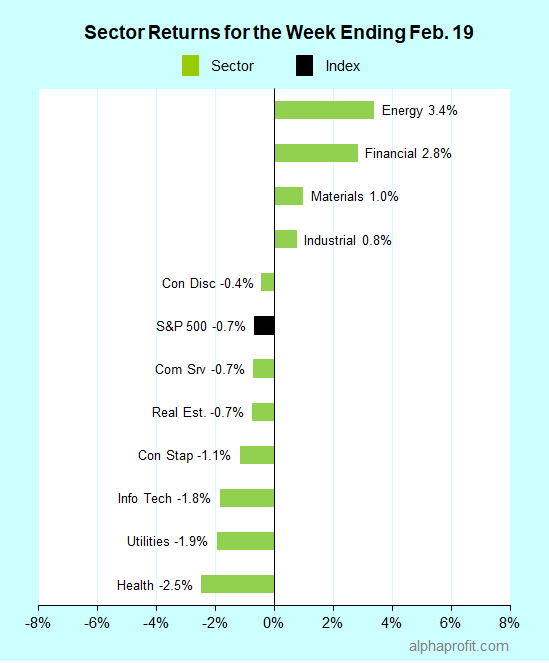

For the week ending February 19, the S&P 500 (SPY) fell 0.7%.

Seven of the 11 sectors declined.

Energy (XLE), financials (XLF), and materials (XLB) bucked the S&P 500.

Health care (XLV), utilities (XLU), and information technology (XLK) lost more than the benchmark.

Market breadth was however positive. The number of advancing stocks in the S&P 500 beat the number of decliners by an 11-to-10 ratio.

Consumer discretionary companies accounted for three of the S&P 500’s top 10 winners. Materials, energy, financial, real estate, and communication services companies were also among the other top 10 winners.

1. Materials

Shares of Freeport-McMoRan (FCX) surged 21% to claim the top spot among the S&P 500’s winners for the week. The copper producer’s shares followed the rise in the red metal’s price to its highest level since late 2011. Rising expectations of an infrastructure spending bill boosted the price of copper.

2. Consumer discretionary

Shares cruise operators were strong on optimism over the effectiveness of COVID-19 vaccines. Encouraging comments from Carnival Corp. and its successful close of $3.5 billion in financing added to bullishness. Carnival CEO Donald said he expects “most, if not all” of his company’s fleet will be in operation by the end of 2021. Shares of Carnival (CCL), Royal Caribbean (RCL), and Norwegian Cruise Line (NCLH) shot up 19%, 16%, and 13%, respectively.

3. Energy

Severe winter weather and analyst upgrades helped shares of oil refiners to double-digit gains. Prices for refined fuels spiked as cold weather hampered oil & gas production in Texas. Credit Suisse raised its share price targets for HollyFrontier (HFC) and Valero Energy (VLO), sending their shares higher by 17% and 11%, respectively.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Major bank Wells Fargo (WFC) 16%

- Hotel REIT Host Hotels & Resorts (HST) 15%

- Entertainment provider Discovery (DISCA) 12%

- Financial services provider Charles Schwab (SCHW) 11%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Global X Copper Miners ETF (COPX) 15%

- Amplify Transformational Data Sharing ETF (BLOK) 13%

- iShares MSCI Global Metals & Mining Producers ETF (PICK) 7%

- U.S. Global Jets ETF (JETS) 5%

- Invesco KBW Bank ETF (KBWB) 5%

Looking ahead to the week of February 22

Investors’ attention will be on Powell’s testimony, stimulus, and earnings this week. Stocks appear extended from sentiment, technical, and valuation perspectives and may be due for further consolidation.

* Federal Reserve Chairman Powell delivers his semi-annual testimony on the economy before the Senate Banking Committee and the House Financial Services Committee. Economists await Powell’s current view on the economy and inflation, particularly in light of the improvement in economic data and the sharp rise in 10-yr Treasury bond yield. Towards the end of the week, durable goods orders and the personal consumption expenditure price index should provide economists data on the economy and inflation.

* The Democrats have drafted a 591-page coronavirus relief plan, in line with President Biden’s $.19 trillion stimulus proposal. This bill is likely to come before the House of Representatives this week. Speaker Pelosi has said the House will try to pass the coronavirus relief plan before the end of February. The plan is likely to face hurdles in the Senate, where Democrats cannot afford to have any opposition from their party.

* The fourth-quarter earnings reporting season is tapering. Retailers and selected technology companies, that have benefited from the pandemic, will be in focus this week. Home Depot (HD), Lowe’s (LOW), and Etsy (ETSY) are among the retailers reporting. Investors will get insights into the technology space from earnings reports of semiconductor chipmaker NVIDIA (NVDA), software companies salesforce.com (CRM) & Intuit (INTU), and payments company Square (SQ).

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023