The Labor Department reported consumer prices rose in May at their fastest rate in 13 years. Both stock and bond investors, however, shrugged off worries of rising inflation becoming a secular issue. They reasoned the rise in consumer prices resulting from the easing in COVID restrictions will prove transitory.

The major stock indexes were range-bound last week ahead of the much-anticipated consumer price index (CPI) data on Thursday. The Labor Department reported consumer prices rose in May at their fastest pace since 2008. The total CPI rose 5.0% from a year ago, up from 4.2% in April. The increase in the CPI exceeded the 4.7% forecasted by economists.

Economists attributed most of the increase in the consumer price index to the surge in commodity, airfare, and used car prices. Jitters of inflation starting a secular uptrend eased as investors believed that the impact of the pandemic on the above prices is likely to be temporary. They concluded the Federal Reserve could prove correct in expecting the rise in inflation to be transitory.

The Treasury bond market appeared to agree with the assessment of stock investors that the rise in inflation will be temporary. The yield on the 10-year Treasury bond slid below 1.43% to a three-month low.

Meanwhile, the size of the proposed infrastructure spending plan was shrinking in Washington. A bipartisan group of senators consisting of five Democrats and five Republicans pushed a $579 billion infrastructure plan forward to negotiate a deal. This bipartisan plan is substantially smaller than President Biden’s $2 trillion infrastructure spending proposal.

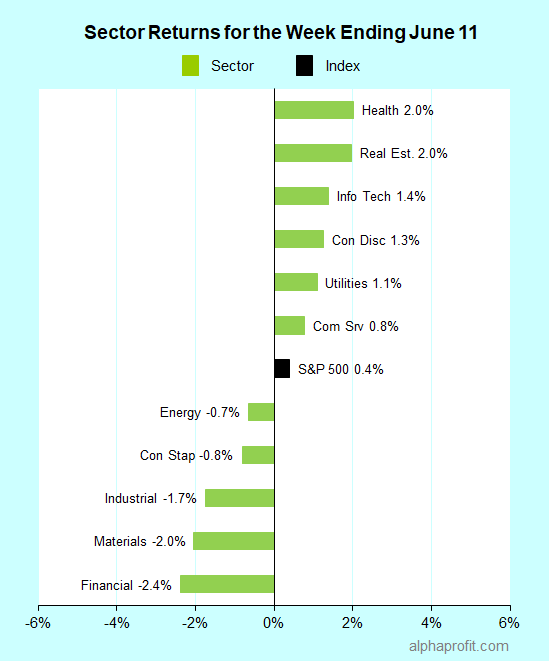

For the week ending June 11, the S&P 500 (SPY) rose 0.4%. Six of the 11 sectors gained.

Health care (XLV), real estate (XLRE), and information technology (XLK) gained over 1.4% to lead the S&P 500.

Financials (XLF), materials (XLB), and industrials (XLI) lagged the benchmark.

The number of advancing stocks in the S&P 500 roughly equaled the number of declining stocks.

Health care and information technology companies collectively accounted for eight of the S&P 500’s top 10 winners. The winner list also included one member each from the industrials and utility sectors.

1. Health Care

Biogen (BIIB) +39% – The biotechnology firm was the top performer in the S&P 500 for the week. The shares surged after the Food & Drug Administration (FDA) approved Biogen’s Alzheimer’s treatment, Aduhelm. The approval has, however, been controversial. Three members of the FDA’s expert panel resigned saying, the decision threatens the integrity of the review process.

Eli Lilly (LLY) +11% – The drug company’s shares rose on speculation that FDA’s decision to approve Aduhelm could improve approval prospects for Lilly’s donanemab to treat Alzheimer’s.

Illumina (ILMN) + 8% – The genomic tools provider gained after providing optimistic comments at a Goldman Sachs healthcare conference.

Catalent (CTLT) + 8% – The drug delivery company rose on the continuing possibility of AstraZeneca shifting its COVID vaccine production to Catalent.

2. Utilities

NRG Energy (NRG) +10% – The independent power producer rallied after announcing it would host an Investor Day this week on Thursday, June 17.

3. Information Technology

Enphase Energy (ENPH) +9% – The renewable energy technology company rose after Refinitiv/Verus upgraded from Sell to Hold.

ServiceNow (NOW) +8% – Goldman Sachs added the enterprise software company to its Conviction Buy list, citing the potential to accelerate growth in subscription revenue in 2022.

Adobe (ADBE) + 7% – Traders likely built positions in the software giant ahead of the company reporting earnings this week on Thursday, June 17.

Tyler Technologies (TYL) +7% – The IT service provider rose after boosting its fiscal 2021 sales and EPS guidance.

4. Industrials

Generac Holdings (GNRC) +7% – KeyBank upgraded the power generation equipment maker and affirmed its $400 a share price target, citing bright prospects for Generac’s Home Standby business.

Top ETFs for the week

The following ETFs themes worked well: biotech & genomics, energy MLPs, Chinese clean tech, and cloud computing. The top ETFs for the week include:

- ARK Genomic Revolution ETF (ARKG) +8.3%

- First Trust NYSE Arca Biotechnology Index Fund (FBT) +7.7%

- InfraCap MLP ETF (AMZA) +7.3%

- KraneShares MSCI China Clean Technology ETF (KGRN) +6.7%

- WisdomTree Cloud Computing Fund (WCLD) +6.5%

Top Fidelity Fund for the week

- Fidelity Select Biotechnology (FBIOX) +7.2%

Looking ahead to the week of June 14

The Federal Open Market Committee’s June monetary policy meeting is the big event for markets this week. Economists expect the FOMC to leave interest rates changed. Market participants are watching for clues on the central bank’s timetable for tapering bond purchases.

* The Federal Open Market Committee meets on June 15-16 to determine interest rate policy. Stocks are likely to be range-bound before the completion of this event. Economists see the FOMC leaving monthly bond purchase amounts and interest rates unchanged. Wall Street’s attention is on the FOMC’s statement after the meeting. Market participants will look for changes the central bank makes to its interest rate and inflation forecasts. They will also focus on details policymakers share on the thought process and timetable for tapering monthly bond purchases.

* Although the earnings calendar is relatively light, the companies reporting will garner attention. The reporting companies include Adobe and Oracle from the software group, home builder Lennar, and contract manufacturer Jabil.

* In economic data, May retail sales and producer prices are due. According to Briefing.com, economists expect retail sales to fall 0.6% in May from April. They expect producer prices to increase 0.5% in May from April.

* Investors will also be watching the news from President Biden’s meetings with NATO allies at the G-7 summit. Biden also meets Russian President Putin one-on-one on Wednesday in Geneva, after which Biden will hold a solo press conference.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023