President-elect Biden provided details of his $1.9 trillion stimulus proposal called the American Rescue Plan. Bond yields continued climbing for a second straight week on expectations of a pickup in growth and inflation. Bank stocks fell after they kicked off the fourth-quarter reporting season with mixed reports.

President-elect Biden provided details of his widely anticipated $1.9 trillion stimulus proposal last week. The American Rescue Plan includes $350 billion in state & local government aid and $70 billion for COVID testing & vaccination programs. The plan also includes $1,400 direct payment to many Americans and additional federal unemployment payments through September. It also extends the Federal moratoriums on evictions & foreclosures through September.

Expectations of growth and inflation have risen after Democrats took control of both the House and the Senate, opening the door for additional fiscal stimulus. Bond yields extended their increase into the second trading week of 2021, rising to their highest since March 2020. After starting the year at 0.91%, the 10-year Treasury bond yield rose as high as 1.19% last week before pulling back to close at 1.08%.

Banks kicked off the fourth-quarter earnings reporting season. JPMorgan Chase (JPM) reported revenue and earnings above analysts’ forecast. Earnings at Citigroup (C) and Wells Fargo (WFC) topped analysts’ estimates. Their revenues, however, fell short of expectations. Bank stocks sold off en masse after these earnings reports. Investors wanted more from banks after their shares had risen 50% since September 30, 2020.

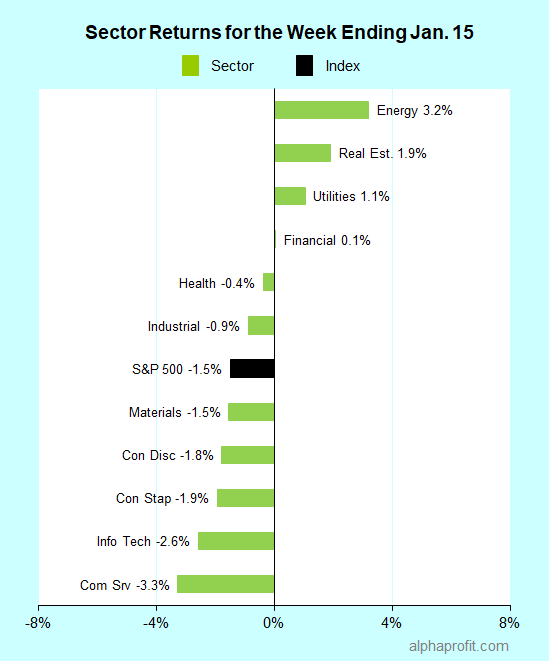

For the week ending January 15, the S&P 500 (SPY) fell 1.5%.

Four of the 11 sectors gained.

Energy (XLE), real estate (XLRE), and utilities (XLU) gained to lead the S&P 500.

Communication services (XLC), information technology (XLK), and consumer staples (XLP) lagged the benchmark.

The number of declining stocks in the S&P 500 edged out the number of advancers by an 8-to-7 ratio.

The S&P 500’s top 10 winners included companies from the consumer discretionary and energy sectors.

1. Consumer discretionary

Etsy (ETSY) shares surged 16%, claiming the top spot among the S&P 500 winners for the week. Jefferies raised its price target for the online arts & crafts retailer by 22% to $205 a share. The broker expects Etsy’s sales to ‘defy gravity’ from a doubling in November & December website traffic and gains in greeting card market share.

General Motors (GM) shares also rose 16%, trailing Etsy just fractionally. GM unveiled a new electric commercial-vehicle brand BrightDrop, targeting the last-mile delivery and logistics market. The new brand’s EV 600 van is expected to be available in late 2021. Nomura and Argus upgraded their ratings on GM stock.

2. Energy

The bullish backdrop for natural gas and oil supported energy stocks. Continued strength in demand for U. S. liquified natural gas (LNG) from abroad, hopes of vaccines and stimulus driving oil demand, and a weaker U. S. dollar demand supported the bullish sentiment.

The five energy companies from the S&P 500 in the top 10 winners were oil producers Occidental Petroleum (OXY) and Marathon Oil (MRO), oil refiner HollyFrontier (HFC), pipeline ONEOK (OKE), and natural gas producer Cabot Oil & Gas (COG). Their gains ranged between 9% and 12%.

3. Other top 10 winners

The top 10 winners included one company each, from the healthcare, consumer discretionary, and information technology sectors.

Eli Lilly (LLY) shares rose 15%. The drug maker’s phase 2 trial of Alzheimer’s disease treatment donanemab, slowed the decline in cognitive functions by a statistically significant 32%.

Shares of ViacomCBS (VIAC) were up 13% after the entertainment giant’s chief financial officer made optimistic comments on the upcoming launch of its Paramount+streaming service.

Intel (INTC) shares were up 11% for the week after the semiconductor chipmaker announced former Intel veteran Gelsinger would become its CEO in February.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Global X Cannabis ETF (POTX) +27%

- ETFMG Alternative Harvest ETF (MJ) +18%

- Alerian MLP ETF (AMLP) +6%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +6%

- SPDR S&P Retail ETF (XRT) +6%

Looking ahead to the week of January 19

The observance of the Martin Luther King Jr. Day holiday on Monday shortens the trading week. Biden’s inauguration and earnings reports are in focus. These earnings reports should shed light on the response of stock prices to earnings during this reporting season.

* President-elect Biden will be inaugurated as the 46th U. S. president on Wednesday. The near-term concern is on the potential for protests in Washington or at state capitals. More importantly, investors have their attention on two items: the effectiveness of Biden’s COVID19 plan and the final size of the stimulus package approved by Congress. Biden needs the votes of moderate Democrats and Republicans to get the package approved by the Senate. At this point, the compromises required to win their support is unknown.

* Last week, bank stocks sold off after reporting earnings. The earnings reporting season gets into a higher gear this week. Bank of America, Goldman Sachs, Intel, International Business Machines, Morgan Stanley, Netflix, and Procter & Gamble are among the 33 S&P 500 members reporting this week. Investors are watching the response of their stocks to earnings reports. They should provide clues on whether the response bank stocks received last week will become the norm for this reporting season.

* The economic calendar is light. Following the rapid rise in bond yields in 2021, Wall Street is alert to the possibility of rising yields impacting stock prices.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023