Biden signed a host of executive actions and released his pandemic action plan after becoming the 46th U. S. President. Investors lost their appetite for cyclical stocks after some Democrats and Republicans opposed Biden’s $1.9 trillion stimulus proposal. U. S. stocks continued their rally as investors returned to the mega-cap communication services and technology stocks.

Biden signed several executive orders on issues ranging from COVID-19 and the economy to climate change shortly after becoming the 46th President. He also released his plan to fight the pandemic. The pandemic plan includes provisions to speed up the rollout of vaccines and the production of protective equipment.

Investors, however, lost their appetite for cyclical stocks that stand to benefit from faster economic growth. Some Democrats and Republicans opposed President Biden’s proposed $1.9 trillion financial aid package, suggesting stimulus passed would be lower and later than expected. European economic data also weighed on stocks. They raised fears of another recession as economies in the continent bore the brunt of lockdown measures to combat COVID-19.

Investors replaced their appetite for cyclical stocks with a taste for their pandemic favorites or mega-cap growth stocks. The gains in mega-cap growth stocks helped U. S. stocks in total to rally.

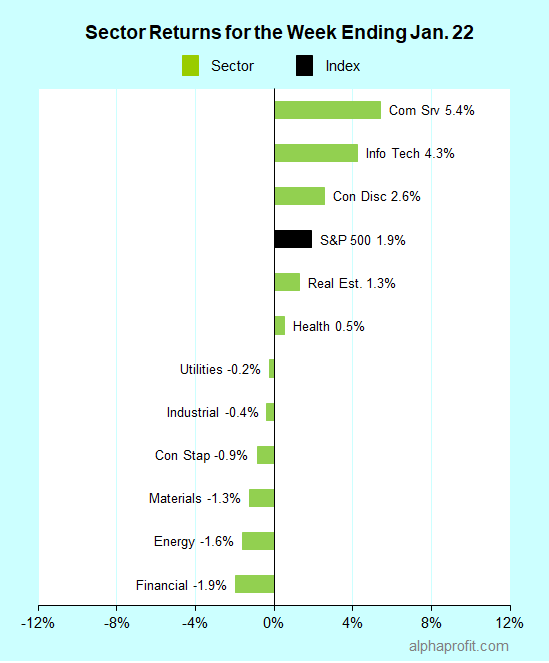

For the week ending January 22, the S&P 500 (SPY) rose 1.9%.

Five of the 11 sectors gained.

Communication services (XLC), information technology (XLK), and consumer discretionary (XLY) led the S&P 500.

Financials (XLF), energy (XLE), and materials (XLB) lost ground, lagging the benchmark.

Six of the S&P 500’s top 10 winners were consumer discretionary sector members. The winner list also included companies from the communication services, industrial, and healthcare sectors.

1. Consumer Discretionary

Homebuilding stocks rallied on industry data bolstering the outlook for homebuilder earnings. Housing starts & building permits rose to their highest since September 2006 and August 2006, respectively, while the supply of existing homes is at an all-time low.

Homebuilder PulteGroup (PHM) led the charge; its shares rose 14%. NVR, Inc. (NVR), Lennar (LEN), and D.R. Horton (DHI) were the other homebuilders featuring in this list with gains of 10-12% each.

Shares of Ford Motor (F) led the auto group with a 17% gain after Deutsche Bank and JPMorgan upgraded them. Shares of auto retailer CarMax (KMX) also cruised to an 11% gain after Northcoast Research upgraded the stock to buy. Auto stocks are rising on expectations of electric vehicles growing their market share from Biden’s clean-energy push.

2. Communication Services

Netflix (NFLX) shares climbed 13%. The internet television network added 8.5 million subscribers in the fourth quarter, beating analysts’ 6.5 million forecast. Netflix also increased its 2021 and 2022 free cash flow forecasts.

Shares of social media giant Facebook (FB) rebounded from their prior week losses with a 9% gain. The shares return to favor on rising earnings expectations and positive comments from BMO Capital Markets ahead of Facebook’s fourth-quarter earnings report on January 27.

3. Other top 10 winners

- Truck maker PACCAR (PCAR) 12%

- Drug maker Eli Lilly (LLY) 8%

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Invesco Solar ETF (TAN) 13%

- VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) 12%

- KraneShares CSI China Internet ETF (KWEB) 12%

- Invesco WilderHill Clean Energy ETF (PBW) 10%

- iShares U.S. Home Construction ETF (ITB) 9%

Looking ahead to the week of January 25

Investors have plenty to look forward to this week, including fourth-quarter earnings reports, Federal Reserve’s interest rate meeting, and GDP growth data. Investors will also seek clues to the size and timing of the stimulus plan likely to be approved. There is also room for optimism in the fight against COVID-19. Small-cap stocks remain overbought and are vulnerable to a pullback.

* Over 100 S&P 500 members will report their quarterly earnings this week. The reporting companies include Apple (AAPL), Facebook (FB), Johnson & Johnson (JNJ), Mastercard (MA), Microsoft (MSFT), Tesla (TSLA), and Visa (V).

* Johnson and Johnson may release results from the trials of its single-regimen COVID-19 vaccine. Positive trial data can help to boost vaccine supplies soon. Investors will also watch if the January 8 peak in the nationwide count of daily new COVID-19 cases endures.

* The Federal Open Market Committee holds its first interest rate policy meeting in 2021. Economists do not expect the central bank to take any action or make significant changes to its statement after the two-day event.

* In economic data, the Commerce Department provides its first estimate of the fourth quarter U. S. gross domestic product growth. Economists expect the economy to grow by 4.4% from the previous quarter.

* Investors will remain tuned to the size and timing of the stimulus plan likely to be approved. They will be alert to any impact on the progress of Biden’s fiscal stimulus bill from the Senate’s impeachment proceedings against former President Trump.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023