U. S. stocks closed the week at an all-time high. The S&P 500 companies reporting first-quarter EPS showed 49% growth in EPS year-over-over. Job creation in April fell short of the economists’ forecast. Treasury Secretary Yellen unsettled investors saying interest rates may have to rise to prevent the economy from running too hot.

The Labor Department reported the U. S. created 266,000 new jobs in April, well below economists’ forecast for almost 1 million. The unemployment rate rose to 6.1% from 6.0% in March, amid an escalating shortage of available workers.

For the most part, Wall Street saw the jobs number as a one-off data point. Goldman Sachs raised doubts about the correctness of the data, citing seasonal adjustments as a potential source of error.

The yield on the 10-year Treasury bond ticked lower in response to the April jobs report, helping technology stocks pare their losses for the week.

Earlier, technology stocks fell sharply when economic data suggested the recovery to be robust, supporting the case for higher interest rates. Initial unemployment benefit claims fell to a new post-pandemic low of 498,000. Treasury Secretary Yellen unnerved investors saying, “interest rates will have to rise somewhat to make sure that our economy does not overheat”.

The S&P 500 companies continued to surpass analysts’ first-quarter EPS expectations by a wide margin. The reporting companies grew the EPS by over 49% year-over-year, nearly twice the 24% growth analysts forecasted before the beginning of the reporting season on March 31.

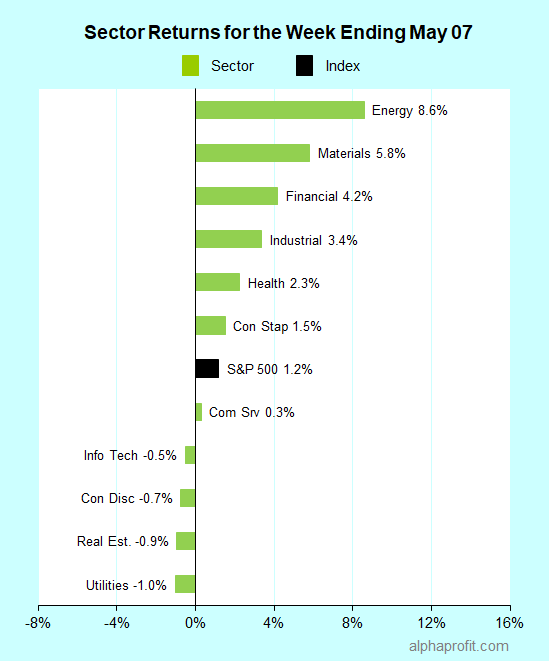

For the week ending May 7, the S&P 500 (SPY) rose 1.2%. Seven of the 11 sectors gained.

Energy (XLE), materials (XLB), and financials (XLF) gained over 4.0% each to lead the S&P 500.

Utilities (XLU), real estate (XLRE), and consumer discretionary (XLY) lagged the benchmark.

Market breadth was strong. The number of advancing stocks in the S&P 500 beat the number of decliners by a 7-to-4 ratio.

Energy and materials companies collectively accounted for seven of the S&P 500’s top 10 winners.

1. Energy

Higher oil prices, increasing rig count, and analyst upgrades drove the rally in energy service stocks. Strong oil demand in the U. S., China, and the U. K. and falling oil inventories in the U. S. pushed prices to a seven-week high. The number of rigs drilling for oil & gas rose in the U. S. and Canada. Barclays upgraded its view on the energy service group and raised its stock price targets for leading group members.

Baker Hughes (BKR) +23% – Baker Hughes was the week’s top performer in the S&P 500. Barclays upgraded the stock from equal weight to overweight and raised its share price target from $25 to $28.

Schlumberger (SLB), Halliburton (HAL), and NOV Inc. (NOV) shares rose between 15% and 18% each.

2. Materials

Materials stocks enjoyed a broad rally after the ISM’s April Manufacturing report showed all 18 industries incurred higher raw material prices. Separately, Warren Buffett said his businesses are seeing “substantial inflation”.

Nucor Corp. (NUE) +20% – The steel maker gained as benchmark steel prices surged to a record $1,500 a ton, nearly triple the 20-year average.

Freeport-McMoRan (FCX) +17% – The miner of copper & gold rose as the price of copper surged to an all-time high of $4.75 a pound.

Sealed Air (SEE) +16% – The packaging products maker known for BUBBLE WRAP and CRYOVAC topped analysts’ quarterly EPS forecasts by 11% and raised full-year EPS guidance by 5%.

Top ETFs for the week

The following ETFs themes worked well: oil service, uranium, and industrial metals such as copper & steel. The top ETFs for the week include:

- VanEck Vectors Oil Services ETF (OIH) +19.0%

- Global X Uranium ETF (URA) +13.3%

- SPDR® S&P Metals and Mining ETF (XME) +13.0%

- Global X Copper Miners ETF (COPX) +12.3%

- VanEck Vectors Steel ETF (SLX) +11.7%

Top Fidelity Fund for the week

- Fidelity Select Energy Service (FSESX) +18.2%

Looking ahead to the week of May 10

Investors will focus on inflation this week, with April CPI and PPI numbers due. The first-quarter earnings season enters its ending lap. Stocks may lose ground in the week before the May 17 federal income tax filing deadline.

* The data on consumer prices is in the spotlight this week. Economists expect the consumer price index (CPI) to rise 0.2% in April, down from its 0.4% increase in March. The change in the CPI is, however, expected to tick up on a year-over-year basis. The inflation measure is forecasted to increase 3.6% year-over-year in April, compared to 2.6% in March. The Federal Reserve has stated that the uptick in inflation will be transitory. The Fed’s position may appear less credible if the CPI’s rise in April exceeds expectations. Investors will also get a feel for inflation in wholesale prices when the producer price index (PPI) is reported later in the week.

* The first-quarter earnings season tapers with nearly 20 companies reporting. The reporting companies include sector leaders such as Disney (DIS) from communication services, Duke Energy (DUK) from utilities, Air Products and Chemicals (APD) from materials, Marriott International (MAR) from consumer discretionary, and Simon Property Group (SPG) from real estate.

* The week before the May 17 federal income tax filing deadline has added significance this year since stocks are up sharply in the past year, and President Biden has proposed higher capital gains tax rates. Stocks could lose ground if investors sell their winners to pay their tax bill.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023