The S&P 500 dropped for a second straight week. Stocks were pressured by crashing bitcoin prices after China and the U. S. clamped down on cryptocurrency trading. The Fed’s minutes from its April meeting hinted at reconsidering asset purchases in the future. Economic data showed business activity picked up in the U. S. in May. Retailers lost ground after reporting stellar earnings.

A sharp drop in cryptocurrency prices impacted prices of risk assets, including stocks. Bitcoin plunged over 28% in the past week after China clamped down on bitcoin mining and trading. China moved to ban financial institutions from providing cryptocurrency services. The Treasury Department said it would require cryptocurrency transactions worth $10,000 or more to be reported to the Internal Revenue Service.

Minutes from the interest rate-setting Federal Open Market Committee meeting in April showed participants agreed the U. S. economy remained far from the Fed’s employment and inflation goals. Several participants suggested it may be appropriate to begin discussing a plan for adjusting the pace of asset purchases at some point.

In economic data, IHS Markit’s readings showed U. S. business activity picked up in May amid robust domestic demand. The flash U. S. composite index rose to a record 68.1 in May as both the services and manufacturing indexes set records. The number of Americans filing new unemployment benefits claims fell to 444,000, their lowest since March 14, 2020.

In earnings news, top retailers Home Depot and Walmart exceeded analysts’ EPS expectations by 25% and 40%, respectively. Quarterly same-store sales at Home Depot topped analysts’ estimates. Walmart raised its full-year earnings forecast. Yet, the Dow Jones U.S. Retail Index ended 1.0% lower for the week.

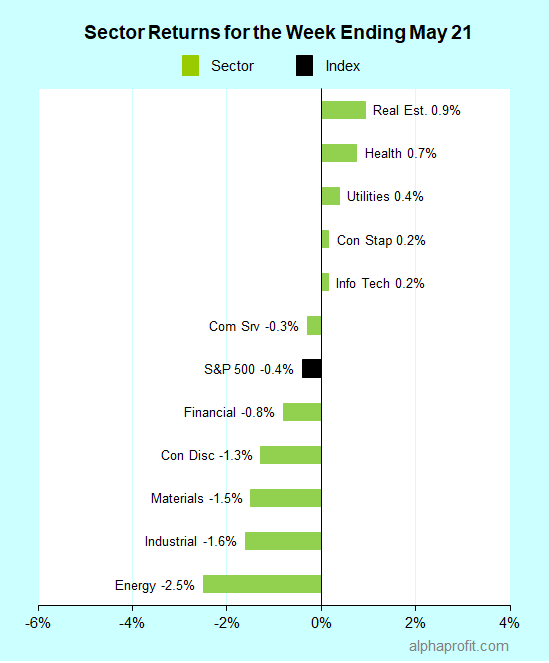

For the week ending May 21, the S&P 500 (SPY) fell 0.4%. Five of the 11 sectors gained.

Real estate (XLRE), health care (XLV), and utilities (XLU) ended above the flat-line to lead the S&P 500.

Energy (XLE), industrials (XLI), and materials (XLB) lost more than 1.5% to lag the benchmark.

Market breadth was weak. The number of declining stocks in the S&P 500 beat the number of advancers by a 2-to-1 ratio.

Information technology, consumer discretionary, and communication services companies collectively accounted for seven of the S&P 500’s top 10 winners.

1. Information Technology

Enphase Energy (ENPH) +19% – The energy technology company was the top performer in the S&P 500 for the week. Enphase led the broad advance in solar energy stocks after holding its annual meeting and authorizing a new $500 million share repurchase program.

Analog Devices (ADI) +7% – Benefiting from robust demand from the automotive, communication, and industrial sectors, the semiconductor chipmaker topped analysts’ quarterly sales and EPS forecasts. Analog Devices guided current quarter projections towards the higher end of its previous forecast. Bernstein upgraded its rating on Analog Devices from Market Perform to Outperform.

Maxim Integrated Products (MXIM) +6% – Deutsche Bank raised its share price target on the semiconductor chipmaker to $104 a share from $100 a share.

2. Consumer Discretionary

Ford Motor (F) +13% – The vehicle maker debuted its F-150 Lightning electric truck capable of traveling up to 300 miles per battery charge and received over 44,000 reservations from retail customers in less than 48 hours. Ford also announced plans to form a battery joint venture in the U. S. with Korean battery maker SK Innovation.

Target (TGT) +7% – The retailer topped analysts’ quarterly sales and EPS forecasts by 11% and 67%, respectively, as Americans spent their stimulus checks. Same-store sales rose 18%. Target also raised its current-quarter profit margin forecast.

3. Communication Services

Take-Two Interactive Software (TTWO) +10% – The video game software maker’s quarterly net income soared 78% year-over-year after revenues rose 10% from higher sales of virtual currency and add-on content. Total net bookings grew 8% year-over-year.

ViacomCBS (VIAC) +8% – Bank of America upped the odds of the media company becoming a takeover target after AT&T announced its plan to spin off its WarnerMedia business and combine it with Discovery. Bank of America raised its ViacomCBS share price target by 40% to $53 a share.

Top ETFs for the week

The following ETFs themes worked well: clean energy and precious metals. The top ETFs for the week include:

- Defiance Next Gen H2 ETF (HDRO) +9.5%

- Invesco Solar ETF (TAN) +8.2%

- ETFMG Prime Junior Silver Miners ETF (SILJ) +5.8%

- First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) +5.4%

- VanEck Vectors Junior Gold Miners ETF (GDXJ) +5.4%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +4.6%

Looking ahead to the week of May 24

The S&P 500 stayed above its 50-day moving average (DMA) in the past week. Cryptocurrencies, inflation data, and earnings reports may renew the pressure on stocks this week.

* The decline in cryptocurrencies weighed on all risk assets, including stocks, during the past week. Widely followed cryptocurrency Bitcoin broke below its 50-DMA and struggled to hold its 200-DMA. Bitcoin’s decisive break below its 200-DMA can bring additional downside in the cryptocurrency and pressure stocks. Meanwhile, the S&P 500 has itself survived the 50-DMA test, bouncing off this support level in two of the past seven trading sessions.

* Investors will get another perspective on inflation. On Friday, the Bureau of Economic Analysis reports the core personal consumption expenditure (PCE) index, the Federal Reserve’s preferred inflation measure. According to data from Briefing.com, economists expect the core PCE to rise 0.6% in April, compared to 0.3% in March.

* The first-quarter earnings reporting season is ending. Yet, the week includes reports from some high-profile companies such as Best Buy, Costco, Medtronic, NVIDIA, and salesforce.com.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023