Better-than-expected economic data and positive news on an experimental COVID-19 vaccine helped stocks perform well last week. Investors continued to remain cautious as the daily number of new COVID-19 cases set a new record.

Upside surprises to employment and factory activity data boosted the confidence of a quick economic recovery if COVID-19 is brought under control.

The Labor Department reported the economy created a record 4.8 million jobs in June, exceeding economists’ 2.9 million forecast. The unemployment rate fell to a better-than-expected 11.1% from 13.3% in May.

Ending three straight months of contraction in factory activity, the Institute for Supply Management’s index jumped by more than 9.0 points to 52.6 in June from 43.1 in May. While readings above 50.0 suggest expansion, the June reading is also the highest since April 2019.

Pfizer (PFE) lifted investment sentiment stating that its COVID-19 vaccine being developed in collaboration with German biotech firm BioNTech created virus-neutralizing antibodies and was well-tolerated in early-stage human trials.

The daily count of new COVID-19 cases continued to rise. Data from the Centers for Disease Control and Prevention set a new record of 54,357 on July 1. The next day, Florida alone reported 10,000 new cases, worse than any European country reported at the peak of their outbreaks.

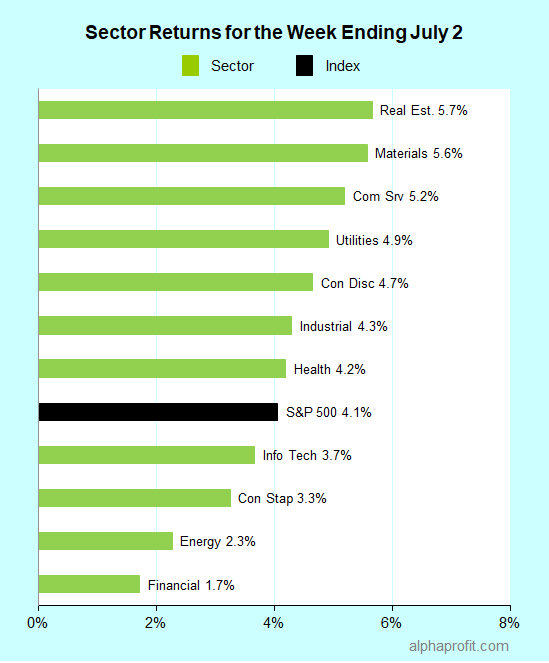

For the week ending July 2, the S&P 500 (SPY) rose 4.1%.

All 11 sectors gained.

Real estate (XLRE), materials (XLB), and communication services (XLC) led the way gaining over 5.0% each.

Financials (XLF), energy (XLE), and consumer staples (XLP) lagged the benchmark.

FedEx (FDX) along with health care and Internet companies were among the S&P 500’s top winners last week.

1. FedEx (FDX) up 20%

The integrated freight & logistics company reported $2.53 a share in EPS vs. $1.62 analysts’ estimate as a rise in online shopping spurred demand for FedEx’s U. S. Ground deliveries.

2. Health care companies Amgen (AMGN) up 11% and Abiomed (ABMD) up 10%

A U.S. appeals court upheld two patents for Amgen’s $5.2 billion rheumatoid arthritis drug Enbrel giving exclusive rights to the biotech company through November 2028 and April 2029.

A U. S. study found 84% survival rate in patients with challenging cardiac conditions using Abiomed’s heart pumps.

3. Internet companies Akamai Technologies (AKAM) and eBay (EBAY) up 7% each

Akamai features here for the second straight week after Cowen analyst upgraded its shares to outperform and boosted the price target to $150 from $107 citing continued growth of its content delivery network and underappreciated security business.

Like Akamai, eBay features here again after its shares rose on the chatter of the online retailer moving to a new end-to-end payments process in July when its agreement with PayPal expires and separately, selling its classifieds unit.

Looking ahead to the week of July 6

The trading week is shortened by the observance of the July 4 holiday on Friday, July 3.

* With the second-quarter earnings reporting season more than a week away, investors’ attention will be on COVID-19 cases and unemployment claims (1.35 million expected). Wall Street will also focus on the ISM’s service activity index that is expected to follow factory activity’s lead in rising above 50.

* The U. S. Treasury will auction nearly $100 billion of 3-year notes, 10-year notes, and 30-year bonds combined.

* The earnings calendar is light with only one S&P 500 Walgreens (WBA) scheduled to report. Other names likely to get attention include Levi Strauss (LEVI) and Bed, Bath, and Beyond (BBBY).

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023