Stocks rallied last week on the back of encouraging coronavirus vaccine trial data and rising expectations of a rebound in economic activity. Transportation stocks thrived in this milieu. Selected consumer discretionary companies also posted strong gains in this risk-on setting.

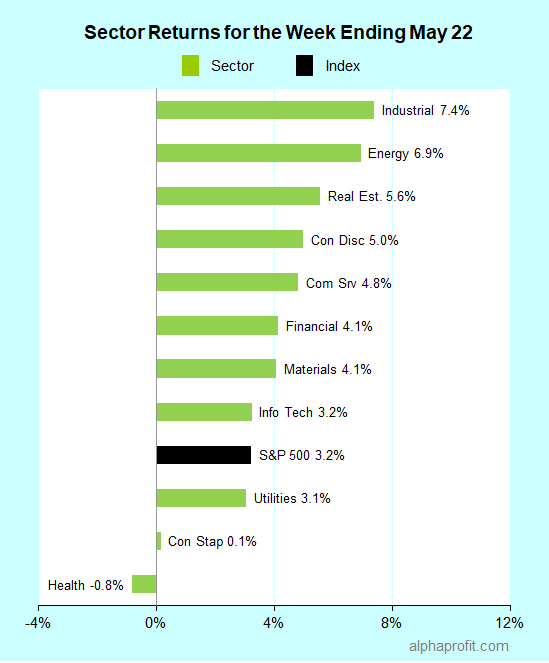

For the week ending May 22, the S&P 500 (SPY) rose 3.1%.

Economically sensitive sectors industrials (XLI), energy (XLE), and real estate (XLRE) outperformed the S&P 500.

Defensive sectors health care (XLV) and consumer staples (XLP) lagged the S&P 500.

Health care (XLV) was the only losing sector for the week.

Transportation stocks fared well on optimism that the economy is going to get better and travel demand will pick up. Airlines, in particular, got a boost from the Transportation Security Administration’s checkpoint data. The number of travelers going through TSA checkpoints rose for the fourth straight week.

Three of the S&P 500’s top 10 winners were airline stocks. Alaska Air (ALK), Southwest Airlines (LUV), and United Airlines (UAL) gained between 21% and 28%, each.

Norwegian Cruise Line (NCLH) rose 27% on the hope of cruises resuming sometime in 2020.

Selected consumer discretionary companies also made it to the top 10. They are:

1. Victoria’s Secret parent L Brands (LB) +39%

Plans to close ~ 250 or 25% of Victoria’s Secret stores in the U. S. & Canada after a worse-than-expected quarterly loss.

2. Motorcycle manufacturer Harley-Davidson (HOG) +24%

Optimism on new CEO Zeitz turning around the company after he bought nearly $3 million in Harley shares.

3. Homebuilder PulteGroup (PHM) +20%

A 7 point surge in the National Association of Homebuilders’ monthly confidence index in May stoked hopes of a rapid recovery in home sales post-pandemic.

Looking ahead to the week of May 26

The trading week is shortened by the Memorial Day holiday.

* Concerns over rising tension between the U. S and China are likely to return to the front burner as U. S. moves to act strongly against Chinese companies if China imposes a national security law on Hong Kong.

* Investors will continue to focus on the reopening of the economy and development of coronavirus vaccines & drugs.

* Costco (COST) and Salesforce.com (CRM) are scheduled to report quarterly earnings.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023