Stocks benefited from promising COVID-19 vaccines trial results and an agreement in Europe for a rescue fund. However, stubbornly high jobless claims and deteriorating Sino-U.S. relations pressured stocks. While individual stocks moved significantly, the weekly change for the S&P 500 and its sectors was muted ahead of the upcoming busy week.

Stocks started the past week on a strong note after Pfizer (PFE) and German biotechnology company BioNTech reported Phase 1/2 clinical trial data for their COVID-19 vaccine candidate. The data showed their candidate to be both safe and effective. The 27-nation European Union bloc reached agreement on an $860 billion coronavirus rescue fund after four days of intense negotiations.

The uptrend in stocks faltered in the later part of the week. Weekly initial jobless claims increased for the first time since late March. The Labor Department reported an increase in initial benefit claims to 1.4 million. Economists’ had forecasted the claims to decline to 1.3 million.

Political tension between the U. S. and China rose after the U. S. accused China of ‘stealing intellectual property’ and instructed it to close its consulate in Houston. In retaliation, China ordered the U. S. to close its consulate in Chengdu.

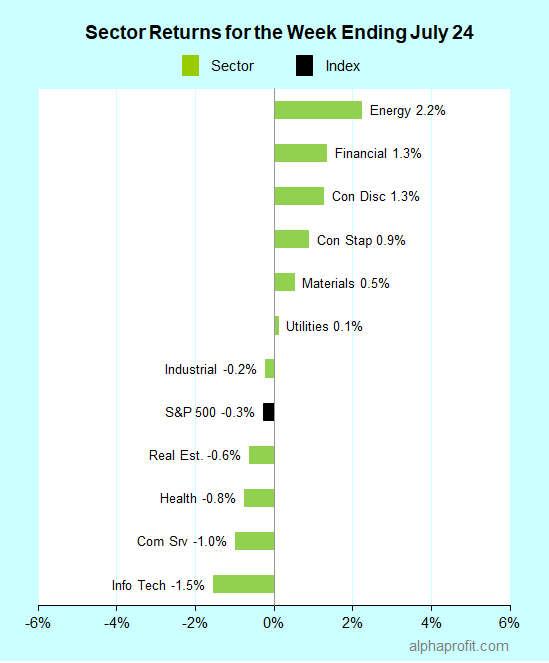

For the week ending July 24, the S&P 500 (SPY) fell 0.3%.

Advancers however edged out decliners by a 5-to-4 ratio.

Six of the 11 sectors gained.

Energy (XLE), financials (XLF), and consumer discretionary (XLY) led the S&P 500 (SPY).

Information technology (XLK), communication services (XLC), and health care (XLV) lagged the benchmark.

The S&P 500’s top 10 winners last week included Advanced Micro Devices (AMD) along with hospital operators, housing-related companies, and energy companies.

Shares of semiconductor chipmaker Advanced Micro Devices surged 26% to be the week’s top performer in the S&P 500. AMD announced a new line of desktop processors based on its 7-nanometer manufacturing process while its key competitor Intel (INTC) delayed the launch of such chips. AMD’s six-month head start should help in gaining market share.

1. Hospital operators – HCA Healthcare (HCA) up 18%, Universal Health Services (UHS) up 11%

Shares of HCA Healthcare and Universal Health Services rose after the former reported $3.23 a share profit in the second quarter compared to analysts’ forecast of $0.39 a share loss. HCA owed part of its outperformance to Uncle Sam as it received over $800 million in federal stimulus money during the quarter.

2. Housing-related companies – PulteGroup (PHM) & NVR, Inc. (NVR) up 14% each, Whirlpool (WHR) up 11%

Shares of homebuilders PulteGroup and NVR as well as home appliances maker Whirlpool rose after their second-quarter per-share earnings topped analysts’ forecast. PulteGroup and NVR grew the dollar value of their order backlog over 13%. Whirlpool’s North American & European product demand strengthened in June.

3. Energy companies – Noble Energy (NBL) up 13%, Halliburton (HAL) up 12%

Chevron (CVX) offered to buy oil & gas producer Noble Energy in an all-stock transaction valued at $5 billion. Halliburton reported $0.05 a share in second-quarter profit versus analysts’ forecast of $0.11 a share loss. Bank of America upgraded Halliburton shares to Buy, citing current cost reduction programs significantly benefiting cash flow during the next oil & gas upcycle.

Looking ahead to the week of July 27

The coming week is a busy one on several fronts.

* Nearly 170 S&P 500 members including several sector leaders are scheduled to report second-quarter earnings in what is the busiest week of this reporting season. The list of reporting companies includes Alphabet (GOOG), Apple (AAPL), Amazon (AMZN), ExxonMobil (XOM), Pfizer (PFE), Procter & Gamble (PG), and Visa (V).

* Economists are awaiting the Commerce Department’s first read of the second-quarter gross domestic product. The report should show the impact of COVID-19 shutdowns on the economy. Economists’ consensus estimate is for the economy to contract ~35% in the second quarter.

* Wall Street is keeping an eye on Senate Republicans. They need to unveil their stimulus proposal early next week for it to have any chance of being passed into law before the $600 per week enhanced unemployment benefit runs out on July 31.

* The Federal Reserve Chair Powell is scheduled to hold a Press Conference after the Federal Open Market Committee discusses interest rate policy. The FOMC is expected to leave benchmark interest rates unchanged.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023