Cautious comments from the top U. S. infectious disease expert Dr. Fauci and Fed chairman Powell dampened the optimism of a quick economic recovery last week. Healthcare stocks fared well in this risk-off setting. Selected non-healthcare companies that had something special made it to the list of the S&P 500’s top 10 winners.

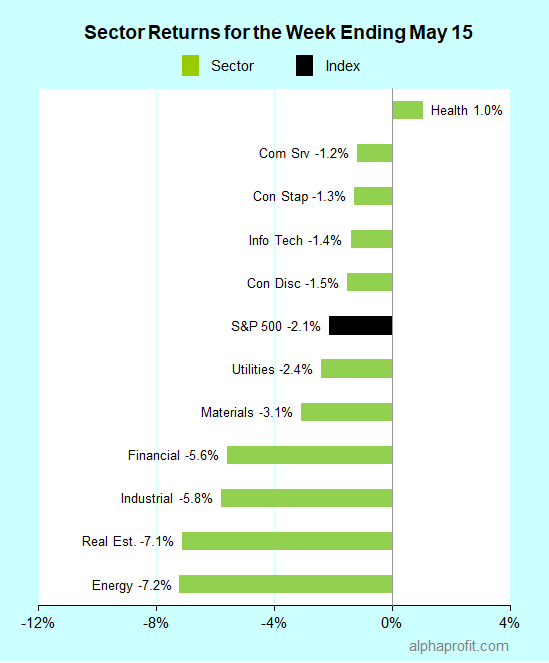

For the week ending May 15, the S&P 500 (SPY) fell 2.1%.

Only one sector, health care (XLV), managed to gain for the week.

Communication services (XLC) and information technology (XLK) held up better than the S&P 500. Energy (XLE) and real estate (XLRE) lagged.

Several states opted to ease stay-at-home orders. Yet, cautious comments from the top U.S. infectious disease expert, Dr. Fauci, and Federal Reserve chairman Powell dampened the optimism of a quick economic recovery.

Healthcare stocks fared well in this risk-off setting, helped by earnings reports as well as positive news on the COVID-19 vaccine and drugs for COVID-19 and other diseases.

Five of the S&P 500’s top 10 winners were health care stocks. Illumina (ILMN), AbbVie (ABBV), Vertex Pharmaceuticals (VRTX), Humana (HUM), and Bristol-Myers Squibb (BMY) gained between 5% and 8%, each.

Selected non-healthcare companies that had something special also made it to the top 10.

Here are some of them:

1. Semiconductor chip maker NVIDIA (NVDA) +9%

Introduced its latest processor with 20 times higher performance for use in data centers, data analytics, scientific computing, and cloud graphics

2. Food flavor titan McCormick (MKC) +9% and restaurant chain Chipotle Mexican Grill (CMG) +5%

Benefiting from consumer behavior changes due to the coronavirus pandemic shutdown

3. Gold miner Newmont Mining (NEM) +5%

Riding gold’s coattails as the metal’s spot price rose as high as $1,751.25 an ounce, its highest since November 2012

Looking ahead to the week of May 18

* Investors will look at the impact of reopening on economic activity and the new COVID-19 case count.

* The housing industry will be in the spotlight with April housing starts data and earnings from Home Depot (HD) and Lowe’s (LOW) on tap.

* Wall Street will pay attention to what Federal Reserve Chairman Powell and Treasury Secretary Mnuchin have to tell the Senate Banking Committee.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023