U. S. stocks snapped a six-week rally. The passage of the $1.2 trillion infrastructure bill in the House gave stocks an early boost. The rally, however, faded as inflation worries took hold. Falling consumer sentiment added to the concerns.

U. S. started the week on a positive note, lifted by enthusiasm over the House of Representatives passing the $1.2 trillion infrastructure bill. Industrials and materials stocks led the rally.

Increasing worries of inflation, however, took a bite out of stocks. The Labor Department reported the consumer price index surged 6.2% during the 12 months ending in October. Economists attributed the 31-year high inflation to supply-chain bottlenecks, labor shortages, and high product demand. The producer price index also showed an annual increase of 8.6% in October, the highest in 11 years.

The expectation of continued higher inflation eroded consumer sentiment. The University of Michigan’s gauge of consumer sentiment slipped 4.9 points to 66.8 in November, marking the lowest reading since 2011. Consumers’ expectations for one-year inflation increased by 0.1% to 4.9% in November.

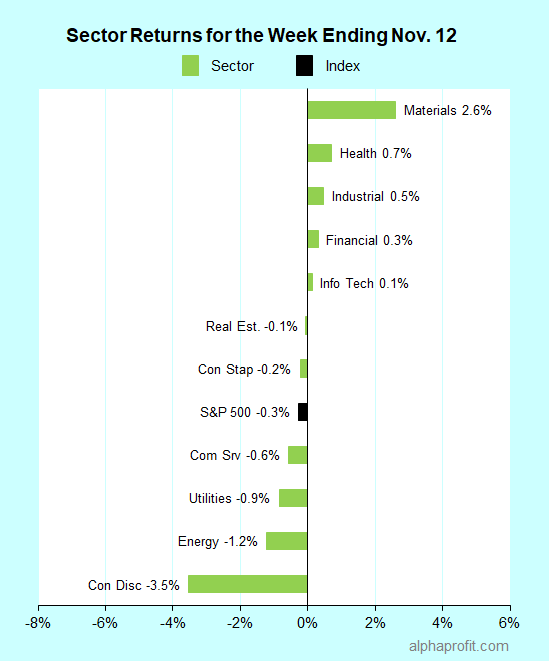

For the week ending November 12, the S&P 500 (SPY) fell 0.3%. Five of the 11 sectors gained.

Materials (XLB), health care (XLV), and industrials (XLI) outperformed the S&P 500, gaining 0.5% or more.

Consumer discretionary (XLY), energy (XLE), and utilities (XLU) lagged the benchmark.

Market breadth was fractionally positive. The number of advancing stocks in the S&P 500 led the number of decliners by a slim 11-to-10 ratio.

The S&P 500’s top 10 winners included consumer discretionary, health care, information technology, and materials companies.

1. Information Technology

Seagate Technology (STX) +12% – The maker of hard disk drives used to store data was the top performer in the S&P 500 for the week. Seagate unveiled innovative technology that integrates hard disk drives with a communication protocol previously compatible only with solid-state drives. This technology can increase the usage and life of hard disk drives.

Semiconductor chipmaker Advanced Micro Devices (AMD) rose 8% after Facebook’s parent Meta Platforms (FB) chose AMD’s processors for its datacenters. Seagate’s competitor Western Digital (WDC) and semiconductor chipmaker Xilinx (XLNX) gained 8% each.

2. Materials

Freeport-McMoRan (FCX) +11% – The largest U. S.-based copper producer rose after the House approved the $1.7 trillion infrastructure bill. Investors expect investments in electric vehicle charging infrastructure and clean energy transmission to drive copper demand higher.

Agricultural chemicals producer CF Industries (CF) gained 9% after Scotiabank raised the share price target.

3. Consumer Discretionary

Pool Corp. (POOL) +10% – The leading swimming pool distributor gained after agreeing to buy Porpoise Pool & Patio, including its operating subsidiaries, Pinch A Penny and Sun Wholesale Supply.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Auto manufacturer General Motor (GM) +8%

- Medical diagnosis company Laboratory Corp. of America (LH) +8%

- Medical equipment maker PerkinElmer (PKI) +9%

Top ETFs for the week

The following ETFs themes worked well: cannabis, China Internet, gold & silver miners, video gaming. The top ETFs for the week include:

- AdvisorShares Pure US Cannabis ETF (MSOS) +14.0%

- KraneShares CSI China Internet ETF (KWEB) +10.8%

- VanEck Junior Gold Miners ETF (GDXJ) +7.2%

- VanEck Video Gaming and eSports ETF (ESPO) +7.2%

- ETFMG Prime Junior Silver Miners ETF (SILJ) +7.0%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +7.0%

Looking ahead to the week of November 15

Financial markets get more data on the consumer this week. Retailer earnings and retail sales data are in store. The earnings calendar also includes reports from Nvidia and Cisco Systems. The virtual summit between President Biden and Chinese leader Xi will attract investors’ attention.

* The spotlight is on consumers this week after last week’s poor reading on consumer sentiment. Major retailers, including Walmart, Home Depot, Lowe’s, and Target, report quarterly earnings. Investors are keen to hear retailers’ comments on the supply chain & profit margin pressures and outlook for holiday sales.

* The U. S. Census Bureau adds more to the state of the consumer when it reports October retail sales data on Tuesday. Briefing.com shows economists forecast retail sales to rise 1.2% month-over-month in October. Retail sales rose 0.7% and 0.9% in September and August, respectively, in comparison.

* The earnings calendar includes reports from widely-followed names in the information technology sector, including Nvidia, Cisco Systems, and Applied Materials.

* President Biden and Chinese leader Xi hold a virtual summit on Monday evening. Investors are watching for signs of improvement in trade relations between the two nations.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023