Gains in information technology and retailing stocks helped the S&P 500 close fractionally above the flat line last week. Persistent inflation worries, however, limited the advance. COVID concerns returned towards the end of the week, pressuring value, and small-cap stocks.

Information technology stocks rose after semiconductor chipmakers Nvidia and Qualcomm provided optimistic assessments of their future. Falling bond yields also provided a supportive backdrop.

Robust earnings reports from home improvement retailers Home Depot & Lowe’s and department stores like Kohl’s & Macy’s drove retailer shares higher. Retail sales rose by a better-than-expected 1.7% in October, helping investor sentiment.

Inflation worries persisted in the wake of consumer and producer price index data from the previous week. Adding to these worries, New York Federal Reserve Bank President Williams said inflation is becoming more broad-based and that expectations for future price increases are rising.

Concerns of COVID impacting economic growth returned after Austria announced a 20-day nationwide lockdown, and Germany imposed new restrictions on the unvaccinated. Meanwhile, the U. S. daily new case count inched towards 100,000 after bottoming around 71,000 in early November. COVID concerns impacted energy and travel-related stocks significantly.

After months of starts & stops, the House passed President Biden’s $1.7 trillion social safety net and climate bill on Friday. The bill now moves to the Senate, where Democrats await an uphill battle.

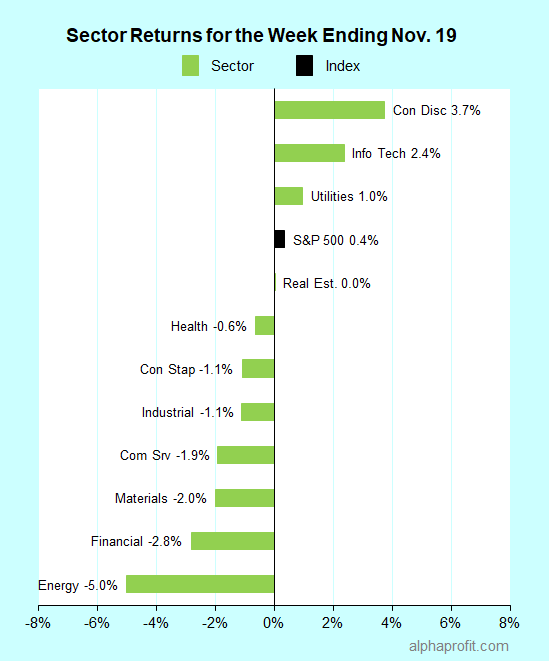

For the week ending November 19, the S&P 500 (SPY) rose 0.4%. Four of the 11 sectors gained.

Market breadth was, however, significantly negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 1-to-2 ratio.

Consumer discretionary (XLY), information technology (XLK), and utilities (XLU) outperformed the S&P 500, gaining 1.0% or more.

Energy (XLE), financials (XLF), and materials (XLB) lagged the benchmark.

The S&P 500’s top 10 winners included consumer discretionary, health care, and information technology companies.

1. Consumer Discretionary

Dollar Tree (DLTR) +19% – The discount store was the top performer in the S&P 500 for the week after activist investor Mantle Ridge disclosed a $1.8 billion stake. Investors expect Mantle Ride to mend Dollar Tree’s Family Dollar acquisition.

Tesla (TSLA) +10% – Cathie Wood of ARK Investment Management predicted the electric vehicle maker could increase its share to 20-25% of the U. S. auto market in five years.

Retailers Home Depot (HD) and Etsy Inc. (ETSY), and apparel maker Under Armor (UAA) gained 8-10% each.

2. Health Care

Moderna (MRNA) +14% – The U. S. Food and Drug Administration authorized Moderna’s COVID booster shots for people aged 18 and older. The FDA had previously approved boosters for people 65 and older.

3. Information Technology

Qualcomm (QCOM) +12% – Holding its Investor Day, the chipmaker outlined plans to grow revenue to over $46 billion by 2024. The company is expanding its addressable market from $100 billion to over $700 billion in the next decade by expanding into high-end Android handsets, automobiles, and the Internet of Things.

Intuit (INTU) +10% – The financial software firm topped analysts’ quarterly sales and EPS forecasts.

Nvidia (NVDA) +9% – The chipmaker provided an upbeat outlook along with bullish comments on ‘metaverse’ opportunities after topping analysts’ quarterly EPS forecast.

Micron Technology (MU) +7% – The memory chipmaker rose on positive comments from Evercore ISI and Citigroup.

Top ETFs for the week

The following ETFs themes worked well: carbon credit, consumer discretionary sector, semiconductors, volatility, large-cap growth. The top ETFs for the week include:

- KraneShares Global Carbon ETF (KRBN) +6.4%

- Consumer Discretionary Select Sector SPDR Fund (XLY) +3.7%

- VanEck Semiconductor ETF (SMH) +3.7%

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) +2.9%

- iShares Russell Top 200 Growth ETF (IWY) +2.5%

Top Fidelity Fund for the week

- Fidelity Select Semiconductors (FSELX) +4.2%

Looking ahead to the week of November 22

The trading week is shortened by the Thanksgiving holiday on Thursday and a half-day session on Friday. Earnings reports and economic data crowd ahead of the holiday. President Biden’s choice of the new Federal Reserve chairperson may well be the significant market mover this week.

* Markets are waiting for President Biden to nominate the next head of the Federal Reserve after Powell’s term ends in February. Markets expect Biden to either renominate Powell or choose Fed Governor Brainard. Investors are more comfortable with Powell than with Brainard, whom Progressive Democrats support. They fear Brainard may not be as aggressive as Powell in fighting inflation if needed.

* Market-moving economic data crowd into Wednesday due to the Thanksgiving holiday. Economists expect the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation measure, to rise 0.6% in November, twice as much as it did in October. Minutes of the November 2-3 Federal Open Market Committee interest rate policy meeting are due on Wednesday too. The Bureau of Economic Analysis updates its estimate for GDP growth in the third quarter.

* Analog Devices, Autodesk, Deere & Co., and Medtronic are among the dozen or so S&P 500 companies reporting earnings this week.

* Investors will keep an eye on the percent of COVID tests proving positive in the U. S. to assess how this situation is likely to evolve.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023