The S&P 500 jumped 7.2%, its biggest weekly gain since April. The election remained unresolved through the market close on Friday. Early results indicated Democrat Biden becoming President and Congress remaining split. Job creation topped expectations in October. New daily COVID19 cases continued to rise.

Democrat Biden was declared the winner on Saturday, four days after the Presidential election.

Stocks surged last week, despite the lack of a winner in the presidential race through Friday. The trend in election results pointed to Democrat Biden becoming President, Democrats retaining control of the House, and Republicans controlling the Senate.

Investors believed the resulting gridlock in Congress would render repealing the 2017 corporate income tax cut or tightening financial regulations difficult. It would also keep fiscal stimulus relatively small and place most of the burden on the Federal Reserve to keep the economy churning via lower rates and asset purchases.

The Labor Department reported the U. S. economy added 638,000 jobs in October, topping economists’ forecast. The jobless rate dropped to 6.9% in October from 7.9% in September.

There was no let-up on the COVID19 front. The U. S. daily new case count set a new record of 132,000 on Friday, pushing the 7-day average above 100,000 for the first time.

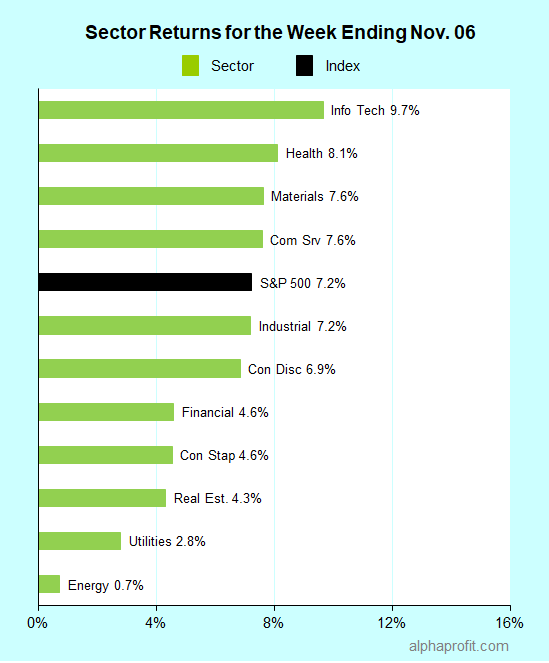

For the week ending November 6, the S&P 500 (SPY) rose 7.2%.

All 11 sectors gained.

Information technology (XLK), health care (XLV), and materials (XLB) led the S&P 500.

Energy (XLE), utilities (XLU), and real estate (XLRE) lagged the benchmark.

The number of advancing stocks in the S&P 500 swamped the number of decliners by a 10-to-1 ratio.

The S&P 500’s top 10 winners included companies from the health care, information technology, and materials sectors. Five of the winners were information technology stocks.

1. Health care: Biogen (BIIB) and Cigna (CI)

Biogen (BIIB) shares rose 34% to be the week’s top performer in the S&P 500. Biogen shares surged on Wednesday on speculation of the U. S. Food and Drug Administration’s advisory committee recommending approval of Biogen’s Alzheimer’s treatment, aducanumab. The FDA advisory committee, however, failed to approve the drug after meeting on Friday. Biogen shares did not trade on Friday.

Cigna (CI) shares rose 21% on the back of group strength and strong earnings. Health insurer shares surged after the November 3 election on the belief Congressional gridlock limits the possibility of disruptive health care reforms. Cigna also raised its full-year revenue guidance due to the strength in its pharmacy benefits management business.

2. Information Technology: Arista Networks ANET), Gartner (IT), Zebra Technologies (ZBRA), Lam Research (LRCX), and Microchip Technology (MCHP)

Arista Networks (ANET) shares rose 24% after the cloud networking solutions provider raised its current-quarter revenue forecast to imply 11-15% year-over-year growth, breaking the string of year-over-year quarterly revenue declines. Arista also topped analysts’ quarterly sales and EPS forecasts in the reporting quarter.

Shares of Gartner (IT) were up 23% after beating analysts’ quarterly sales & EPS forecasts and raising full-year guidance. The IT consulting and services firm upped its 2020 guidance for sales and EPS to $4.05 billion and $4.07 a share, respectively, from $3.88 billion and $3.08 a share in August.

The other winners, Zebra Technologies (ZBRA), Lam Research (LRCX), and Microchip Technology (MCHP), were each up 19% or more.

3. Materials: Albemarle (ALB)

Shares of Albemarle (ALB) rose 20% after the lithium producer raised full-year 2020 EPS forecast to the $3.80-$4.15 range, well above analysts’ $3.48 forecast. Albemarle affirmed it does not expect its lithium rights in Chile to be impacted by the country’s new constitution.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- ETFMG Alternative Harvest ETF (MJ) +27%

- ETFMG Prime Junior Silver Miners ETF (SILJ) +16%

- iShares MSCI Poland ETF (EPOL) +16%

- Invesco DWA Technology Momentum ETF (PTF) +16%

- Invesco WilderHill Clean Energy ETF (PBW) +16%

Looking ahead to the week of November 9

Stocks may well pull-back this week after last week’s surge as reality sinks in on the election, stimulus, and COVID19. The decline can, however, prove to a good buying opportunity ahead of a seasonally strong December.

* Investors will be watching election developments closely, even if the Presidential election is complete. First, recounts are likely from narrow victory margins and lawsuits. Second, the control of the Senate is unknown. The composition of the Senate may remain an open item until Georgia holds the two runoff elections on January 5, 2021. Stocks are likely to lose at least part of their last week’s gains if the odds of Congressional gridlock diminish.

* Stimulus discussions are likely to become a focal point for investors when the Senate reopens for legislative business on November 9. Senate Republicans support a targeted aid package to the tune of $500 billion. House Democrats have approved a new $2.2 trillion coronavirus aid package. Investors will look if the two parties can bridge contentious issues such as state & local government aid and enhanced unemployment insurance.

* Wall Street will also keep an eye on the record-setting surge in coronavirus cases. Economists are concerned that the economic recovery could suffer if some states restrict activities and consumers pull back during the holiday season.

* The third-quarter earnings reporting season starts to wind down with about 20 S&P 500 companies scheduled to report. Reporting names include Air Products (APD), Applied Materials (AMAT), Cisco (CSCO), Disney (DIS), and McDonald’s (MCD).

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023