Worries of rising inflation rattled U. S. stocks. The consumer price index rose 4.2% year-over-year in April, the highest since 2008. The S&P 500 was down nearly 3% at its low for the week. Bargain hunters returned in full force to trim the week’s loss to 1.3% after the CDC eased the requirement for fully vaccinated people to wear masks.

Inflation worries moved to the forefront last week after the rise in the Consumer Price index (CPI) exceeded forecasts.

The CPI rose 0.8% month-over-month in April, well above the 0.2% economists’ forecasts. The data showed the CPI is up 4.2% for the 12 months ending in April, the fastest rate of increase since 2008.

Core consumer prices, which exclude volatile food and energy items, grew 3% for the 12 months ending in April, topping the Federal Reserve’s average annual 2% inflation growth target.

Wholesale prices and imports reflected the increase in inflation too. The Producer Price Index (PPI) jumped 6.0% for the 12 months ending in April. The 10.6% surge in the import-price index in April was the highest in 10 years.

In other economic data, new filings for state unemployment insurance continue to decline. The Labor Department said claims fell to 473,000 for the week ending May 8, from 507,000 in the prior week. Retail sales were unchanged in April, falling short of economists’ forecast for a 0.8% increase.

In an indication that economic activity could return to normal, the U. S. Centers for Disease Control and Prevention said fully vaccinated people no longer need to wear masks outdoors and can avoid wearing them indoors in most places.

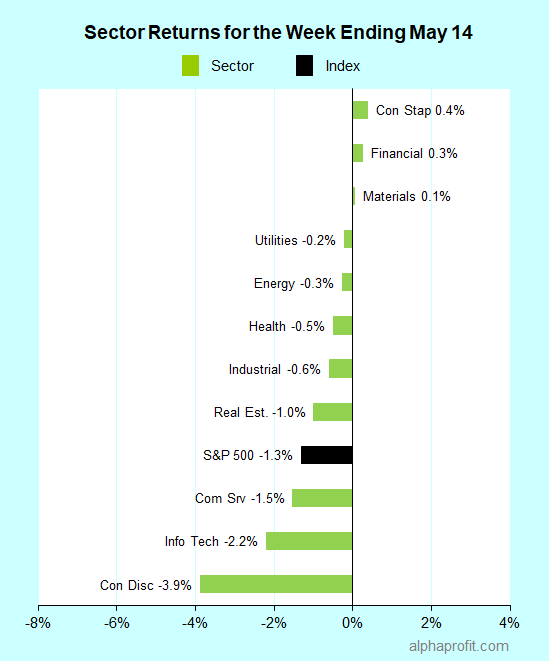

For the week ending May 14, the S&P 500 (SPY) fell 1.3%. Only three of the 11 sectors gained.

Consumer staples (XLP), financials (XLF), and materials (XLB) ended above the flat-line to lead the S&P 500.

Consumer discretionary (XLY), information technology, and communication services (XLC) lost more than 1.5% to lag the benchmark.

Market breadth was weak. The number of declining stocks in the S&P 500 beat the number of advancers by a 2-to-1 ratio.

Information technology, health care, and financial companies collectively accounted for eight of the S&P 500’s top 10 winners.

1. Information Technology

NortonLifeLock (NLOK) +24% – The consumer cybersecurity company was the week’s top performer in the S&P 500 by a wide margin. The company announced a $1.5 billion share buyback program after beating analysts’ sales and EPS forecasts. Norton added 2.8 million new customers in the quarter, growing billings 17% year-over-year. Bank of America raised its share price target on Norton shares by 58% to $30 from $19.

Seagate Technology (STX) +7% – The computer hard disk maker rallied after Morgan Stanley said a new cryptocurrency, Chia, could boost demand for such disks. Chia uses unused storage on a hard drive to generate the cryptocurrency.

DXC Technology (DXC) +7% – The IT service company’s June 18 expiring call options showed unusually high activity.

2. Health Care

Viatris Inc. (VTRS) +14% – The health care company announced its inaugural quarterly dividend after beating analysts’ EPS estimate and reaffirming its 2021 revenue and free cash flow guidance.

Perrigo Company PLC (PRGO) +7% – Investors believed the worst is over for the Ireland-based consumer self-care products company after it posted weaker-than-expected quarterly sales and EPS due to a historically weak cough & cold season this year.

3. Financial

CME Group (CME) +7% – The derivatives marketplace saw record trading of copper options contracts.

CBOE Global Markets (CBOE) +5% – The options exchange sought approval from the U. S. Securities and Exchange Commission to list and trade Fidelity’s bitcoin ETF.

Allstate (ALL) +5% – The property & casualty insurer rose after Argus and Raymond James raised their share price targets ahead of Allstate’s presentation at the Wells Fargo Financial Services investor conference on May 19.

Top ETFs for the week

The following ETFs themes worked well: carbon, China healthcare, Peru, volatility, and MLPs. The top ETFs for the week include:

- KraneShares Global Carbon ETF (KRBN) +8.9%

- KraneShares MSCI All China Health Care Index ETF (KURE) +7.1%

- iShares MSCI Peru ETF (EPU) +7.0%

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +5.1%

- InfraCap MLP ETF (AMZA) +3.1%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +1.0%

Looking ahead to the week of May 17

Earnings reports from retailers, housing industry data, and updates from the Federal Reserve will test stocks this week.

* Earnings reports will bring retailers into focus as major chains report quarterly earnings through the week. Reporting chains include Walmart, Home Depot, Target, TJX Corp., and Lowe’s.

* As for economic data, the housing industry is in the spotlight. The week includes data on existing home sales, housing starts, and the National Association of Home Builders sentiment index.

* The Federal Reserve releases the minutes of the Federal Open Market Committee’s April meeting on interest rate policy.

* The S&P 500 threatened to break below its 50-day moving average (DMA) last week. The benchmark stands closed the past week about 110 points or 2.5% above its 50-DMA after stocks rallied on Thursday and Friday. Investors will watch if the events and news this week can sustain the S&P 500 above its 50-DMA.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023