A bleak economic outlook from the Federal Reserve and fears of a resurgence in the COVID-19 pandemic in the U. S. weighed on stock prices last week. The sell-off reversed the strong gains made in the opening week of June. Three groups of companies bucked the broad decline.

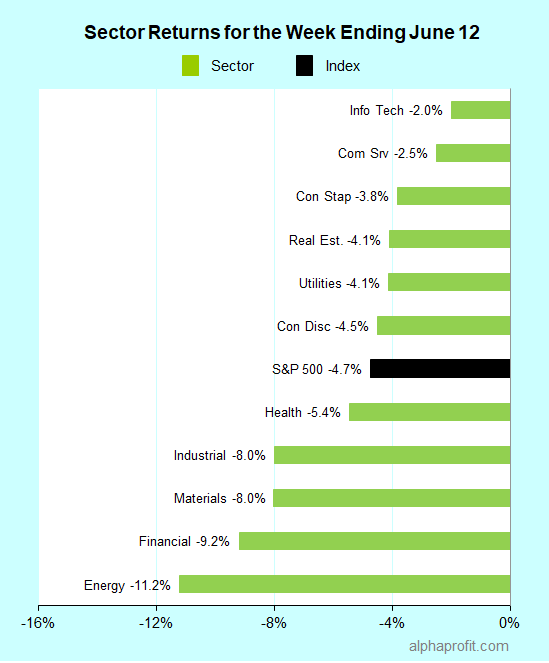

For the week ending June 12, the S&P 500 (SPY) lost 4.7%.

All sectors lost ground for the week.

Information technology (XLK), communication services (XLC), and consumer staples (XLP) held up better than the S&P 500.

Economically sensitive sectors energy (XLE), financials (XLF), and materials (XLB) underperformed the benchmark.

The Federal Open Market Committee indicated it does not expect to raise benchmark interest rates through 2022 after leaving them unchanged near zero. This along with the Fed’s projection for a 6.5% decline in gross domestic product this year and 9.3% unemployment rate at yearend gave investors the impression that the central bank’s concern on the pace of economic recovery has risen.

Data compiled by Johns Hopkins University showed an increase in the number of COVID-19 cases in states like California, Florida, and Texas that have lifted some restrictions. Texas reported three consecutive days of record-breaking Covid-19 hospitalizations.

Only 25 of the S&P 500 members stayed above the flatline last week.

Three types of stocks featured among the S&P 500’s top 10 winners:

1. Videogame software makers

Activision Blizzard (ATVI), Electronic Arts (EA), and Take-Two Interactive Software (TTWO) rose between 3% and 4% each from a host of favorable news.

Demand from the stay-and-play crowd vaulted sales of videogame software to a 52% gain in May. Sony (SNE) announced its plan to include a new version of Take-Two’s Grand Theft Auto V in its upcoming PlayStation 5 console. All three game software firms are seen as potential buyers for AT&T’s Warner Bros. gaming division valued at ~ $4 billion.

2. Household products makers

Clorox (CLX) rose 4%. Investors gravitated towards sanitization products & disinfectants as the nationwide count of confirmed COVID-19 cases topped 2 million.

3. Mega-cap growth companies

The three largest S&P 500 members in market capitalization, Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT), eked out small gains last week. Investors felt more comfortable with the ability of these $1 trillion club members to deliver on earnings expectations during the economic downturn.

Looking ahead to the week of June 15

* The Federal Reserve is once again in the spotlight. The Fed Chairman Powell is scheduled to provide his semi-annual economic testimony to Congress on Tuesday and Wednesday. This gives him a chance to calm the stock market.

* May retail sales data are on deck for Tuesday. This key consumer spending measure is likely to be scrutinized for alignment with a surprisingly strong May jobs report. Economists expect retail sales to increase by 9% in May from April.

* A relatively light earnings calendar is in store. Oracle (ORCL), Kroger (KR), and a few consumer discretionary companies Lennar (LEN), CarMax (KMX), and Carnival (CCL) are set to report.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023