U. S. stocks started the new year with a decline. Investors feared the Federal Reserve would tighten interest rate policy quickly in 2022. As bond yields surged and the yield curve steepened, growth stocks swooned while value stocks gained.

Fears of the Federal Reserve aggressively tightening monetary conditions escalated after the minutes of the December 14-15 Federal Open Market Committee (FOMC) meeting came out last week.

The minutes showed the FOMC officials viewed the labor market as “very tight.” They also indicated their readiness to end pandemic-era stimulus, shrink the balance sheet, and raise interest rates.

The U. S. economy added just 199,000 jobs in December, short of the 422,000 forecasted by economists. The sub-par job creation, however, did not quell interest rate fears.

Investors saw the larger-than-expected 0.6% increase in average hourly earnings and a bigger-than-expected drop in the unemployment rate to a pandemic era low of 3.9%, encouraging the Fed to tighten.

Traders raised the odds of the Fed raising the short-term benchmark federal funds rate in March to 90% from 63% at the start of 2022. Somewhat surprisingly, the yield on the longer-dated 10-year Treasury soared 0.26% to a two-year high of 1.77%.

The yield curve steepened as the yield on longer-dated Treasury notes rose more than the yield on the shorter-term Treasury bills.

Rising bond yields took a toll on growth stock prices that trade on cash flows expected far off in the future. Value stocks fared better as investors bet on economically sensitive companies performing better in a rising rate environment.

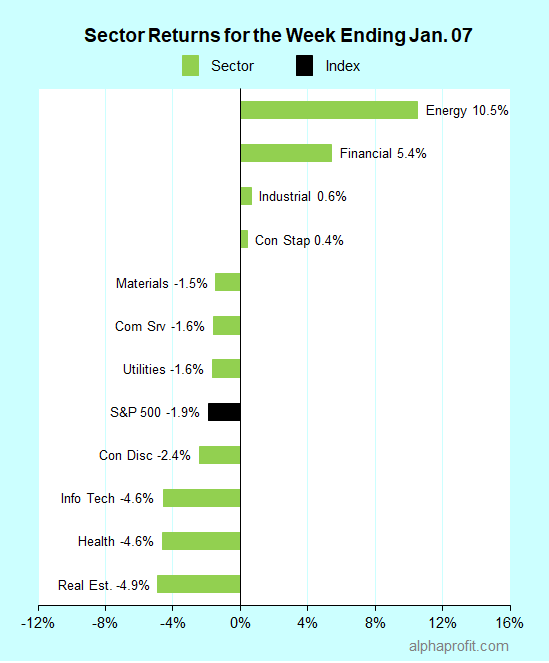

For the week ending January 7, the S&P 500 (SPY) fell 1.9%. Four of the 11 sectors gained..

Market breadth was neutral, with the number of advancing stocks in the S&P 500 almost equal to the number of decliners.

Energy (XLE), financials (XLF), and industrials (XLI) led the S&P 500.

Real estate (XLRE), health care (XLV), and information technology (XLK) lagged the benchmark losing 4.6% or more.

The S&P 500’s top 10 winners included communication services, consumer discretionary, energy, and financial companies.

1. Communication Services

Surging 28%, Discovery, Inc. (DISCK, DISCA) was the top performer in the S&P 500 for the week. Bank of America raised the media company to Buy, expecting its pending merger with Warner Media to create a dynamic rival to Netflix and Disney+ in the streaming space.

Share of media giant ViacomCBS (VIAC) gained 17% after the Wall Street Journal reported AT&T-owned WarnerMedia and ViacomCBS are exploring a possible sale of a significant stake or all of the CW Network, which they jointly own.

2. Consumer Discretionary

Automaker Ford Motor (F) gained 18% after announcing that it will nearly double the production of its all-electric F-150 Lightning pickup to 150,000 units annually due to strong customer demand.

3. Energy

Energy companies Hess (HES) and Schlumberger (SLB) rose 17% each, while Occidental Petroleum (OXY) rose 15%, following the 5% rally in the price of oil in the opening week of 2022 on supply concerns. Investors doubted if OPEC & Russia could deliver on their agreement to increase output by 400,000 barrels per day (BPD) in February after Reuters reported OPEC increased production by only 70,000 in December from November, short of the 253,000 BPD increase allowed under the supply deal.

4. Financials

Regional bank Regions Financial (RF), M&T Bank (MTB), Citizens Financial Group (CFG), and People’s United Financial (PBCT) rose 14-15%. The difference in yield between 10-year Treasury notes and 3-month Treasury bills, also called the yield curve, rose by 0.2% last week to 1.66%. A steeper yield curve expands the net interest margin for banks and increases lending profits.

Top ETFs for the week

The following ETFs themes worked well: oil services and energy, banks, energy master limited partnerships, and uranium. The top ETFs for the week include:

- VanEck Oil Services ETF (OIH) +14.6%

- Energy Select Sector SPDR Fund (XLE) +10.5%

- Invesco KBW Bank ETF (KBWB) +10.1%

- Alerian MLP ETF (AMLP) +7.1%

- Global X Uranium ETF (URA) +6.1%

Top Fidelity Fund for the week

- Fidelity Select Energy Portfolio (FSENX) +10.8%

Looking ahead to the week of January 10

Investors will focus their attention on the bond market again this week, seeking clarity on whether last week’s steepening of the yield curve was an aberration. Investors will also receive inputs from Fed Chairman Powell and data on inflation. The fourth-quarter earnings reporting season starts at the end of the week.

* Last week, blue-chip companies rushed to issue bonds and lock lower borrowing costs. The yields on longer-dated income securities rose more than the yields on shorter-dated income securities on account of these corporate bond sales. Treasury auctions this week can bring clarity on the likelihood of the yield curve flattening when corporate bond sales subside. Value stocks can come under pressure if the yield curve flattens.

* Federal Reserve Chairman Powell testifies at his nomination hearing before a Senate panel this week. Investors are keenly waiting for his tone and comments in light of the tightening plans evident in the Fed minutes released last week. This week also includes the nomination hearing to confirm Fed Governor Brainard’s to the post of the vice-chair.

* The economic calendar includes inflation data at the consumer and producer level. Briefing.com shows economists forecasting the core consumer price index to rise 0.5% in December, matching November’s tally. They expect the increase in the core producer price index to moderate to 0.5% in December from 0.7% in November.

* The week also marks the start of the fourth-quarter earnings season, with the nation’s top banks, JPMorgan Chase, Citigroup, and Wells Fargo, reporting on Friday. Investors will also get insight into the state of the semiconductor and airline industries when Taiwan Semiconductor and Delta Air Lines report ahead of the banks.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023