Bond yields rose in response to comments from Federal Reserve as well as the February jobs report. The stock market struggled with the rising bond yields throughout the week. The rotation from growth to value continued, investors bought stocks of cyclical companies likely to benefit the most from a post-pandemic economic recovery, while selling the pandemic winners.

Bond yields rose in response to comments from Federal Reserve Chair Powell as well as the February jobs report. Starting the week at 1.46%, the yield on the 10-year Treasury bond rose as high as 1.63% before pulling back to close at 1.55%.

Speaking at the Wall Street Journal jobs summit, Powell said the economic reopening could ‘create some upward pressure on prices,’ and acknowledged the recent rise in interest rates. He added that the pickup in inflation is likely to be transitory and the central bank would be patient before changing interest rates or its bond purchase policy.

The lack of specific actions or plans disappointed some investors who expected the Fed to step up purchases of long-term bonds to lower long-term interest rates. The bond market interpreted Powell’s comments as a signal that yields can rise further.

The Labor Department reported the U. S. economy created 379,000 new jobs in February. The number of jobs created was nearly double economists’ forecast and marked the biggest increase in four months. The yield on the 10-year Treasury bond spiked to 1.63% before strong buying materialized to help the yield close the week at 1.55%.

The stock market wrestled with rising bond yields throughout the week. Investors bought cyclical or value stocks that benefit from the reopening of the economy and improving economic growth. Investors sold secular growth stocks and ‘story stocks’ with the promise of ‘far-off’ profits.

The Nasdaq Composite index which is heavily weighted towards the latter group ended 2.1% lower for the week, recording its third straight weekly decline. Providing hope for a near-term rebound in growth stocks, this benchmark reversed an intraday loss of 2.6% on Friday to end the day with a 1.6% gain.

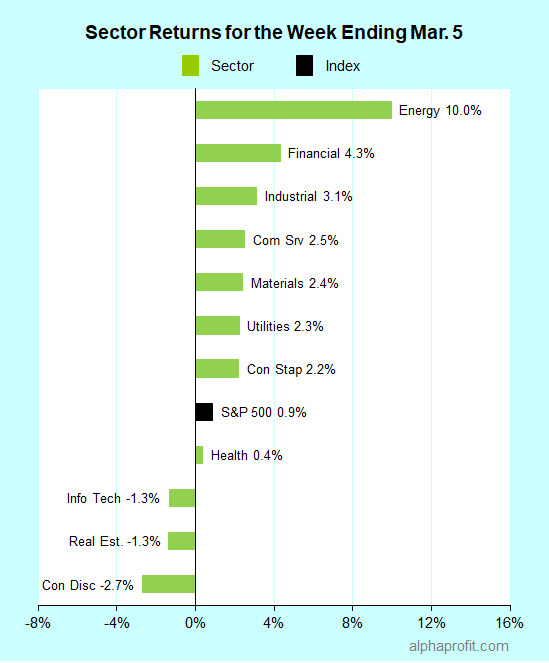

For the week ending March 5, the S&P 500 (SPY) rose 0.9%. Eight of the 11 sectors gained.

Energy (XLE), financials (XLF), and industrials (XLB) led the S&P 500.

Consumer discretionary (XLY), real estate (XLRE), and information technology (XLK) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 beat the number of decliners by a 5-to-2 ratio.

Communication services and energy companies accounted for nine of the S&P 500’s top 10 winners. One member from the materials sector rounded out the top 10.

1. Communication Services

Broadcaster shares were in the limelight on analyst upgrades and excitement over streaming services. Fox Corp. (FOXA) shares surged 24% to claim the top spot among the S&P 500’s winners for the week. Bank of America raised its share price target for Fox citing underappreciated assets such as online betting. The Financial Times stirred speculation of Fox examining transaction options as the company’s Executive Chairman Rupert Murdoch turns 90.

Discovery (DISCA) shares were up 21% after the owner of niche channels such as Animal Planet, HGTV, and Travel Channel announced its Discovery+ platform now serves 12 million users.

ViacomCBS (VIAC) shares rose 15% after the entertainment content giant launched its streaming service Paramount+, offering content from Nickelodeon and MTV along with sports and news.

2. Energy

Oil and gas producers showed strong gains after the price of oil jumped 7.5% last week to approach a two-year high. Oil prices shot up after OPEC and Russia rolled over their current production cuts into next month. While oil traders expected OPEC+ to increase production by 1.5 million barrels a day, the cartel agreed to hold April output steady at 7.2 million barrels a day after Saudi Arabia extended its 1 million barrel a day voluntary production cut.

Shares of Apache (APA), Devon Energy (DVN), Diamondback Energy (FANG), EOG Resources (EOG), Marathon Oil (MRO), and Occidental Petroleum (OXY) rose 16-23%, each to make it to the list of top 10 winners.

3. Materials

Shares of paper and packaging solutions provider WestRock (WRK) rose 16% after the company announced a succession plan for its Chief Executive.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) 12%

- Alerian MLP ETF (AMLP) 11%

- VanEck Vectors Oil Services ETF (OIH) 11%

- Fidelity MSCI Energy Index ETF (FENY) 10%

- Vanguard Energy Index Fund ETF (VDE) 10%

Looking ahead to the week of March 08

The Senate passed a $1.9 trillion coronavirus relief package on Saturday, March 6. The plan was approved by a 50-49 vote as Republicans questioned the need for another package. Investors have plenty to chew on interest rates, inflation, and stimulus this week. The expectation of a near-term bottom in growth stocks will also be tested.

* Interest rates will be in focus as the U.S. Treasury is set to auction $120 billion in Treasury securities this week. This auction follows a poor one in February for 7-year Treasury notes that sent interest rates higher. The upcoming auction includes $38 billion in 10-year and $24 billion in 30-year securities along with $58 billion in 3-year notes.

* Wall Street will get a read on inflation in consumer as well as producer prices this week. Economists expect consumer prices to show a 1.4% rise year-over-year.

* The Democratic-held House will seek to pass the bill this week and send it to President Biden for his approval before unemployment aid programs end on March 14. Some weeks ago, investors were cheering the stimulus bill. With inflation concerns rising, the reaction to the stimulus bill cannot be taken for granted. Inflation data and interest rate trends may well determine how stocks react to stimulus.

* Collectively, interest rates, inflation, and stimulus are likely to test the new-found expectation of a near-term bottom in growth stocks.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023