S&P 500 members continued to post robust third-quarter earnings reports, staying on track to grow EPS by 32.7% year-over-year. Over 84% of the reporting companies topped analysts’ forecasts. The damage from a few that disappointed was reasonably confined. The much-anticipated cryptocurrency ETF debuted. Economic data gave no cause for alarm.

The parade of impressive third-quarter earnings continued in the second week of the reporting season. Health care and financial companies led the way. According to FactSet, 84% of S&P 500 companies reporting earnings have topped analysts’ EPS forecast.

Blending actual EPS for those reporting with estimates for those to follow, third-quarter profits are on track to grow 32.7% year-over-year, higher than 27.5% analysts forecasted on September 30.

Concerns of component and labor shortages affecting holiday season sales and Internet advertising emerged after semiconductor chipmaker Intel and communication services company Snap Inc. disappointed with their earnings reports.

Yet, the damage from these worries did not spill over beyond the communication services sector. Investors felt relieved many companies are maintaining profit margins by passing on higher costs to customers.

The widely-anticipated ProShares Bitcoin Strategy ETF began trading last Tuesday and garnered over $1 billion in assets by the end of the week.

In economic data, existing-home sales rose more than expected. Initial unemployment benefit claims dropped to a new pandemic low, suggesting an improving job market.

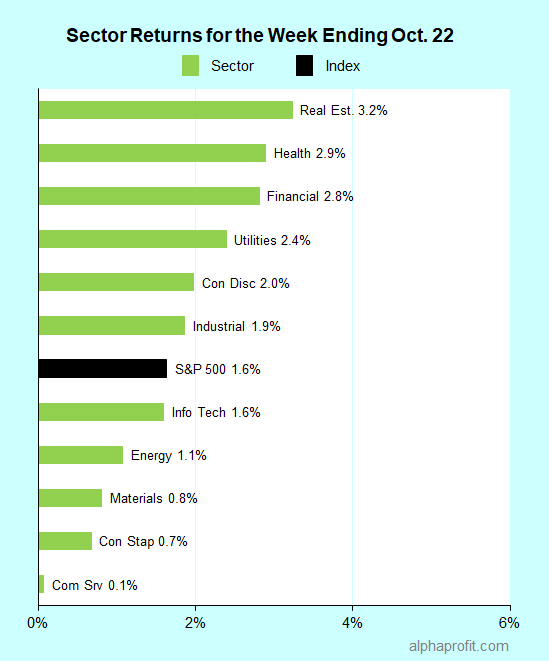

For the week ending October 22, the S&P 500 (SPY) rose 1.6%. All of the 11 sectors gained.

Real estate (XLRE), health care (XLV), and financials (XLF) outperformed the S&P 500, gaining 2.8% or more.

Communication service (XLC), consumer staples (XLP), and materials (XLB) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 4-to-1 ratio.

The S&P 500’s top 10 winners included consumer discretionary, financials, information technology and health care companies.

1. Consumer Discretionary

Pool Corp. (POOL) +11% – The world’s largest swimming pool products distributor was the top performer in the S&P 500 for the week. Pool Corp. shares surged after the company’s third-quarter sales and EPS grew by 24% and 55%, respectively, to set new records. The company raised the mid-point of its 2021 EPS forecast range by nearly 8%.

Automotive parts retailer Advance Auto Parts (AAP), online marketplace Etsy Inc. (ETSY), and electric-vehicle maker Tesla Inc. (TSLA) were the other winners, gaining 8-9% each. Tesla’s stellar quarterly results drove its shares past the $900 mark for the first time.

2. Health Care

Anthem, Inc. (ANTM) +10% – The nation’s second-largest health insurer raised its 2021 profit guidance. It also forecasted the pandemic to have a lower impact on 2022 profits as infections decline and more people get vaccinated.

Medical devices maker Abbott (ABT) rose 8% after posting impressive quarterly results and raising its full-year EPS forecast.

3. Financials

SVB Financial Group (SIVB) +9% – The parent of Silicon Valley Bank posted decent quarterly performance metrics. Loans and net interest income rose 21% and 17%, respectively, while provisions for credit losses fell 20%.

Diversified financial institution PNC Financial Services (PNC) gained 9% in a delayed reaction to its October 15 earnings report, supported by the broad rally in the banking group.

4. Information Technology

HP Inc. (HPQ) +8% – The PC and printer maker allayed fears of sales slowing down due to peaking demand and supply constraints. HP raised its quarterly dividend by 29% and its fiscal 2022 EPS guidance by 8% above analysts’ forecast.

Business technology retailer CDW Corp. (CDW) gained 8% after announcing a deal to buy Sirius Computer Solutions for $2.5 billion. The buyout bolsters CDW’s service capabilities in hybrid infrastructure, digital innovation, security, and cloud services.

Top ETFs for the week

The following ETFs themes worked well: banks, China Internet, healthcare providers, silver, and data centers. The top ETFs for the week include:

- iShares U.S. Regional Banks ETF (IAT) +5.1%

- KraneShares CSI China Internet ETF (KWEB) +4.7%

- iShares U.S. Healthcare Providers ETF (IHF) +4.7%

- iShares Silver Trust (SLV) +4.4%

- Pacer Benchmark Data & Infrastructure Real Estate ETF (SRVR) +4.0%

Top Fidelity Fund for the week

- Fidelity Select Health Care Services (FSHCX) +4.7%

Looking ahead to the week of October 25

Mega-cap technology companies are among the 150-plus S&P 500 companies reporting earnings this week. The Commerce Department releases its preliminary estimate on third-quarter GDP growth. The economic calendar also includes data on the Federal Reserve’s preferred inflation measure.

* Alphabet, Amazon, Apple, Facebook, and Microsoft, collectively accounting for over 22% of the S&P 500 market capitalization, report third-quarter earnings next week amidst a few misses in the technology sector. Last week, Intel, International Business Machines, and Snap shares declined sharply after posting disappointing results. Investors now seek insights into the impact of supply chain issues such as semiconductor chip & component shortages on the holiday shopping season when Apple and Amazon report. Likewise, investors await comments from Alphabet and Facebook on Internet advertising in the context of Apple increasing user privacy this year and companies reducing advertising spending due to labor shortages and supply chain disruptions.

* The Commerce Department reports its first estimate for third-quarter gross domestic product growth. Economists expect GDP to grow at an annualized rate of 2.8% in the third quarter, down from 6.7% in the second.

* The Commerce Department’s Bureau of Economic Analysis reports the personal consumption expenditures index, the Federal Reserve’s preferred inflation measure, for September. Economists forecast the PCE to rise 0.3% in September, down a tad from 0.4% in August.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023