The S&P 500 lost 5.6%, its biggest weekly decline since March. Investors worried about the possibility of prolonged uncertainty from a contested presidential election. A record-setting increase in daily new COVID19 cases triggered concerns of a return to lockdowns. Positive surprises in U. S. third-quarter gross domestic product growth and third-quarter earnings reports fell by the wayside.

Nervousness over the outcome of the November 3 presidential elections weighed on stocks as investors worried about the implications of a contested election that could drag on for weeks.

The daily number of new COVID19 cases set records last week. The count topped 100,000 for the first time on Friday. The state of Illinois ordered Chicago to shut down indoor dining.

In economic data, the Commerce Department estimated U. S. gross domestic product expanded at a 33.1% annualized rate in the third quarter, its fastest growth ever. The GDP expansion rate topped economists’ forecast.

In earnings news, large-cap information technology and communication services companies like Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT) reported positive EPS surprises. Yet, their shares came under selling pressure. The Technology Sector SPDR (XLK) and the Consumer Discretionary Sector SPDR (XLY) lost 6.4% and 6.6%, respectively.

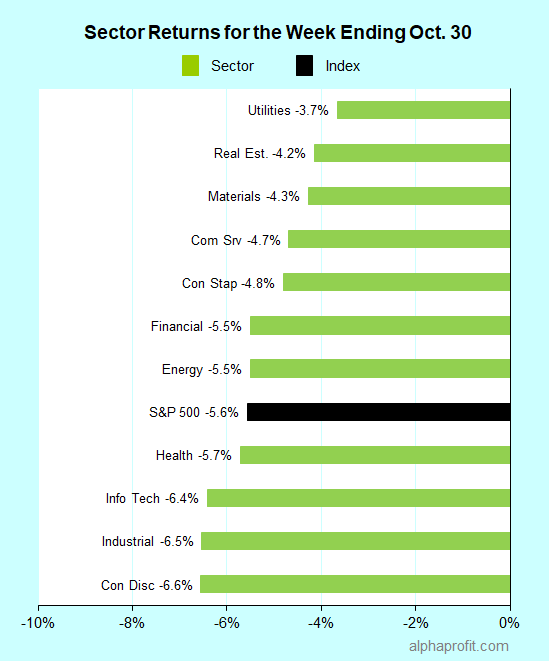

For the week ending October 30, the S&P 500 (SPY) fell 5.6%.

All 11 sectors declined.

Utilities (XLU), real estate (XLRE), and materials (XLB) held up better than the S&P 500.

Consumer Discretionary (XLY), industrials (XLI), and information technology (XLK) lost more than the index.

The number of declining stocks in the S&P 500 swamped the number of advancers by an 18-to-1 ratio.

The S&P 500’s top 10 winners included companies from the real estate, consumer discretionary, and information technology sectors.

1. Real Estate: CBRE Group (CBRE)

CBRE Group (CBRE) shares rose 8% to be the week’s top performer in the S&P 500. The commercial real estate services & investment leader made positive comments on its business trends after beating analysts’ third-quarter revenue and EPS estimates. The company also announced it is relocating its headquarters to Dallas from Los Angeles.

2. Consumer Discretionary: Tiffany (TIF) and Tapestry (TPR)

France’s LVHM Moet Hennessy (LVMUY) and Tiffany (TIF) ended their 1-year old takeover saga started by the pandemic. LVMH finally agreed to buy Tiffany for $15.8 billion or $131.50 a share, about $425 million less than the price agreed last November before the pandemic. Tiffany shares were up 6%.

Shares of another luxury goods-maker Tapestry (TPR) rose 4% to fare among the S&P 500’s top 10 winners. The parent of Coach and Kate Spade brands beat analysts’ fiscal first-quarter revenue and EPS estimates after e-commerce sales surged triple digits.

3. Information Technology: Automatic Data Processing (ADP) and F5 Networks (FFIV)

Shares of Automatic Data Processing (ADP) rose 6% after the payroll processor raised its revenue and EPS forecasts after beating analysts’ fiscal first-quarter revenue and EPS estimates.

Application security and delivery company F5 Networks (FFIV) cited healthy customer interest in its solutions like the BIG-IP app delivery services and the Nginx platform after topping analysts’ fiscal fourth-quarter revenue and EPS estimates. F5 shares rose by 4%.

Other top 10 winners in the S&P 500

The following stocks rose 3-5% each to round out the top 10 list:

- Cloud-connected medical devices maker ResMed (RMD)

- Healthcare research equipment maker PerkinElmer (PKI)

- Gold miner Newmont (NEM)

- Energy services provider Baker Hughes (BKR) and

- GPS navigation and wearable specialist Garmin (GRMN)

Looking ahead to the week of November 2

Stocks stand to rebound from their recent decline if the presidential election result is decisive. The resumption of stimulus talks can also help to improve investor sentiment.

* The nation goes to the polls to elect the next President on November 3. Investors are hoping for a clear outcome in this close presidential election. While Democrats are likely to retain control of the House of Representatives, the result for the Senate race is less clear.

* On the economic calendar, the spotlight is on the October employment report due on Friday. Economists expect nonfarm payrolls to increase by about 570,000, less than the 661,000 jobs added in September. Wall Street expects the Federal Open Market Committee’s interest-rate policy meeting to be an ordinary affair this week, with monetary policy staying unchanged.

* The third-quarter earnings reporting season continues with more than 100 S&P 500 companies scheduled to report. Reporting names include CVS Health (CVS), Duke Energy (DUK), PayPal (PYPL), Qualcomm (QCOM), and T-Mobile (TMUS).

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023