Nearly 86% of S&P 500 companies reporting third-quarter earnings topped analysts’ forecast. Two COVID19 vaccine trials were halted due to safety concerns, while COVID19 cases continued to rise in the U. S. and Europe. Washington lawmakers held on to their entrenched positions, thwarting any movement towards a new stimulus bill.

The third-quarter earnings reporting season kicked off last week. Nearly 86% of the S&P 500 companies reporting earnings topped analysts’ EPS forecast according to FactSet. Although companies are, on average, exceeding analysts’ EPS forecast by 22%, aggregate 2020 third-quarter- earnings are likely to be down 18.4% year-over-year.

The 3-day average of daily new COVID19 cases in the U. S. rose above 65,000 after a gap of nearly 10 weeks. Rising COVID19 case counts in Europe prompted France, Germany, and the U. K. to reinstate strict social distancing rules.

Johnson & Johnson (JNJ) and Eli Lilly (LLY) paused trials of their COVID19 vaccine candidates due to safety concerns. Pfizer (PFE) sounded more reassuring, saying it may submit its vaccine for emergency use authorization by late November.

Lawmakers in Washington made little progress toward a stimulus deal. Senate Republicans, including Majority Leader McConnell, remained opposed to trillion-dollar packages. Democrats, including House Speaker Pelosi, maintained their opposition to a smaller package since the House of Representatives has already passed a $2.2 trillion package. Last week, President Trump tried to push Republicans for a bigger stimulus bill with no effect.

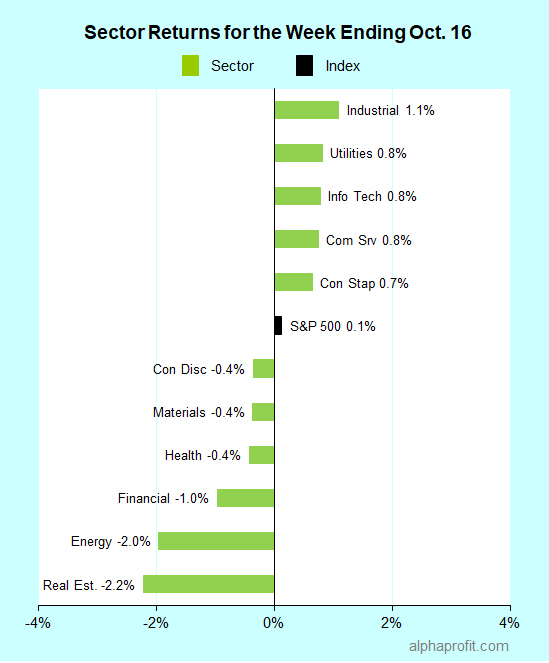

For the week ending October 16, the S&P 500 (SPY) rose 0.1%.

Five of the 11 sectors gained.

Industrials (XLI), utilities (XLU), and information technology (XLK) led the S&P 500.

Real estate (XLRE), energy (XLE), and financials (XLF) lagged the index.

The number of advancing stocks in the S&P 500 almost equaled the number of decliners.

The S&P 500’s top 10 winners included companies from the information technology, materials, and energy sectors.

1. Information Technology: Autodesk (ADSK)

Autodesk (ADSK) shares rose 9% to be the week’s top performer in the S&P 500. The Motley Fool recommended shares of the engineering & construction software provider, saying Autodesk’s sales and profits are accelerating from the launch of its new Fusion 360 product and its transition to selling software-as-a-service.

2. Materials: International Paper (IP) and WestRock (WRK)

Shares of International Paper (IP) and WestRock (WRK) rose 9% and 8%, respectively, after BMO Capital rated them Outperform on improving outlook for product pricing and demand growth. BMO Capital raised its price target for International Paper and WestRock shares to $53 and $57, respectively.

3. Energy: Concho Resources (CXO)

Shares of shale oil producer Concho Resources (CXO) rose 8% after Bloomberg reported ConocoPhillips (COP) is in talks to acquire the former. Concho Resources has an equity market capitalization of $10 billion. This deal, if completed, would follow Chevron’s purchase of shale oil producer Noble Energy (NBL) for $4 billion.

Other top 10 winners in the S&P 500

Stocks of several financial firms made healthy gains on a combination of better-than-expected earnings and consolidation possibilities. Shares of Blackrock (BLK), Invesco Ltd. (IVZ), and Morgan Stanley (MS) rose 6-7% each to be among the S&P 500’s top 10 winners last week.

Top ETFs for the week

The following ETFs were among the biggest winners last week, each up about 2%:

- ProShares Pet Care ETF (PAWZ)

- SPDR S&P Capital Markets ETF (KCE)

- Amplify Online Retail ETF (IBUY)

- First Trust Water ETF (FIW)

- Global X Cloud Computing ETF (CLOU)

Looking ahead to the week of October 19

Stocks may have trouble extending their three-week winning streak without positive surprises on the stimulus or the COVID19 vaccine fronts.

* Investors will keep their focus on Washington during the week ahead as lawmakers continue to wrangle over a new U. S. fiscal stimulus bill. The Senate will likely vote on a skinny $500 million package, including a Paycheck Protection Program. While the implementation of even such a limited stimulus package would be a welcome development, such an outcome is unlikely.

* Nearly 80 of the S&P 500 companies report earnings. Reporting companies include communications services leaders Verizon (VZ) & Netflix (NFLX) and consumer staples titans Procter & Gamble (PG) & Coca-Cola (KO). Intel (INTC), Abbott Laboratories (ABT), Union Pacific (UNP), and NextEra Energy (NEE) are among the others set to report.

* The housing industry is among the better performing parts of the economy, thanks to near-zero interest rates. Investors will seek confirmation when home builders’ sentiment, housing starts, and home sales data come out.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023