Progress on COVID-19 vaccines helped stocks stage a broad rally last week. Mixed economic data and the continued rise in COVID-19 cases however limited the advance. The leadership of large-cap technology stocks faltered as investors gravitated towards laggards.

The U. S. Food & Drug Administration granted fast track designation to two of the four COVID-19 vaccines being developed by Pfizer and German biotech BioNTech SE. Separately, data published by the New England Journal of Medicine showed Moderna’s coronavirus vaccine produced a ‘robust’ immune response. Moderna announced its plans to start late-stage clinical trials for its vaccine candidate on or around July 27.

In economic data, retail sales rose 7.5% in June to exceed economists’ forecast. However, jobless claims remained stubbornly high suggesting a slowdown in the pace of hiring. In COVID-19 news, the 7-day average of the number of new cases topped 67,500, up from 57,000 the week before.

The continued leadership of large-cap growth stocks and the NASDAQ Composite index was threatened after this benchmark set multiple new highs the week before. Growth stocks in general and large-cap technology stocks in particular lost ground as investors rotated into out-of-favor parts of the market. Value stocks, large and small fared well.

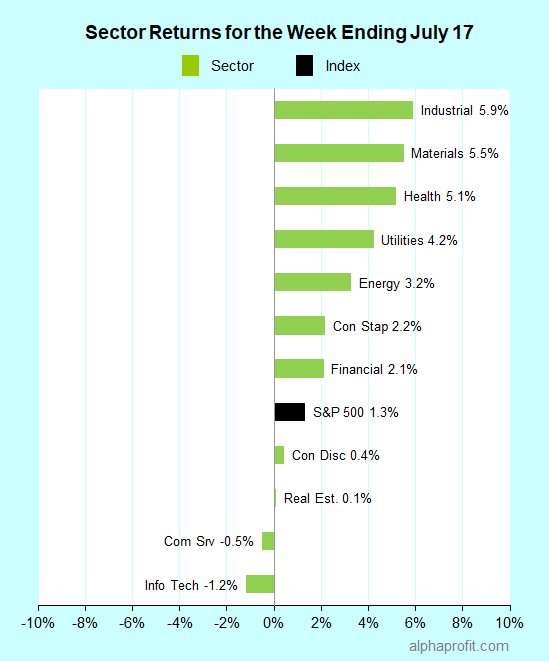

For the week ending July 17, the S&P 500 (SPY) rose 1.3%.

The rally was broad with advancers beating decliners over 5-to-1.

Nine of the 11 sectors gained.

Industrial (XLI), materials (XLB), and healthcare (XLV) led the S&P 500.

Information technology (XLK), communication services (XLC), and real estate (XLRE) lagged the benchmark.

Six of the S&P 500’s top 10 winners last week were health care companies. Two health care groups, health care diagnostics & research and medical devices, fared notably well.

1. Hanesbrands (HBI) up 23%

Apparel maker Hanesbrands was the week’s top performer in the S&P 500. Analysts at Bank of America (BAC), Credit Suisse (CS), and Raymond James (RJF) upgraded their ratings as COVID-19 is increasing demand for Hanesbrands’ comfortable apparel and masks.

2. Health care diagnostics & research – Waters Corp. (WAT) up 20% and Laboratory Corporation of America (LH) up 12%

Life sciences tools & services provider Waters Corp. pre-announced second-quarter sales of ~ $520 million better than analysts’ $485 million forecast and appointed a new CEO.

Laboratory Corporation of America shares rose after analysts at Bank of America upgraded the diagnostics company’s shares to Buy, citing prolonged COVID-19 testing tailwinds. The analysts raised their price target by 13% to $220 a share.

3. Medical Devices – Align Technologies (ALGN) up 18%, Zimmer Biomet (ZBH) up 13%, and Intuitive Surgical (ISRG) up 13%

Shares of orthodontic device maker Align Technologies and orthopedic implant maker Zimmer Biomet rose after analysts at Cowen (COWN), Stifel (SF), and SVB Leerink raised their share price targets.

Investors perceived robotic surgery leader Intuitive Surgical as a beneficiary of delays in Johnson & Johnson’s (JNJ) robotic surgery program and bid up the former’s shares.

Looking ahead to the week of July 20

* Investors are awaiting early-stage human trial data on a COVID-19 vaccine being developed by Oxford University and AstraZeneca. They are expected to be released on Monday by The Lancet, a peer-reviewed medical journal.

* The coming week is a busy one for second-quarter earnings reports. Nearly 90 S&P 500 members report this week. The list of reporting companies includes American Express (AXP), Coca-Cola (KO), Microsoft (MSFT), Union Pacific (UNP), and Verizon (VZ).

* Congress is expected to debate a new $1+ trillion stimulus package. Both Republicans and Democrats have a strong incentive to agree on additional stimulus in this Presidential election year. The extension of the $600 per week enhanced unemployment benefit beyond July 31 is a contentious issue.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023