Stocks pulled back from record highs to end their winning streak after three weeks. The nationwide count of daily new COVID cases rose from the delta variant of the coronavirus. Investors provided a muted response to second-quarter earnings reports. The surprising drop in consumer sentiment weighed heavily on stocks.

The delta variant of the coronavirus impacted stocks after public health officials said U. S. COVID cases are up 70% from the previous week. Several counties in California including, Los Angeles, and parts of Nevada, including Las Vegas, asked people to wear masks regardless of their vaccination status.

The S&P 500 companies reporting second-quarter earnings showed robust year-over-year growth. Over 85% of the reporting members beat analysts’ EPS forecasts. Several financial firms including, Citigroup, Goldman Sachs, PNC Financial, and Wells Fargo, topped analysts’ EPS forecast by over 40% each.

Investors were, however, not enthused. Stocks of reporting companies fell more often than they gained. The median decline of S&P 500 member reporting earnings last week amounted to 1.9%. Investors fretted over the impact of the resurgence in COVID cases on third-quarter earnings.

In economic data, U. S. retail sales rose 0.6% in June from May as consumers spent more on services and in-store goods. Economists expected retail sales to fall by 0.4%.

Inflation concerns lurked in the background through the week after the consumer price index rose 5.4% for the 12 months ending in June. Federal Reserve Chairman Powell told Congress the rise in inflation would likely be temporary. Investors perceived the surprising decline in consumer sentiment as the verdict on inflation for the week.

Stocks sold off after the University of Michigan’s consumer sentiment index fell to 80.8 in July from 85.5 in June, compared to economists’ forecast for the index to rise to 86.3. Investors interpreted the data as evidence for inflation concerns outweighing positive job growth trends. The survey showed consumers expecting the cost of living to rise 4.8% this year, the highest since 2008.

The yield on the 10-year Treasury note fell over 0.05% last week to close at 1.30%.

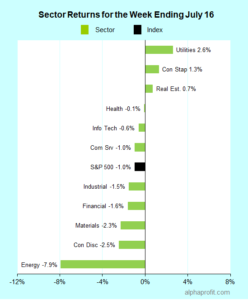

For the week ending July 16, the S&P 500 (SPY) fell 1.0%. Eight of the 11 sectors declined.

Utilities (XLU), consumer staples (XLP), and real estate (XLRE) bucked the S&P 500, gaining 0.7% or more.

Energy (XLE), consumer discretionary (XLY), and materials (XLB) lagged the benchmark.

Market breadth was negative. The number of declining stocks in the S&P 500 led the number of advancers by more than a 2-to-1 ratio.

Utility companies accounted for six of the S&P 500’s top 10 winners. Consumer staples, financial, and real estate companies rounded out the top 10.

1. Utilities

Eversource Energy (ES), Evergy (EVRG), Duke Energy (DUK), WEC Energy (WEC), NextEra Energy (NEE), and Ameren Corp. (AEE) +4 to 6% each – The defensive attributes of utility stocks and their 3.25% average dividend yield appealed to investors amidst falling bond yields and declining stock prices.

In company-specific news, Duke Energy hiked its quarterly dividend by 2%. Credit Suisse assumed coverage of NextEra Energy with an Outperform rating and $85 price target, implying a 9% upside.

2. Consumer Staples

PepsiCo (PEP) +4% – The beverage and snack giant topped analysts’ second-quarter sales and EPS forecasts by 7% and 12%, respectively, and provided an upbeat assessment for the remainder of 2021.

3. Financial

Visa (V) and Mastercard (MA) +4% each – Credit card networks fared well, with Visa setting a new all-time high and Mastercard approaching its all-time high set in April. India’s fifth-largest credit card issuer RBL Bank teamed up with Visa to issue credit cards. MasterCard announced a partnership with Verizon Communications to jointly develop contactless payments and new shopping formats.

4. Real Estate

Welltower (WELL) +4% – Health care REIT rose after RBC Capital Markets raised Welltower’s per-share funds from operations estimate for 2021, 2022, and 2023, citing stronger-than-expected improvement in senior housing occupancy rates from COVID.

Top ETFs for the week

The following ETFs themes worked well: agricultural commodities, utilities, Brazilian stocks, and residential real estate. The top ETFs for the week include:

- Invesco DB Agriculture Fund (DBA) +3.7%

- First Trust Global Tactical Commodity Strategy (FTGC) +2.7%

- Utilities Select Sector SPDR Fund (XLU) +2.6%

- iShares MSCI Brazil ETF (EWZ) +1.7%

- iShares Residential and Multisector Real Estate (REZ) +1.7%

Top Fidelity Fund for the week

- Fidelity Select Utilities (FSUTX) +1.2%

Looking ahead to the week of July 19

Earnings reports take center stage this week. Concerns about the delta variant of the coronavirus are rising. Falling long-term bond yields will continue to be among investor’s focal points, with the European Central Bank and the People’s Bank of China announcing interest rate decisions. The economic calendar includes data from the housing industry.

* The flow of second-quarter earnings picks up. Nearly 70 S&P 500 members report bringing the healthcare, communication services, information technology, and industrials sectors into focus. Sector heavyweights Johnson & Johnson, Netflix, Intel, and Honeywell, report this week. American Express, Coca-Cola, and NextEra Energy are among the other S&P 500 members reporting earnings this week.

* Investors are becoming antsy over the uptick in the daily number of new COVID cases from the delta variant. The 7-day daily new case average has risen to about 30,000, after bottoming in the latter part of June at around 12,000. Further increases in the number of cases can overshadow earnings reports and negatively impact stocks.

* Wall Street will maintain its focus on interest rates. The slide in yields suggests bond investors are unsure of the prospects of continued economic growth. The European Central Bank meets to discuss interest rate policy this week. With the recovery of the Eurozone economies stalled and COVID cases on the rise, the ECB could strengthen its commitment to low-interest rates and asset purchases. Investors also await the People Bank of China’s interest rate decision after the bank changed course abruptly last week, increasing liquidity.

* Several data points from the housing industry are due this week. They include housing starts, building permits, and existing home sales. Investors will look to assess the impact of falling lumber prices and mortgage rates on the housing industry.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023