Fears of worsening economic damage from COVID-19 pushed stocks to close near their two-week low. The Fed placed restrictions on banks returning capital to shareholders. The IMF cut its 2020 economic forecast.

The number of new COVID-19 cases nationwide set a new record last week. FL and TX backtracked on reopening their economies. NY, NJ, and CT imposed a 14-day quarantine for visitors from some hard-hit states. Investors fretted over further economic damage from extension of measures to slow the pandemic.

The Federal Reserve told banks they cannot increase dividends or resume buybacks through at least the third quarter. The Fed’s stress tests showed banks getting close to minimum capital levels in certain COVID-19 scenarios.

The International Monetary Fund worsened its forecast for the impact of the pandemic on the U. S. economy. The IMF now expects the U. S. economy to contract 8.0% in 2020 compared to the 6.0% contraction it predicted in April.

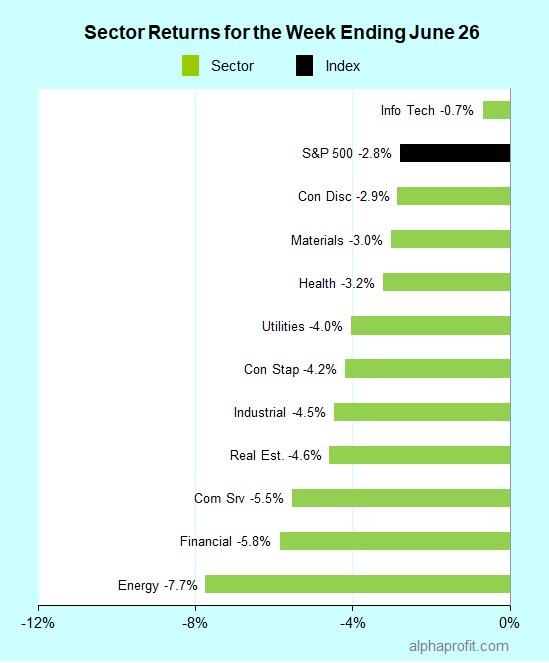

For the week ending June 26, the S&P 500 (SPY) fell 2.8%.

Information technology (XLK) was the only sector to hold up better than the S&P 500.

Energy (XLE), financials (XLF), and communication services (XLC) lost the most.

The number of losers in the S&P 500 swamped the number of winners by a 9-to-1 margin.

A few one-off plays and some COVID-19 beneficiaries in the information technology sector were among the S&P 500’s top winners last week.

1. The Gap (GPS) up 13%

The retailer partnered with hip-hop musician Kanye West’s Yeezy studio to design clothing lines.

2. Howmet Aerospace (HWM) up 11%

Credit Suisse assumed coverage of the jet engine component supplier formerly called Arconic with a $22 price target implying a 50% upside.

3. Accenture (ACN), eBay (EBAY), and Akamai Technologies (AKAM) up 5% each

IT services firm Accenture posted strong quarterly numbers with sales and EPS above analysts’ estimates. New bookings rose from growth in digital and cloud services businesses.

Analysts raised their price targets for eBay shares as the online retailer is seeing a continued boost to business from the COVID-19 pandemic.

Demand for Akamai’s content delivery network is growing as the use of the Internet becomes more pervasive. Akamai is likely to benefit further if Amazon Prime adds Live TV.

Looking ahead to the week of June 29

The trading week is shortened by the observance of the July 4 holiday on Friday, July 3.

* The June employment data due on July 2 is the main event of the week. Economists expect the economy to have created 3 million jobs. They forecast the unemployment rate to fall to 12.2% from 13.3% in May.

* Wall Street is trying to assess what the next fiscal assistance package could look like. Analysts will focus on what the Fed Chairman Powell and Treasury Secretary Mnuchin testify to the House Financial Services Committee next week.

* The earnings calendar includes a few technology, consumer, and industrial bellwethers. Micron Technology (MU), Constellation Brands (STZ), General Mills (GIS), and FedEx (FDX) are scheduled to report next week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023