The S&P 500 rallied to close the week ending November 13 at a record high. Pfizer and BioNTech sparked the rally after trial data indicated their COVID-19 vaccine is more than 90% effective. Cyclical and value stocks included in the ‘reopening plays’ led the rally while large-cap tech stocks lagged. News outlets increased Biden’s lead over Trump in their electoral college vote estimates.

Stocks started last week with a bang after trial data from Pfizer & BioNTech indicated their COVID-19 vaccine is more than 90% effective. The Dow Jones Industrial Average was up over 1,600 points or 5.7% within a few minutes of trading on November 9 as stocks of ‘reopening plays’ surged and ‘stay-at-home plays’ lagged.

The continued rise in COVID-19 cases, however, restrained enthusiasm. On November 13, the nationwide daily new COVID-19 case count set a record of 183,000. The cumulative case tally exceeded 11 million, with both CA and TX topping 1 million. The state of New York and the city of Chicago imposed restrictions to curb the spread.

News outlets increased their estimates of Biden’s electoral college vote tally and continued to project Biden as the next President. Associated Press estimated Trump would have to overcome vote deficits of 60,000 in PA, 11,400 in AZ, and 14,100 in GA to reverse the election result.

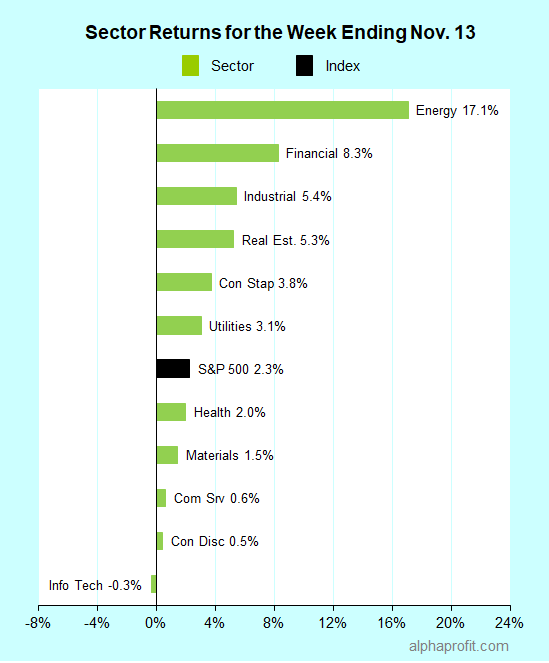

For the week ending November 13, the S&P 500 (SPY) rose 2.3%.

Ten of the 11 sectors gained. Information technology was the sole loser.

Energy (XLE), financials (XLF), and industrials (XLI) led the S&P 500.

Information technology (XLK), consumer discretionary (XLY), and communication services (XLC) lagged the benchmark.

The number of advancing stocks in the S&P 500 outnumbered the number of decliners by a 4-to-1 ratio.

The S&P 500’s top 10 winners included companies from the real estate and energy sectors. Six of the winners were real estate investment trusts (REITs). Four were energy stocks.

1. Real Estate:

The shares of shopping center REITs posted massive gains since a COVID-19 vaccine can boost the prospects of mall and strip shopping center owners by allowing consumers to shop at retail outlets.

Shopping center REIT Kimco Realty (KIM) led the charge. Its shares surged 39% to be the week’s top performer in the S&P 500. Regency Centers (REG) and Federal Realty Investment Trust (FTR) rose 34% and 28% to claim the third and fifth spots.

Office REIT Vornado Realty (VNO), healthcare REIT Ventas (VTR), and hotel REIT Host Hotels & Resorts (HST) gained 27%, 26%, and 26%, respectively, to feature among the S&P 500’s top 10 winners.

2. Energy:

With the pandemic crushing petroleum demand, favorable COVID-19 vaccine trial data provided hopes of a revival in oil & gas consumption. The price of oil rallied nearly $3 a barrel or 8% last week.

The S&P 500’s top 10 winners included shares of selected companies across the petroleum value chain. They were shale oil producer Diamondback Energy (FANG) up 36%, oil refiners Valero Energy (VLO), and HollyFrontier (HFC) up 33% and 26%, respectively, and diversified manufacturing and logistics company Phillips 66 (PSX) up 26%.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- iShares MSCI Turkey ETF (TUR) +22%

- SPDR S&P Oil & Gas Exploration & Production ETF (XOP) +20%

- VanEck Vectors Oil Services ETF (OIH) +19%

- Energy Select Sector SPDR Fund (XLE) +17%

- Vanguard Energy Index Fund ETF (VDE) +17%

Looking ahead to the week of November 16

The tug-of-war between ‘reopening’ and ‘stay-at-home’ plays is likely to continue next week. ‘Stay-at-home’ plays can regain their leadership, particularly if COVID-19 cases continue rising. Reopening plays can get some relief if Moderna provides favorable data from its vaccine trials.

* Wall Street will continue to keep an eye on both election and COVID-19 related developments. Reopening and stay-at-home plays are likely to stay locked in their duel with odds favoring the latter as COVID-19 cases rise. Data from Moderna’s COVID-19 vaccine trials can move stock prices.

* The earnings reporting season shifts to retailers. Walmart (WMT), Home Depot (HD), and Lowe’s (LOW) are among the S&P 500 members that report next week. Semiconductor chipmaker NVIDIA (NVDA) and tax software provider Intuit (INTU) report as well.

* The economic data focus on the consumer. October retail sales and existing home sales are both in the spotlight. Economists expect a 0.6% gain in October retail sales from September and 6.5 million in existing home sales.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023