Stocks managed to overcome a disappointing September jobs report and advance last week. The Senate approved a bill to increase the nation’s borrowing limit by $480 billion, effectively funding the U. S. government through early December.

The U. S. Labor Department reported the economy added 194,000 jobs in September. Economists surveyed by Dow Jones forecasted 500,000 in job creation.

The unemployment rate, however, fell more sharply than economists expected to 4.8%. Wages increased 4.6% on an annual basis.

Although job creation disappointed, investors believed wage increase and the unemployment rate in September would keep the Federal Reserve on track to reduce stimulus in the coming months. The yield on the 10-year Treasury note ticked higher.

The U. S. Senate approved a bill to increase the U. S. borrowing limit by $480 billion after 11 Republicans joined 50 Democrats in voting to end the debate. The nation’s debt can now rise to about $28.8 trillion from $28.4 trillion, allowing the Treasury Department to pay bills until December 3. The bill now moves to the House for Congressional approval, expected before Tuesday.

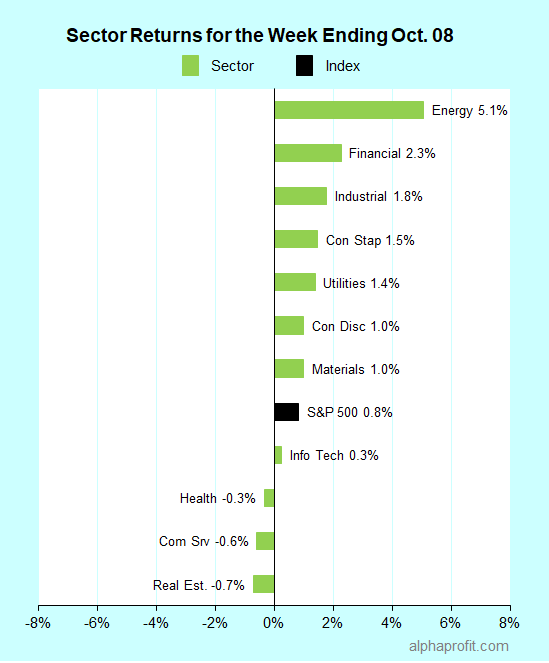

For the week ending October 8, the S&P 500 (SPY) rose 0.8%. Eight of the 11 sectors gained.

Energy (XLE), financials (XLF), and industrials (XLI) outperformed the S&P 500, gaining 1.8% or more.

Real estate (XLRE), communication service (XLC), and health care (XLV) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 9-to-5 ratio.

The S&P 500’s top 10 winners included communication service, consumer discretionary, energy, financials, and industrial companies.

1. Energy

Energy stocks accounted for six of the top 10 winners. They rallied as oil & natural gas prices soared to multi-year highs. Petroleum prices rallied after the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, stuck to their current production plans. Oil rose 4.6% last week to close just shy of the $80 a barrel last seen in 2014. Natural gas prices pulled back after climbing to their highest level since 2008.

Phillips 66 (PSX) gained 13% to be the top performer in the S&P 500 for the week after the company increased its quarterly dividend payment and reduced borrowings by $500 million.

Oil & gas producers APA Corp. (APA), Diamondback Energy (FANG), Hess Corp. (HES), Marathon Oil (MRO), and Pioneer Natural Resources (PXD) gained between 10% and 13%, each.

2. Financials

Intercontinental Exchange (ICE) +11% – The exchange operator reported an 18% increase in the third quarter average daily volume from higher volumes in Commodities and Financials. Comments from JPMorgan on the likelihood of ICE resuming share buybacks added to bullishness.

3. Consumer Discretionary

General Motors (GM) +10% – The automaker shared its goal to double sales by 2030, including several new electric vehicle models. General Motors believes this transition could expand its profit margin to 12-14% from 7.9% last year. The company plans to debut an all-electric Silverado pickup truck in January 2022.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Gaming software maker Take-Two Interactive (TTWO) +10%

- Railroad Norfolk Southern (NSC) +9%

Top ETFs for the week

The following ETFs themes worked well: China Internet, gold miners, Russia, platinum, and energy. The top ETFs for the week include:

- KraneShares CSI China Internet ETF (KWEB) +8.2%

- VanEck Junior Gold Miners ETF (GDXJ) +6.3%

- VanEck Russia ETF (RSX) +5.2%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT) +5.1%

- Energy Select Sector SPDR Fund (XLE) +5.1%

Top Fidelity Fund for the week

- Fidelity Select Natural Gas (FSNGX) +5.8%

Looking ahead to the week of October 11

This week is about earnings and inflation. The third-quarter earnings reporting season kicks off this week. Investors will focus on what companies have to say about supply chain disruptions and surging oil prices. Consumer and producer price data are in store as well this week.

* The top banks start the third-quarter earnings reporting season this week. Reporting banks include JPMorgan Chase, Bank of America, Morgan Stanley, Citigroup, and Goldman Sachs. According to FactSet, analysts expect S&P 500 company aggregate earnings to grow 27.6% year-over-year. Although a far cry from the 90.9% growth in earnings recorded in the second quarter, the third quarter could mark the third-fastest growth rate since 2010.

* Investors will likely pay attention to what companies have to say about the impact of supply chain disruptions and rising energy prices on profits. Oil price is up more than 27% since August 20 and is driving inflation. Transportation and consumer discretionary companies could be at risk of falling short of their EPS forecasts.

* The economic calendar includes data on inflation in consumer and producer prices. Briefing.com shows economists expect consumer and producer prices to increase 0.3% and 0.5%, respectively, in September. Investors will also sense how inflation is impacting consumer spending when the Commerce Department reports September retail sales. Economists expect retail sales to fall 0.5%.

* Although a truce between Senate Democrats and Republicans helped avoid a debt default, the debt ceiling is likely to get investors’ attention. Senate Minority leader McConnell threatens to withdraw his assistance when the debt ceiling topic comes into focus again in early December.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023