As COVID-19 cases continued to surge, investors sought safety in large-cap technology stocks. The NASDAQ Composite Index set new all-time highs on four of the five trading sessions last week. Stock prices were also helped by U. S. economic data and positive analysis on Gilead Sciences’ antiviral drug.

COVID-19 cases continued in surge particularly in AZ, CA, FL, and TX pushing the nationwide tally over 3.1 million. The daily new case count continued to rise, setting a new record of 63,000 on July 10. The daily death count worryingly showed signs of rising after trending lower from its April high through July 5.

Against this uncertainty, investors gravitated toward the steadiness and predictability of mega-cap information technology and communication services stocks amply included in the NASDAQ Composite Index (ONEQ). The sustained buying pressure into such stocks enabled the NASDAQ Composite to rise to new all-time highs last week and repeat this feat thrice.

The Institute of Supply Management’s service activity index for the U. S. surged back above 50.0 in June to suggest expansion. This index recorded its largest monthly increase soaring to 57.1 in June from 45.4 in May. Additional data from a late-stage study showed Gilead Sciences’ (GILD) remdesivir significantly improved clinical recovery of COVID-19 patients and reduced their risk of death.

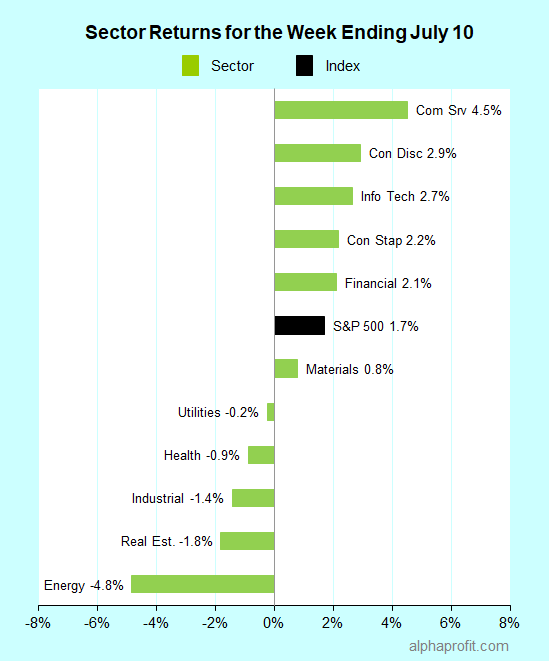

For the week ending July 10, the S&P 500 (SPY) rose 1.7%.

Six of the 11 sectors gained.

Communication services (XLC), consumer discretionary (XLY), and information technology (XLK) led the S&P 500.

Energy (XLE), real estate (XLRE), and industrials (XLI) lagged the benchmark.

Last week, the S&P 500’s top winners included companies in communication services, retailing, and materials.

1. Communication Services – Netflix (NFLX) and Twitter (TWTR) up 15% each

Anticipating strong results this year, Goldman Sachs (GS) raised its share price target for the streaming entertainment provider Netflix to $670 from $540 implying nearly 30% upside.

Twitter shares rose after a job posting revealed the social media network’s plan to start a subscription service.

2. Materials – Freeport-McMoRan (FCX) up 13% and Air Products (APD) up 10%

Shares of Freeport-McMoRan gained after the miner raised its second-quarter forecast for copper and gold sales to exceed its April guidance by 8% and 10%, respectively.

Air Products along with ACWA Power and NEOM signed an agreement for a $5 billion green hydrogen-based ammonia production facility in Saudi Arabia’s upcoming smart city, NEOM.

3. Retailers Amazon (AMZN) up 11%, Walmart (WMT) up 10%, and eBay (EBAY) up 9%

Citigroup (C) raised its share price target on Amazon to $3,550 from $2,700 implying an 11% upside citing Amazon’s ability to retain pandemic-driven market share gains.

Walmart shares rose on reports of the retailer launching its new subscription service Walmart+ rivaling Amazon Prime.

With eMarketer projecting online sales to grow 18% this year, shares of online retailer eBay continued to ride the e-commerce wave and claimed a spot here for a third straight week.

Looking ahead to the week of July 13

* Wall Street will watch developments related to COVID-19 as in new case trends, changes to keeping businesses open, and reintroduction of quarantines or social distancing measures to assess the trajectory of the economy.

* Second-quarter earnings reports will compete for investors’ attention. Nearly 30 of the S&P 500 members including Johnson & Johnson (JNJ), JPMorgan Chase (JPM), Netflix (NFLX), PepsiCo (PEP), and Honeywell International (HON) report this week. According to Factset, second-quarter earnings are expected to drop 45% from a year ago.

* In economic data, June retail sales will be key. In May retail sales rose 17.7% from April’s depressed level as several retailers reopened for business. Economists are waiting to see if June retail sales show the impact of reversal or delays in reopening retail activity.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023