Stock prices reacted positively after retail sales data surprised to the upside and the Federal Reserve unleashed additional measures to stem the damage from COVID-19. However, the persistent increase in new COVID-19 cases and related hospitalizations weighed on stocks. Healthcare stocks fared well.

Last week, the Commerce Department reported an 18% surge in retail sales in May from April. The tally topped the 8% growth economists expected.

The Federal Reserve expanded the scope of its $750 billion emergency corporate loan facility to buy individual corporate bonds.

Arizona, California, Florida, and Texas set new records for daily increases in COVID-19 cases. These increases offset the decline in cases in the New York metro area and caused the nationwide case count to top 2.25 million.

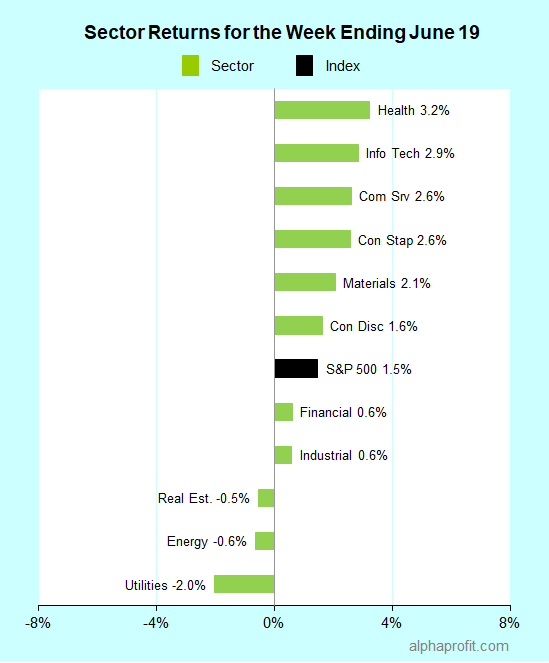

For the week ending June 19, the S&P 500 (SPY) gained 1.5%.

Eight of the 11 sectors advanced.

Healthcare (XLV), information technology (XLK), and communication services (XLC) led the S&P 500 (SPY).

Utilities (XLU), energy (XLE), and real estate (XLRE) lost ground.

Eight of the S&P 500’s top 10 winners were healthcare stocks. Three of them gained double-digits. Two information technology stocks also gained double-digits to figure amongst the top 10 winners.

1. Double-digit healthcare winners

Shares of Incyte (INCY), Eli Lilly (LLY), and DexCom (DXCM) rose over 10% last week.

Incyte shares surged after enrollment started for Phase 3 trials of baricitinib in hospitalized COVID-19 patients. Eli Lilly shares rose on news of the drugmaker’s key breast cancer treatment Verzenio meeting the main goal of a Phase 3 study.

Shares of continuous glucose monitoring systems developer DexCom rebounded after Bank of America analysts reiterated their Buy recommendation and raised their share price objective to $500 from $375.

2. Other healthcare winners

Shares of Amgen (AMGN), Cerner (CERN), Hologic (HOLX), Regeneron Pharmaceuticals (REGN), and Vertex Pharmaceuticals (VRTX) recorded strong single-digit gains, advancing between 9% and 10%.

3. Double-digit information technology winners

Semiconductor equipment maker Lam Research (LRCX) and electronic measurement systems provider Keysight Technologies (KEYS) rose 11% each. Morgan Stanley made positive comments on the long-term outlook for Lam Research and raised its share price objective to $334 from $253. Investors returned to Keysight shares after they lost 13% in the first half of June believing supply chain disruptions from COVID-19 would be temporary.

Looking ahead to the week of June 22

* Wall Street will continue to focus on the trend in COVID-19 cases & hospitalizations amidst efforts to restart economic activity.

* Jobless claims will be in focus after last week’s 1.5 million tally marked the slowest rate of decline in claims since early April. The data raised worries of a slowdown in rehiring. Economists will look for this week’s data to either confirm or refute rehiring worries.

* Nike (NKE), Accenture (ACN), IHS Markit (INFO), McCormick (MKC), and Darden Restaurants (DRI) are scheduled to report earnings.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023