The lockdown-relief rally extended into the early part of last week as all 50 states reopened at least partly and hopes of a COVID-19 vaccine increased. The rally broadened to consumer discretionary stocks from the prior week winners, i.e., transportation stocks. By the end of the short trading week, the rally was partly undone by worries of rising tension between the U. S. and China.

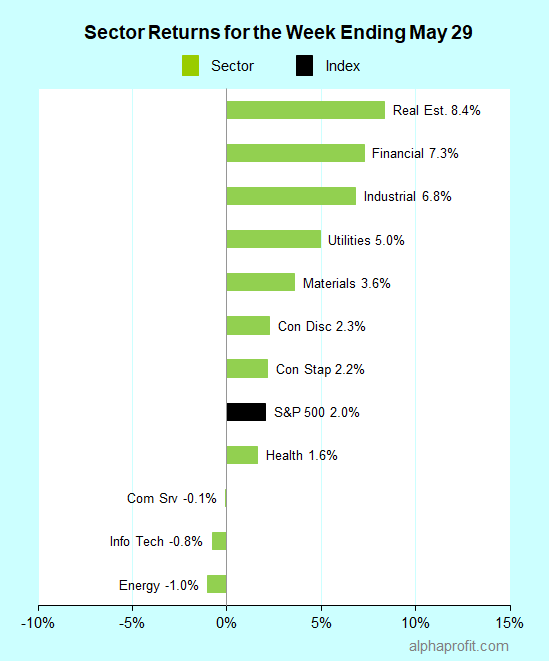

For the week ending May 29, the S&P 500 (SPY) rose 2.0%.

Real estate (XLRE), financials (XLF), and industrials (XLI) outperformed the S&P 500 as investors rotated into beaten-down sectors from stay-at-home plays.

Energy (XLE), information technology (XLK), and communication services (XLC) lagged the S&P 500.

News of Novavax (NVAX) starting a Phase 1/2 trial for its coronavirus vaccine boosted hope of a ‘permanent fix’ to COVID-19.

Retailers fared well as people emerged from the lockdown. Macy’s (M) ability to secure funds for its $1.3 billion debt offering boosted confidence in the retailing sector’s recovery.

Four of the S&P 500’s top 10 winners were apparel retailers and department store operators. L Brands (LB), Gap (GPS), Kohl’s (KSS), and Nordstrom (JWN) gained between 20% and 33%, each.

Other notable top 10 winners in the S&P 500 include:

1. Beauty company Coty (COTY) +28%

Reports of German consumer goods company Henkel AG & Co. (HENOY) acquiring Coty. Coty owns 51% of Kylie Cosmetics founded by Kylie Jenner.

2. Discount store Dollar Tree (DLTR) +23%

Same-store sales grew 7% in the fiscal first quarter from pandemic-related stocking, helping sales and EPS top analysts’ forecasts.

3. Property & casualty insurer Chubb (CB) +18%

Lloyd’s of London lowers estimate for industry-wide losses from the pandemic to about $100 billion.

Looking ahead to the week of June 1

* Investors will continue to focus on the tension between Washington and Beijing. Rising tension can prompt a flight to safety and stay-at-home plays.

* May employment report is on deck for Friday. Economists expect 8.4 million job losses with the unemployment rate rising to 19.8% from 14.7% in April.

* Several stay-at-home beneficiaries including Zoom Video Communications (ZM), Slack Technologies (WORK), and Campbell Soup (CPB) along with semiconductor biggie Broadcom (AVGO) are scheduled to report quarterly earnings.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023