The stock market returned to focus on earnings during the week ending May 8. Nine of the S&P 500’s top 10 winners reported earnings during the week. The one that did not, too took its cue from a peer’s report. April retail sales due on Friday, May 15 will be in focus next week.

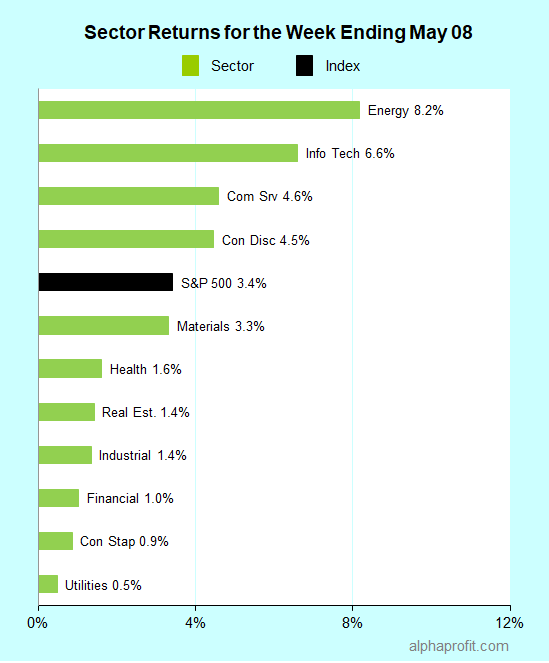

For the week ending May 8, the S&P 500 (SPY) gained 3.4%.

All sectors gained during the week ending May 8.

Energy (XLE), information technology (XLK), and communication services (XLC) outperformed the S&P 500. Utilities (XLU) and consumer staples (XLP) lagged.

The stock market returned to focus on earnings during the week ending May 8.

Nine of the S&P 500’s top 10 winners reported earnings during the week.

Looking at this list, shares of IPG Photonics (IPGP), PayPal (PYPL), Phillips 66 (PSX), News Corp. (NWS, NWS/A), American International Group (AIG), and EOG Resources (EOG) rallied between 15% and 27% even though the companies reported lower EPS or sales from the year-ago period.

However, three standouts reported higher sales and EPS from the year-ago period even in this COVID-19 challenged milieu. They are:

* Cybersecurity company Fortinet (FTNT) +31%

Work-from-home increasing demand for Fortinet’s products that secure virtual private networks (VPNs)

Revenue +22%, EPS +33%, EPS surprise +20%

EPS guidance for next quarter: $0.64-$0.66 versus $0.59 estimate

* IT Services provider Jack Henry & Associates (JKHY) +15%

Higher fees and software usage revenue from strong demand for private cloud offerings and transaction processing

Revenue +13%, EPS +25%, EPS surprise +20%

EPS guidance for next quarter: $0.77-$0.79 versus $0.79 estimate

* Semiconductor capital equipment manufacturer KLA Corporation (KLAC) +14%

Record shipments in the Semiconductor Process Control segment with demand for products or services largely unaffected by COVID-19

Revenue +30%, EPS +37%, EPS surprise +5%

EPS guidance for next quarter: $1.81-$2.87 versus $2.36 estimate

Although KLA’s 14% gain did not place it among the top 10 winners last week, KLA’s strong earnings report spurred a rally in the shares of its larger peer Applied Materials (AMAT). Applied Materials rose 15% to make the top 10 winner list.

Looking ahead to the week of May 11

Investors will closely scrutinize reports of different states reopening their economies.

April retail sales data are in focus after they slumped by 8.7% in March. Economists forecast retail sales to decline by 11.9% in April. Retail sales data are due on May 15.

Applied Materials shares took their cue from KLA Corp.’s earnings report last week and rallied 15%. Applied Materials reports on May 14.

AlphaProfit’s Recommendations of Best Growth Stocks to Buy Now

AlphaProfit recommends attractively valued stocks with favorable near-term prospects in each Premium Service Monthly Report to help you profit from short-term investment opportunities.

To provide you with reliable winning stock recommendations, AlphaProfit evaluates stocks on both fundamental and technical factors.

Fundamental analysis ensures recommended companies are worthy of committing your precious dollars from quality, valuation, and growth perspectives.

Technical analysis provides precise buy & sell price recommendations to lock your gains.

The proof of AlphaProfit’s methodology is in the results (registration required).

On average, subscribers have netted a 12.8% gain in 2.6 months from each stock recommendation at a 91% win rate.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023