The nation’s top banks kicked off the third-quarter earnings season with robust reports. The reports boosted investors’ confidence in the U. S. economy. Economic data suggested the inflation rate may be peaking, soothing fears of higher interest rates. The gain in retail sales in September exceeded expectations, boosting confidence in the health of the consumer.

The third-quarter earnings reporting season kicked off last week, with leading banks painting a healthy picture of the U. S. economy and the consumer. Bank of America, Citigroup, Goldman Sachs, JPMorgan, Morgan Stanley, and Wells Fargo reported stellar results.

Economic data raised hopes that the rate of inflation could be peaking. Supporting this optimism, the producer price index (a measure of wholesale prices) gained less than economists’ forecast while the consumer price index (a measure of retail prices) topped the forecast.

Retail sales data raised optimism about the state of the economy. The Commerce Department reported retail sales excluding auto sales rose 0.8%, exceeding economists’ 0.5% forecast. Although retail sales advanced partly due to higher prices, investors saw the data as evidence for the consumer’s inclination to spend.

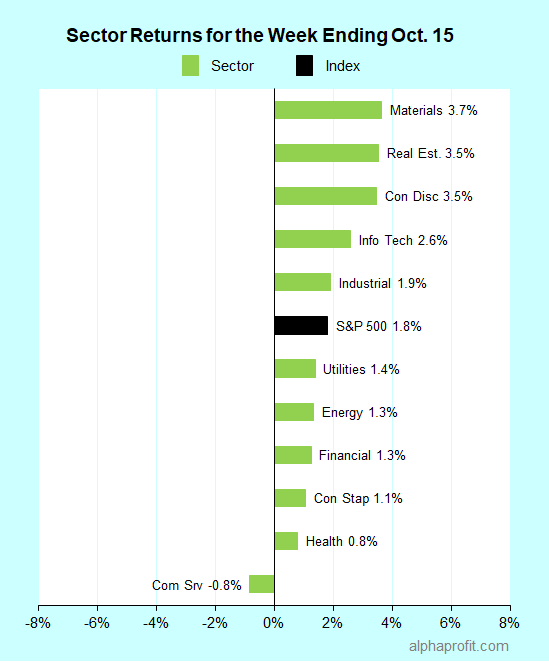

For the week ending October 15, the S&P 500 (SPY) rose 1.8%. Ten of the 11 sectors gained.

Materials (XLB), real estate (XLRE), and consumer discretionary (XLY) outperformed the S&P 500, gaining 3.5% or more.

Communication service (XLC), health care (XLV), and consumer staples (XLP) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 3-to-1 ratio.

The S&P 500’s top 10 winners included consumer discretionary, energy, financials, industrial, information technology and materials companies.

1. Materials

Freeport-McMoRan (FCX) +13% – The largest U. S.-based copper producer was the top performer in the S&P 500 for the week. The price of copper surged 11% last week after inventories not earmarked for deliveries dropped on the London Metal Exchange to their lowest since 1974.

2. Industrial

J. B. Hunt (JBHT) +12% – The trucking company reported stellar third-quarter results, topping analysts’ sales and EPS forecasts by 27% and 25%, respectively.

3. Information Technology

Enphase Energy (ENPH) +12% – The energy technology company rallied with the alternative energy group on headlines of energy crises impacting many locations due to rising oil and natural gas prices.

4. Energy

Halliburton (HAL) +9% – Piper Sandler raised the price target on shares of the energy services company along with those of its peer Schlumberger. Halliburton reports quarterly earnings on Tuesday.

5. Consumer Discretionary

VF Corp. (VFC) +8% – Ahead of the apparel brand announcing quarterly earnings next Friday, Goldman Sachs and Wells Fargo raised their VF Corp. share price targets. VF shares also benefited from broad strength in consumer discretionary stocks.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Power generation equipment maker Generac Holdings (GNRC) +11%

- Gases and specialty chemicals producer Air Products and Chemicals (APD) +10%

- Casino & resort operator MGM Resorts International (MGM) +8%

- Oil & gas producer APA Corp. (APA) +8%

- Asset manager BlackRock (BLK) +7%

Top ETFs for the week

The following ETFs themes worked well: metals including uranium, copper, and rare earth, solar and clean energy. The top ETFs for the week include:

- North Shore Global Uranium Mining ETF (URNM) +19.3%

- Global X Copper Miners ETF (COPX) +12.3%

- Invesco Solar ETF (TAN) +11.0%

- VanEck Rare Earth/Strategic Metals ETF (REMX) +10.3%

- iShares Global Clean Energy ETF (ICLN) +7.5%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +6.1%

Looking ahead to the week of October 18

The third-quarter earnings reporting season continues into its second week. The Fed’s beige book and housing industry data will be in focus this week. The first cryptocurrency ETF could debut as well.

* The third-quarter earnings reporting season broadens beyond the financial sector. Honeywell Intl., Intel, Johnson & Johnson, Netflix, NextEra Energy, Procter & Gamble, and Tesla are among the S&P 500 members reporting this week. The commentaries from these companies on inventories, backlog, and delivery times should give investors a better perspective on how companies are managing component shortages and rising input costs.

* On Wednesday, the Federal Reserve releases its beige book with insights on current economic conditions ahead of the November 2-3 Federal Open Market Committee meeting on interest rate policy.

* The economic calendar focuses on the housing industry. Data on housing starts and building permits come out on Tuesday, followed by data on existing home sales on Thursday.

* The much-awaited first cryptocurrency ETF could debut this week. The ProShares Bitcoin Strategy ETF investing in bitcoin futures could begin to trade next week if the Securities and Exchange Commission gives the green light.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023