The gap between the stimulus proposals made by Democrats & Republicans continues to be substantial, diminishing the odds of further pandemic relief before the November 3 election. Nearly 84% of S&P 500 companies reporting third-quarter earnings topped analysts’ forecast. The U. S. FDA approved remdesivir for patients hospitalized with COVID19.

The odds of a new stimulus bill passing before the election declined further last week. The gap between the stimulus proposals supported by Democrats and Republicans continues to remain over a trillion dollars.

The White House and House Speaker Nancy Pelosi have put the onus on the other party to compromise for a deal. Senate Majority Leader McConnell has now changed his stance and refused to commit to a pre-election vote on an aid package, saying he worries about dividing Republicans days before the election.

In third-quarter earnings reports, 84% of reporting S&P 500 companies topped analysts’ forecast. While companies are, on average, exceeding analysts’ EPS forecast by 17%, aggregate 2020 third-quarter earnings are likely to be down 16.5% year-over-year.

The seven-day average of daily new COVID19 cases in the U. S. rose last week to 64,000 from 56,000 the week before. The U. S. Food and Drug Administration approved Gilead Sciences’ (GILD) Veklury (remdesivir) for hospitalized patients.

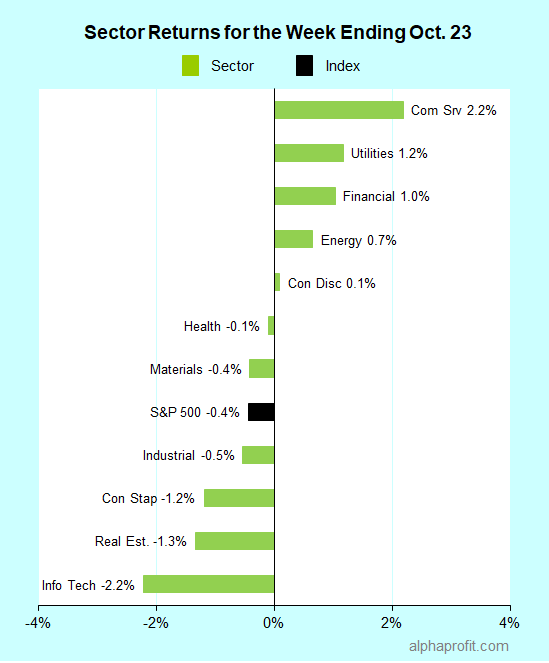

For the week ending October 23, the S&P 500 (SPY) fell 0.4%.

Five of the 11 sectors gained.

Communication services (XLC), utilities (XLU), and financials (XLF) led the S&P 500.

Information technology (XLK), real estate (XLRE), and consumer staples (XLP) lagged the index.

The number of advancing stocks in the S&P 500 almost equaled the number of decliners.

The S&P 500’s top 10 winners included companies from the healthcare, consumer discretionary, and financial sectors.

1. Healthcare: Align Technology (ALGN)

Align Technology (ALGN) shares surged a whopping 40% to be the week’s top performer in the S&P 500. The orthodontic-device maker reported third-quarter sales and EPS exceeding analysts’ forecast by 43% and 317%, respectively. Sales rose from strong demand for Invisalign clear aligners from teenagers.

2. Consumer Discretionary: Under Armor (UAA) and Las Vegas Sands (LVS)

Under Armor (UAA) shares were up 13%. Analysts at Deutsche Bank and Raymond James raised their price targets for the apparel & footwear maker’s shares.

Shares of Las Vegas Sands (LVS) jumped 12% after the casino operator reported a smaller-than-expected loss on higher than expected sales. Analysts at Jefferies and JP Morgan upped their share-price targets on the expectation, results from the company’s Macau and Singapore properties should improve.

3. Financials: Comerica (CMA) and Travelers (TRV)

Shares of Comerica (CMA) rose 11% after the regional bank reported third-quarter EPS of $1.44 on $710 million revenue, beating analysts’ forecast by 73% and 2%, respectively.

Travelers (TRV) shares were up 11% after the property & casualty insurer earned $3.12 per share in the third quarter, above analysts’ $3.07 estimate on a 2.7% year-over-year increase in sales.

Other top 10 winners in the S&P 500

COVID19 reopening plays in the consumer discretionary sector, Norwegian Cruise (NCLH), Expedia (EXPE), and Gap (GPS) were up over 11% each.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Global X Social Media ETF (SOCL) +8%

- SPDR S&P Regional Banking ETF (KRE) +8%

- U. S. Global Jets ETF (JETS) +7%

- Global X Copper Miners ETF (COPX) +6%

- VanEck Vectors Oil Services ETF (OIH) +5%

Looking ahead to the week of October 26

With a new stimulus bill unlikely before November 3, stocks may extend their downtrend in the coming week, particularly if the odds of a contested election increase and new COVID-19 cases continue rising.

* This is last week before the nation goes to the polls on November 3. Although Biden’s lead in national polls has shrunk in recent weeks, his widening advantage in battleground states has boosted Wall Street’s confidence in a clear winner emerging after the election. This confidence is likely to erode and lead to volatility in stock prices if Biden’s lead in battleground states shrinks.

* Nearly 170 of the S&P 500 companies report earnings. Investors will get a read on the information technology sector from Apple (AAPL), Facebook (FB), and Google parent Alphabet (GOOG). Amazon.com (AMZN), Boeing (BA), Caterpillar (CAT), Merck (MRK), and Pfizer (PFE) are also among the companies reporting this week.

* Investors will get a first look at third-quarter U. S. gross domestic product when the Commerce Department puts out its preliminary estimate on Thursday. Economists expect U. S. GDP to rebound at an annualized rate of 32% in the third quarter after contracting by nearly the same magnitude in the second due to COVID19.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023