U. S. stocks extended their decline from the first week of 2022. Bank earnings disappointed investors. In economic data, retail sales and consumer sentiment declined. Inflation remained high. Investors questioned the strength of the economy to get through the omicron risk.

U. S. stocks fell for a second consecutive week. Bank stocks, which had been rising in recent weeks against the backdrop of rising interest rates, dropped as their earnings reports underwhelmed investors. JPMorgan guided profits to fall short of targets due to higher expenses, the threat of the omicron virus variant, and lower trading revenues.

In economic data, retail sales fell 1.9% in December, more than the 0.1% decline expected by economists surveyed by Dow Jones. Shortage of goods and a steep increase in omicron-related infections impacted retail sales.

The University of Michigan’s preliminary January consumer sentiment reading fell 1.8 points in January to 68.8. The decline in consumer sentiment reflected the pain lower-income Americans face from inflation.

Inflation stayed high and generally in line with economists’ expectations. The consumer price index showed a year-over-year increase of 7%, the highest in four decades, while the producer price index report reflected a rise of 9.7% over the same period.

The above data raised doubts on the economy having enough strength to overcome the pressure from the omicron virus while the Federal Reserve tapers monetary stimulus to counter inflation.

By the end of the week, investors rotated out of cyclical value stocks and sought bargains in out-of-favor large-cap growth stocks.

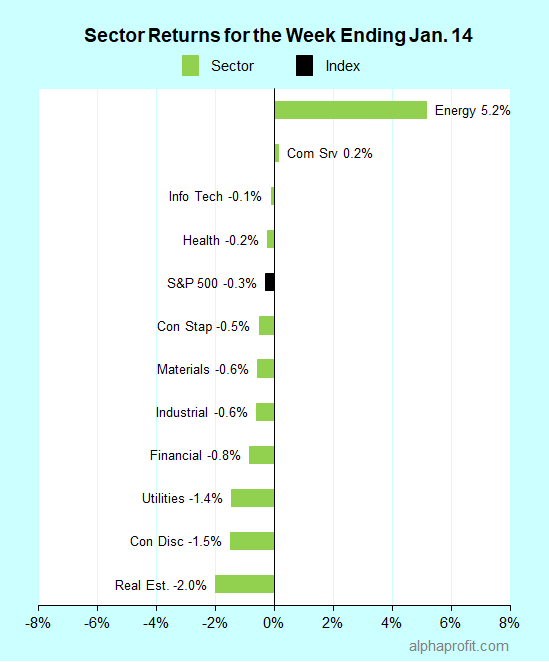

For the week ending January 14, the S&P 500 (SPY) fell 0.3%. Two of the 11 sectors gained.

Market breadth was neutral, with the number of advancing stocks in the S&P 500 almost equaling the number of decliners.

Energy (XLE) and communication services (XLC) ended above the flat line.

Real estate (XLRE), consumer discretionary (XLY), and utilities (XLU) lagged the S&P 500, losing 1.4% or more.

The S&P 500’s top 10 winners included consumer discretionary, energy, health care, and information technology companies.

1. Consumer Discretionary

Gaining 13%, Las Vegas Sands (LVS) was the top performer in the S&P 500 for the week. Sand’s competitor Wynn Resorts (WYNN) rose 8%. Casino stocks rose after the Macau government clarified the number of casinos allowed to operate there would remain limited to six.

Robust quarterly results & forecasts and comments on firm pricing & rising margins from non-S&P 500 index homebuilder KB Home lifted share prices across this group. Index member PulteGroup (PHM) ended 9% higher for the week.

2. Energy

APA Corp. (APA), Halliburton (HAL), Pioneer Natural Resources (PXD), and Phillips 66 (PSX) rose 8-12% each, following oils 6% gain for the week. Oil rose on a weaker U. S. dollar and escalating supply concerns, spurred by the tension between the U. S. and Russia vis-à-vis Ukraine.

3. Information Technology

Semiconductor capital equipment makers Applied Materials (AMAT) and Lam Research (LRCX) rose 11% and 9%, respectively, after semiconductor chipmaker Taiwan Semiconductor said it intends to spend over $40 billion expanding and upgrading capacity in 2022 due to unprecedented chip shortage.

4. Health care

Illumina (ILMN) shares rose 9% after the gene-sequencing technology company upped its 2022 revenue forecast and announced new partnerships with four healthcare companies.

Top ETFs for the week

The following ETFs themes worked well: oil services, Brazil, oil & gas, copper mining, and Saudi Arabia. The top ETFs for the week include:

- VanEck Oil Services ETF (OIH) +7.7%

- iShares MSCI Brazil ETF (EWZ) +6.7%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +6.0%

- Global X Copper Miners ETF (COPX) +5.8%

- iShares MSCI Saudi Arabia ETF (KSA) +5.6%

Top Fidelity Fund for the week

- Fidelity Select Energy Portfolio (FSENX) +5.7%

Looking ahead to the week of January 17

With things quiet on the bond front during this four-day trading week, investors will shift their focus to fourth-quarter earnings. Investors will get insights on what companies expect in 2022 and how they are coping with inflation as earnings reports broaden beyond financials to other sectors. The extension of the rally in cyclical stocks hinges on what economically sensitive businesses say. Data on manufacturing and housing are also in store.

* Investors will focus on fourth-quarter earnings reports during this trading week, shortened by the observance of Martin Luther King Jr. Day. For one, the bond market could provide some calm following the completion of Treasury auctions last week. Federal Reserve officials are also in a “quiet period” ahead of their January 25-26 interest rate policy meeting.

* Fourth-quarter earnings reports pick up steam this week, with good representation from sectors other than information technology. The reporting companies include Bank of America, Netflix, Procter & Gamble, PPG Industries, Prologis, Schlumberger, Union Pacific, and UnitedHealth Group. Commentary from economically sensitive businesses on the outlook for 2022 earnings and inflation can either extend or curtail the rally in value stocks.

* The economic calendar includes manufacturing surveys from the New York & Philadelphia Federal Reserve, housing starts, and existing home sales.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023