Mega-cap favorites outperformed analysts’ EPS expectations by 45% on average. The Fed maintained its commitment to support economic recovery by leaving its interest rate policy and bond purchase program unchanged. U. S. stocks struggled to maintain their uptrend amidst their high valuation and ended fractionally higher for the week.

In a busy week for corporate earnings, mega-cap companies outperformed analysts’ expectations. Alphabet, Amazon, Apple, Facebook, and Microsoft beat analysts’ EPS forecasts by 45% on average. The reporting S&P 500 companies, in aggregate, showed 45% year-over-year EPS growth, nearly twice the 24% growth analysts expected on March 31.

The Federal Open Market Committee held interest rates and its monthly bond-buying program steady after upgrading its assessment of economic growth and acknowledging the rise in inflation. The FOMC said it needs to see ‘substantial further progress’ towards its inflation and employment goals before stepping back from its monthly bond purchases.

The core personal consumption expenditures price index, the Fed’s preferred inflation metric, rose 0.4% in March, bringing the year-over-year rate to 1.8%.

President Biden completed his 100th day in office. He addressed a joint session of Congress and unveiled his $1.8 trillion plan for families, children, and students.

Stock prices had trouble extending their gains. Investor enthusiasm was limited by the historically high stock valuation metrics. Signs of weaker manufacturing and services activity in China and recession in Europe also pressured stocks.

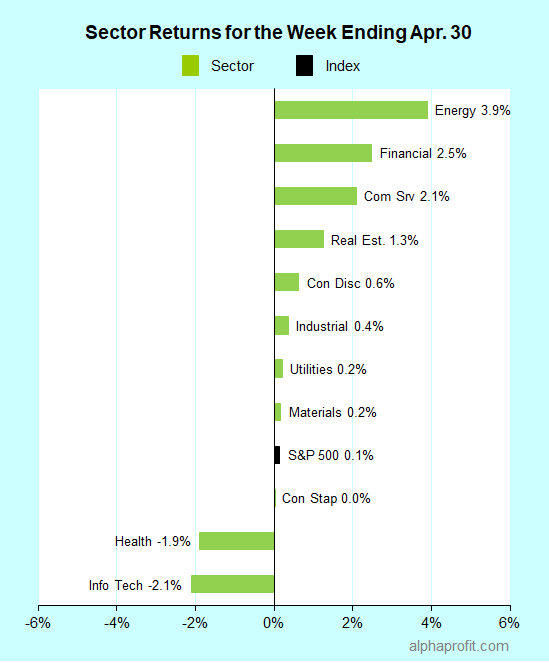

For the week ending April 30, the S&P 500 (SPY) rose 0.1%. Nine of the 11 sectors gained.

Energy (XLE), financials (XLF), and communication services (XLC) gained over 2.0% each to lead the S&P 500.

Information technology (XLK), health care (XLV), and consumer staples (XLP) lagged the benchmark.

The number of declining stocks in the S&P 500 roughly equaled the number of advancing stocks.

Energy companies accounted for four of the S&P 500’s top 10 winners. Industrials, financials, and consumer discretionary companies rounded out the top 10.

1. Industrials

United Parcel Service (UPS) +14% – The freight delivery company beat analysts’ sales and EPS forecasts by 61% and 11%, respectively, after delivery volume rose 14%. United Parcel Service was the week’s top performer in the S&P 500.

Otis Worldwide (OTIS) +9% – The elevator & escalator rewarded investors with a beat-and-raise quarter. It raised its full-year sales & EPS forecasts by 3% and 2%, respectively, after beating analysts’ current quarter sales and EPS projections.

2. Energy

Energy stocks followed the rise in the price of oil. Oil prices rose to a six-week high before pulling back on concerns of Indian oil demand falling due to the surge in COVID cases.

NOV Inc. (NOV) +12% – The energy service firm reported a bigger-than-expected quarterly loss. Yet, its shares rallied after the company’s management provided an upbeat outlook.

Hess Corp. (HES) +11% – The oil & gas producer and refiner rose 10% after topping analysts’ EPS estimate by over 100%.

APA Corp. (APA) and Devon Energy (DVN) also featured among the S&P 500’s top 10 winners with gains of 10% and 9%, respectively.

3. Financials

Willis Towers Watson PLC (WLTW) +11% – The insurance broker traded higher after Reuters reported the European Union will approve its proposed merger with fellow insurance broker AON PLC (AON). Further, Willis Towers topped analysts’ quarterly EPS forecast by 11%.

Discover Financial (DFS) +11% – The consumer lender rallied after Bank of America upgraded Discover’s stock rating to buy from neutral and raised the stock price target to imply a 17% upside.

Capital One (COF) +10% – Strong credit conditions enabled the financial services company to report $7.03 a share in quarterly EPS, well above analysts’ $4.17 a share estimate.

Top ETFs for the week

The following ETFs themes worked well: cannabis, uranium, oil & natural gas, blockchain. The top ETFs for the week include:

- AdvisorShares Pure US Cannabis ETF (MSOS) +7.5%

- North Shore Global Uranium Mining ETF (URNM) +6.2%

- First Trust Natural Gas ETF (FCG) +5.9%

- Amplify Transformational Data Sharing ETF (BLOK) +5.8%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +5.7%

Top Fidelity Fund for the week

- Fidelity Select Natural Gas (FSNGX) +4.3%

Looking ahead to the week of May 3

The opening week of May starts with a continuation of earnings reports across sectors. The April jobs report may well determine the week’s outcome for stock prices as investors focus on the longevity of the Fed’s bond purchase program.

* The first-quarter earnings season continues with a wide range of companies reporting. The reporting companies include Pfizer in health care, Booking Holdings in consumer discretionary, Estee Lauder in consumer staples, ConocoPhillips in energy, Activision Blizzard in communication services, MetLife in financials, and Cummins in industrials.

* The Labor Department releases the April jobs report on Friday. Economists expect job creation to be relatively strong after the economy added 916,000 jobs in March. A survey of economists by Dow Jones showed the consensus forecast is for 978,000 job additions. Individual estimates range from 700,000 to 2.1 million job additions. This jobs report may have a bearing on the Federal Reserve’s bond purchase program. Stock prices could come under pressure if job creation exceeds 1 million by a wide margin. Strong job creation can prompt the Fed to bring forward its timetable to taper bond purchases.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023