U. S. stocks rose to record highs in the first week of 2021 on expectations of a larger fiscal package and higher infrastructure spending under a Democratic-led U. S. Congress. The December jobs report reflected the impact of a resurgence in COVID19 cases and the return of lockdowns.

U. S. stocks set new records in the first week of 2021. They rallied sharply after the Democrats won both the runoff elections from Georgia for the U. S. Senate.

The result shifted control of the Senate to Democrats, giving Democrats control over both chambers of Congress.

Investors believed the Democrat President-elect Biden would deliver a bigger stimulus package than what would have been possible under a divided Congress. Investors also expected infrastructure spending to rise under the Biden administration.

Both chambers of Congress convened to confirm Biden as the next President but not before a riot at the Capitol delayed the electoral vote count.

COVID19 continued to take a heavy toll on human life last week. The U. S. daily death tally exceeded 4,000 for the first time while the number of daily new cases topped 300,000 for the first time.

Economic data showed the impact of lockdowns. The Labor Department reported the U. S. economy lost 140,000 jobs in December, the first monthly job loss since April. Investors were unfazed, interpreting the data as giving the Biden administration more reason for stimulus.

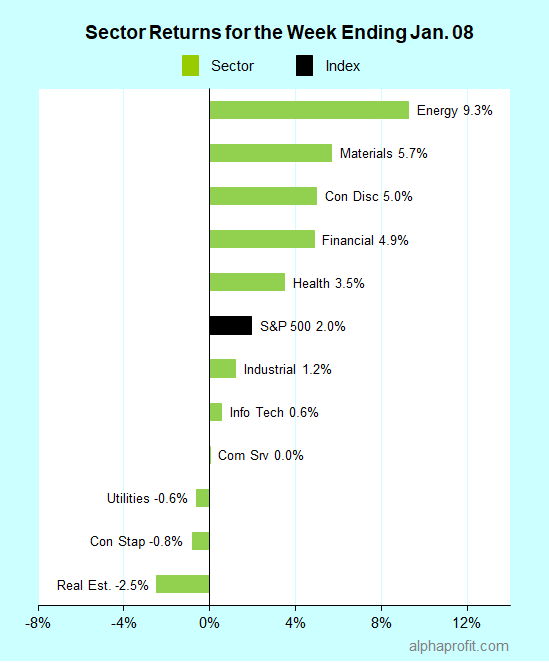

For the week ending January 8, the S&P 500 (SPY) rose 2.0%.

Eight of the 11 sectors gained.

Energy (XLE), materials (XLB), and consumer discretionary (XLY) led the S&P 500.

Real estate (XLRE), consumer staples (XLP), and utilities (XLU) lagged the benchmark.

The number of advancing stocks in the S&P 500 beat the number of decliners by a 2-to-1 ratio.

The S&P 500’s top 10 winners included companies from the consumer discretionary, materials, and energy sectors.

1. Consumer discretionary

L Brands (LB) shares rose 26%, claiming the top spot among the S&P 500 winners for the week. The retailer lifted its fourth-quarter earnings guidance by 35% after same-store sales in its Bath & Body Works segment surged 17% during the nine-week holiday period.

The S&P 500 index’s new entrant Tesla (TSLA) soared 25% after analysts at RBC Capital & Evercore ISI upgraded their ratings. The electric car maker became the fifth largest constituent of the S&P 500.

2. Materials

Shares of lithium producer Albemarle (ALB) vaulted 25% after Democrats controlled both chambers of Congress. Lithium demand should increase from the rising use of lithium-ion batteries if the ‘green deal’ materializes as expected by investors.

Copper producer Freeport McMoRan (FCX) and fertilizer producer Mosaic (MOS) saw their shares gain 20% and 17%, respectively. Freeport shares rode the rise in the price of copper. Mosaic shares benefited after Citigroup and JP Morgan upgraded their ratings.

3. Energy

Energy shares got a boost from an 8% price increase in the price of oil. Oil closed at the highest level in nearly a year after Saudi Arabia said it would cut 1 million barrels per day from its February and March production to offset the fall in demand from lockdowns. Hopes of a Democrat-controlled Congress providing additional pandemic aid also lifted oil prices.

Shares of oil services firm TechnipFMC (FTI) rose 24% after the Franco-American resumed its plan to split itself into two, a move delayed since March 2020. Shares of petroleum producers EOG Resources (EOG), Diamondback Energy (FANG), and Apache (APA) rose around 17-18% each.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Global X Cannabis ETF (POTX) +23%

- Amplify Transformational Data Sharing ETF (BLOK) +19%

- iShares Global Clean Energy ETF (ICLN) +17%

- ETFMG Alternative Harvest ETF (MJ) +17%

- Invesco Solar ETF (TAN) +16%

Looking ahead to the week of January 11

Stimulus, earnings, and economic data are likely to dominate the headlines this week. With the large-cap S&P 500 and small-cap Russell 2000 indexes up 17% and 36%, respectively, since the end of October 2020, a pullback of sorts is likely not far away. Disappointment in stimulus discussions may be the catalyst.

* Wall Street will focus on the progress of stimulus discussions in Washington before President-elect Biden’s inauguration on January 20. Biden has upped expectations for his administration’s economic package to amount to trillions of dollars. A package including unemployment insurance and rent forbearance is expected on Thursday. Progress towards such a package may not be smooth if Democratic Senators like Manchin oppose bigger direct checks before addressing the pandemic.

* The fourth-quarter earnings reports kick off next week. Banks are in the spotlight, with JPMorgan (JPM), Wells Fargo (WFC), and Citigroup (C) scheduled to report.

* Investors will get a sense of consumer price inflation and December retail sales. Several Federal Reserve officials, including Chairman Powell, are scheduled for a webcast from Princeton University.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023