The S&P 500 fell 0.8% last week as daily new COVID-19 infections set new records and many states implemented restrictions to curb the spread. Weekly unemployment claims and retail sales data disappointed. COVID-19 vaccine developers reported positive news.

The U. S. seven-day average of daily new Covid-19 infections rose nearly 20% last week to top 172,000, prompting measures to curb the spread. New York City closed its schools for in-person learning. California issued a ‘limited’ Stay-at-Home Order. The Centers for Disease Control and Prevention advised against traveling for Thanksgiving.

The labor market data showed the stress of rising COVID-19 cases and shutdowns. Initial unemployment claims for the week ending November 14 rose by 31,000 to 742,000. The Commerce Department reported a 0.3% gain in October retail sales below economists’ forecast for a 0.5% gain.

Interim late-state trial data showed Moderna’s (MRNA) COVID-19 developmental vaccine to be 94.5% effective in preventing infections. Pfizer (PFE) and BioNTech (BNTX) concluded their COVID-19 vaccine trial and applied for an emergency use authorization from the U. S. Food and Drug Administration. Some Americans could receive the vaccine by the end of the year if the U. S. FDA approves the vaccine in a few weeks as expected.

The push-and-pull between the rise of new COVID-19 cases versus progress on vaccines impacted investor sentiment throughout the week. Market leadership switched back-and-forth between economically-sensitive value stocks and pandemic-resistant growth stocks.

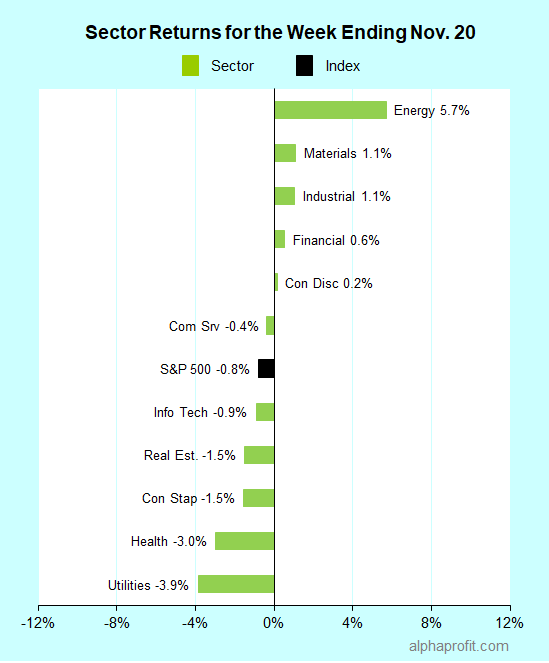

For the week ending November 20, the S&P 500 (SPY) fell 0.8%.

Five of the 11 sectors gained.

Energy (XLE), materials (XLB), and industrials (XLI) led the S&P 500.

Utilities (XLU), health care (XLV), and consumer staples (XLP) lagged the benchmark.

The number of advancing stocks in the S&P 500 surpassed the number of decliners by a 9-to-8 ratio.

The S&P 500’s top 10 winners included companies from the energy, consumer discretionary, and communication services sectors. Six of the winners were energy stocks.

1. Energy:

Energy stocks moved up as oil prices marked their third straight weekly gain. The rising possibility of COVID-19 vaccine rollouts eased oil demand concerns. Hopes of OPEC+ keeping production in check rose last week, supporting oil prices.

Diamondback Energy (FANG) was the week’s top performer in the S&P 500. The shale oil producer’s shares were up 19%.

Shares of Occidental Petroleum (OXY) rose 14% on group strength and analyst comments. Susquehanna raised its price target on the oil and natural gas producer shares to $18.

Energy service providers TechnipFMC plc (FTI) & Schlumberger (SLB), and oil producers Concho Resources (CXO) & ConocoPhillips (COP) were the other top 10 winners, each gaining 12-13%.

2. Consumer Discretionary:

A 55% jump in sales of personal hygiene products such as soap and hand sanitizer powered quarterly results at L Brands (LB). The owner of Bath & Body Works and Victoria’s Secret earned $1.17 a share, well above analysts’ $0.12 a share estimate. L Brands’ shares rose 16%.

Analyst upgrades helped shares of Under Armor (UAA) to a 12% gain. Argus upgraded the apparel manufacturer’s rating to Buy, citing improving earnings recovery prospects. Wells Fargo upgraded the stock to Overweight, anticipating activist investors to get involved.

Online marketplace operator Etsy (ETSY) was the third consumer discretionary name in the top 10 winner list; its shares were up 12%

3. Communication Services:

Entertainment giant ViacomCBS (VIAC) was the only entry from the Communication Services sector to feature among the top 10 winners with a 13% gain. The New York Times (NYT) reported several buyers, including News Corp. (NWSA) are interested in buying ViacomCBS’ book publishing unit, Simon & Schuster. With 19% of ViacomCBS float short, the rotation into value stocks forced short sellers to cover.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Invesco WilderHill Clean Energy ETF (PBW) +12%

- Alerian MLP ETF (AMLP) +8%

- Global X MLP ETF (MLPA) +8%

- First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) +7%

- ARK Next Generation Internet ETF (ARKW) +7%

Looking ahead to the week of November 23

Stocks are likely to extend their downtrend next week as investors try to balance the near-term economic impact from the rise in COVID-19 cases and shutdowns with the potential for a rebound next year. The trading week ahead is shortened by the Thanksgiving holiday on Thursday and by the 1:00 pm, Eastern close on Friday.

* Stocks are likely to be pulled down by the pandemic and pushed up by the promise of recovery this week. The impact of restrictions on the economy during the Thanksgiving holiday is likely to be a focal point. The negatives are likely to be offset by the optimism from vaccine data, approvals, and distribution efforts leading to economic recovery.

* The fiscal stimulus package is likely to return to the front-burner. Pandemic relief in the form of unemployment benefits and mortgage forbearance would end in December without a new stimulus package.

* Wall Street will look for leads into the Federal Reserve’s thinking on tweaking its $80 billion Treasury securities buying program when the central bank releases the minutes of its last interest rate policy meeting.

* The earnings calendar includes reports from medical device maker Medtronic (MDT), agriculture equipment maker Deere (DE), and electronics retailer Best Buy (BBY).

Note: The next Weekly Letter will be published on December 6.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023