President Trump tested positive for the coronavirus. Investors latched on to the idea that Trump’s health concerns and the weaker-than-expected jobs report would lead to the implementation of fiscal stimulus measures relatively soon. This additional pandemic relief package, in turn, would provide renewed impetus to the flagging economic recovery.

Concerns of the impact of the COVID19 pandemic on the election and economy increased after President Trump tested positive for the coronavirus. An increase in New York city’s daily positive rate of coronavirus tests also added to worries.

The economic recovery showed signs of weakening. The Labor Department said the U. S. economy created 661,000 in nonfarm jobs in September, less than the 800,000 economists’ forecast.

Investors perceived Trump’s health concerns and the weaker-than-expected jobs report to up the odds of the additional fiscal stimulus soon. To this effect, Democrats and Republicans put forth pandemic relief packages for $2.2 trillion and $1.6 trillion, respectively, suggesting a narrowing in the gap between the two proposals.

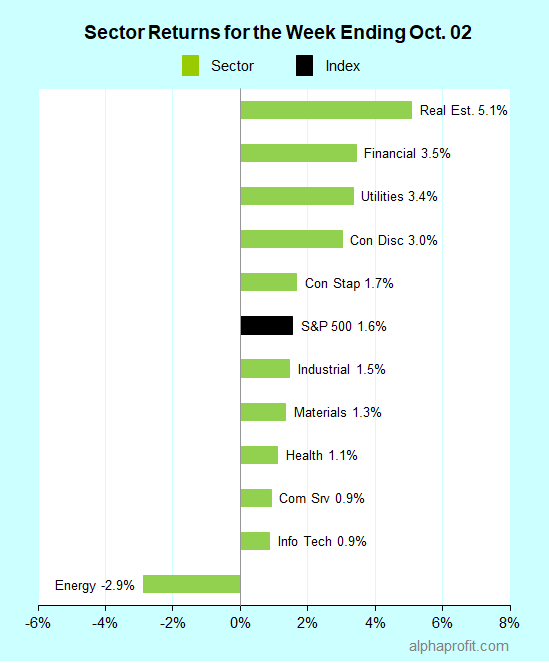

For the week ending October 2, the S&P 500 (SPY) rose 1.6%, its first weekly gain after five straight losses.

Ten of the 11 sectors gained. Energy (XLE) was the only sector to lose ground.

Real estate (XLRE), financials (XLF), and utilities (XLU) led the S&P 500.

Energy (XLE), information technology (XLK), and communication services (XLY) lagged the index.

Breadth was strongly positive, with the number of advancing stocks in the S&P 500 beating decliners by an 11-to-3 ratio.

The rally favored small-caps with the S&P 500’s top 10 winners having a median market capitalization of just $18 billion.

The S&P 500’s top 10 winners included companies from the information technology, consumer discretionary, and financial sectors.

1. Information Technology: Paycom (PAYC) and DXC Technology (DXC)

Paycom (PAYC) shares rose 17% to be the week’s top performer. Stifel raised its rating on shares of the human capital management software provider to Buy. The new $365 share-price target implied a 14% upside.

Shares of DXC Technology (DXC) were up 13% after the IT service provider announced it would use the $5 billion in proceeds from the sale of its state & local health services business to strengthen its balance sheet.

2. Consumer Discretionary: Gap, Inc. (GPS)

Up 13%, Gap (GPS) shares were the second-highest gainer in the S&P 500. To better meet online shopping demand, the apparel retailer plans to hire 10,000 workers for its fulfillment and customer-contact locations this holiday season.

3. Financial: Truist Financial (TFC) and Invesco Ltd. (IVZ)

Truist Financial (TFC) shares rose 11% after Barron’s featured the bank as its stock pick. The publication stated synergies from the SunTrust-BB&T bank merger should help Truist do well.

Invesco (IVZ) shares were up 10%. Activist hedge fund Trian unveiled a 9.9% stake in both Invesco and Janus Henderson (JHG), intending to create an asset management giant.

Top ETFs for the week

Renewable energy ETFs were in favor as Democratic candidate Biden’s chances in the Presidential election appeared to improve. The following renewable energy ETFs were up 10% or more:

- Invesco Solar (TAN)

- iShares Global Clean Energy (ICLN)

- First Trust NASDAQ Clean Edge Green Energy (QCLN)

- Invesco WilderHill Clean Energy (PBW)

- SPDR Kensho Clean Power (CNRG)

Looking ahead to the week of October 5

All attention is on happenings in Washington this week.

* Wall Street has a new concern to contend with in President Trump’s health. Investors and analysts will watch how the president communicates with the public and look forward to health updates from the White House medical staff. Investors are also likely to pay more attention to COVID19 statistics than before.

* The new pandemic relief package is another top-of-the-mind item for the market. Democrats and Republicans have narrowed the gap in their stimulus proposals. They now have another opportunity to middle ground and get the job done.

* Federal Reserve Chairman Powell has one more opportunity to push Congress and the Administration in approving the new pandemic relief package. Powell is scheduled to deliver a speech to the National Association of Business Economists.

* Earnings calendar is light with just four S&P 500 members scheduled to report earnings. They are Delta Air Lines (DAL), Domino’s Pizza (DPZ), Lamb Weston Holdings (LW), and Paychex (PAYX).

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023