The reopening trade was in full swing last week as investors looked beyond the pandemic and social unrest amidst signs of a rapid economic recovery from mandated shutdowns. A surprisingly strong May jobs report spurred a broad rally in stocks to turn an already strong week into an exceptional one for the bulls.

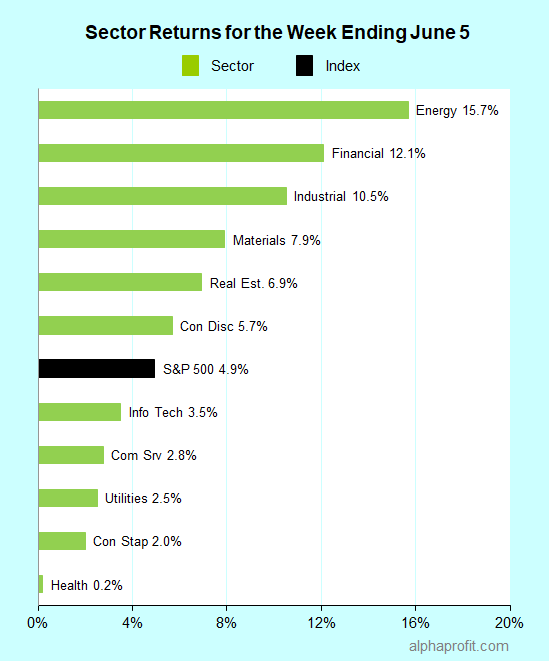

For the week ending June 05, the S&P 500 (SPY) rose 4.9%.

Economically sensitive sectors energy (XLE), financials (XLF), and industrials (XLI) outperformed the S&P 500.

Safe havens health care (XLV), consumer staples (XLP), and utilities (XLU) lost some appeal and lagged the S&P 500.

The economy appeared to reopen at a faster pace than expected last week with COVID-19 seemingly under control. The May jobs report was the highlight of the week. The economy added 2.5 million jobs in May compared to economists’ forecast of 8.0 million job losses. Investors interpreted this as evidence of strong demand compelling businesses to put more people back to work.

Three types of stocks benefited the most as seen from the top 10 winners among the S&P 500 members:

1. Airlines and Boeing

American Airlines (AAL) and United Airlines (UAL) rose 77% and 51%, respectively. The U. S. Global Jets ETF (JETS) was up 33%.

American outlined plans to increase flights during the summer. The airline expects its domestic flights in July to be 45% lower than in July 2019, a sizeable improvement over the 80% reduction seen in April and May.

Shares of aircraft maker Boeing (BA) rose 41% on the back of the rally in airline shares. Boeing also successfully negotiated a couple of its 737 Max orders, avoiding cancellations.

2. Oil producers

Shares of oil producers Occidental Petroleum (OXY) and Apache (APA) rose 61% and 49%, respectively after oil prices gained 11% last week. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) rose 23%.

Oil prices rose on expectations of a rapid increase in demand from reopening and OPEC & Russia preponing their meeting to extend production cuts. On Saturday, the group agreed to extend production cuts by a month, i.e., through July.

3. Retailers and Simon Property Group

Shares of retailers surged as malls across many states reopened for business. Nordstrom (JWN) and Gap (GPS) shares rose 40% and 38%, respectively. Retail REIT Simon Property Group (SPG) surged 54%.

On a side note, Simon Property Group is suing Gap for failing to pay more than $66 million in rent during the COVID-19 pandemic.

Looking ahead to the week of June 8

* The main event next week is the Federal Open Market Committee’s meeting to discuss interest rate policy. Investors will focus particularly on what the Fed has to say about the strong May jobs report.

* In economic data, weekly jobless claims will continue to be of interest as Wall Street looks for a continued decline in claims.

* The earnings calendar is relatively light with a handful of momentum favorites. Adobe (ADBE), Lululemon Athletica (LULU), and Chewy (CHWY) are set to report.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023