Stocks rallied on hopes of additional pandemic relief even though the path to a new stimulus bill remained unclear. Investors appeared to take comfort in a stimulus bill coming through regardless of its timing. Democratic candidate Biden increased his lead over President Trump, arguably raising the odds of a result shortly after the November 3 election.

Stocks rallied on hopes of more stimulus last week despite differences between Congress and the Trump administration. The confusion from President Trump calling off negotiations, restarting them, and pushing skinny as well as comprehensive deals did not dissuade investors.

The path to a new stimulus bill remained unclear. Senate Republicans, including Majority Leader McConnell, remained steadfast in opposing a $1+ trillion package.

Investors appeared to take comfort with the notion that a stimulus package will be implemented by the Biden administration after the election, even if one does not pass before the poll.

Several national polls showed Democratic candidate Biden having established a clear lead over Trump, potentially lowering the odds of a contested election.

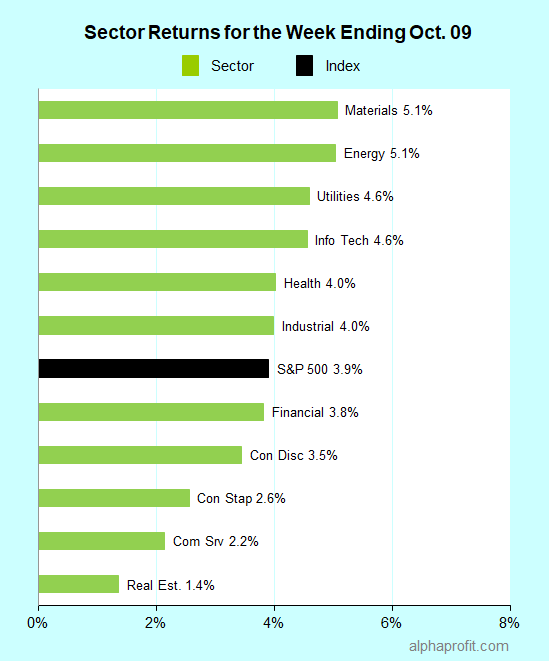

For the week ending October 9, the S&P 500 (SPY) rose 3.9%.

All 11 sectors gained.

Materials (XLB), energy (XLE), and utilities (XLU) led the S&P 500.

Real estate (XLRE), communication services (XLY), and consumer staples (XLP) lagged the index.

Breadth was strongly positive, with the number of advancing stocks in the S&P 500 beating decliners by an 11-to-1 ratio.

The S&P 500’s top 10 winners included companies from the information technology, consumer discretionary, and materials sectors.

1. Information Technology: Xilinx (XLNX) and Arista Networks (ANET)

Xilinx (XLNX) shares rose 18% to be the week’s top performer. The Wall Street Journal reported competitor Advanced Micro Devices (AMD) is in advanced negotiations to acquire Xilinx for as much as $30 billion.

Shares of Arista Networks (ANET) were up 12%. Citing higher demand for networking-equipment from cloud computing enablers in 2021, JP Morgan raised its Arista share price target by 8% to $275 from $255, implying a 25% upside.

2. Consumer Discretionary: Tapestry, Inc. (TPR)

Shares of the luxury goods retailer Tapestry (TPR) were up 17% after Deutsche Bank reiterated its Buy rating and $21 share price target. The analyst expects Tapestry to benefit from consumers reallocating travel & entertainment dollars towards the latest fashions during the pandemic after competitors Capri Holdings (CPRI) and Levi Strauss (LEVI) commented on this trend.

3. Materials: Corteva (CTVA) and Martin Marietta Materials (MLM)

Corteva (CTVA) shares were up 14% after activist investor and shareholder Starboard Value pitched the opportunities available for the agriculture company to cut costs and lower its profit margin gap versus competitors.

Shares of Martin Marietta Materials (MLM) were up 14% after Deutsche Bank upgraded the building materials producer to Buy from Hold and lifted its share price target by 35% to $311.

Top ETFs for the week

Cannabis ETFs were the top performers last week. Democratic vice presidential nominee Harris said the Biden administration would decriminalize the use of marijuana in the U. S.

Renewable energy ETFs gains were in favor for the second straight week as Democratic presidential nominee Biden increased his lead over President Trump.

The following cannabis ETFs and renewable energy ETFs were among the last week’s biggest winners:

- The Cannabis ETF (THCX) +19%

- Global X Cannabis (POTX) +17%

- Invesco Solar (TAN) +14%

- Invesco WilderHill Clean Energy (PBW) +13%

- iShares Global Clean Energy (ICLN) +12%

Looking ahead to the week of October 12

The stock market has a five-day week ahead, while the bond market is closed on Monday in observance of Columbus Day.

* The third-quarter earnings reporting season kicks off next week. Nearly 30 of the S&P 500 companies are due to report. The list has 16 companies from the financial sector, including JPMorgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), Citigroup (C), and BlackRock (BK). Healthcare heavyweights Johnson & Johnson (JNJ) and UnitedHealth Group (UNH) are among the reporting companies as well.

* Washington continues to send mixed signals about a pandemic relief package. Assistance for the troubled airline industry is at stake. It remains to be seen if politicians can set aside their differences and assist at least the neediest constituents before the election.

* The economic calendar includes readings on retail sales and inflation in addition to weekly unemployment claims. Economists expect retail sales to increase by 0.6% in September, matching August’s tally. Inflation measures at the consumer and producer level are due as well.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023