With the delta variant impacting hiring, the U. S. economy added nearly 500,000 fewer jobs in August than economists predicted. U. S. stocks, however, had no trouble extending the rally from the previous week. Economists reasoned the Federal Reserve would not proceed forward with the announcement to taper bond purchases in September in light of the weak August jobs data.

The Labor Department reported the U. S. economy added just 235,000 jobs in August, far fewer than 1.05 million added in July. Economists surveyed by Dow Jones forecasted 720,000 job additions in August. The unemployment rate, however, dropped from 5.4% to 5.2%, a new pandemic low.

The rise in COVID cases from the coronavirus delta variant adversely impacted hiring in the hospitality, leisure, and retail industries.

The jobs report, however, stoked inflation concerns. Average hourly earnings rose 0.6% month-over-month to show a 4.3% increase on a year-over-year basis.

In other data, the Institute for Supply Management reported a decline in its services activity index to 61.7 in August from a record 64.1 in July.

The resurgence in COVID cases prompted the European Union to recommended member countries ban non-essential travel to the U. S.

Inflation and the resurgence in COVID cases took a toll on consumer confidence. The Conference Board’s consumer confidence index slid to a six-month low in August.

U. S. stocks extended their rally from the previous week, setting a few new record highs. Investors saw the subpar August jobs data causing the Federal Reserve to delay the announcement on tapering bond purchases to November.

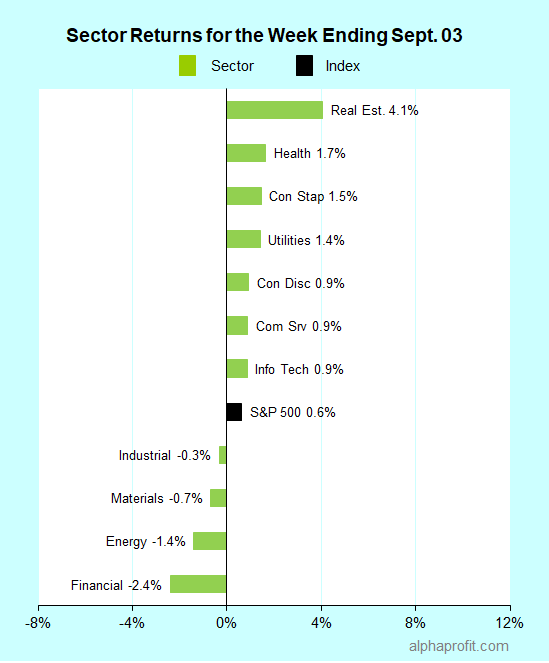

For the week ending September 3, the S&P 500 (SPY) rose 0.6%. Seven of the 11 sectors gained.

Real estate (XLRE), health care (XLV), and consumer staples (XLP) led the benchmark gaining 1.5% or more.

Financials (XLF), energy (XLE), and materials (XLB) lagged the S&P 500.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 9-to-8 ratio.

The S&P 500’s top 10 winners included companies from the energy, industrial, health care, and real estate sectors, with health care and real estate companies accounting for seven of them. ServiceNow (NOW) from the information technology sector rounded out the top 10 list.

1. Energy

Cabot Oil & Gas (COG) +14% – The natural gas producer rose 14% to claim honors as the week’s top performer in the S&P 500. Natural gas soared 7% after inventories rose less than expected, amidst expectations for supplies to remain impacted in hurricane Ida’s aftermath.

2. Industrial

Quanta Services (PWR) +12% – The contract services company announced it is buying privately-held energy contractor Blattner Holding Co. The $3 billion purchase gives Quanta access to Blattner’s prowess in renewable energy.

3. Health Care

Baxter International (BAX) +12% – Health care equipment & supplies firm Baxter International said it would buy Hill-Rom Holdings (HRC) for about $11 billion. The purchase would help Baxter add smart hospital beds to its portfolio of patient monitoring and diagnostic products.

Moderna (MRNA) +9% – The biotechnology company filed initial data on its COVID vaccine booster with the U. S. Food and Drug Administration, seeking regulatory approval. Moderna said it also plans to seek regulatory okay for its COVID vaccine booster from the European Medicines Agency.

Catalent (CTLT) +8% – The contract drug maker company beat analysts’ fourth-quarter sales and EPS forecasts by 4% and 5%, respectively. Catalent also said it is buying a gummy nutritional supplements maker, Bettera, for $1 billion to expand into the supplements market.

4. Real Estate

Datacenter REITs, Equinix (EQIX) and Iron Mountain (IRM), and logistics & warehousing REITs, Duke (DRE) and Prologis (PLD), gained 6-7% each.

REITs benefited from investor’s preference for defensive groups amidst the uncertainty of the Fed tapering monthly bond purchases. The yield on the 10-year Treasury Note was range-bound, supporting REIT prices. Barclays initiated coverage of Duke and Prologis, rating them overweight. Equinix purchased two data centers in India.

Top ETFs for the week

The following ETFs themes worked well: uranium, Chinese Internet, blockchain, Japan, and data & infrastructure REITs. The top ETFs for the week include:

- Global X Uranium ETF (URA) +20.7%

- KraneShares CSI China Internet ETF (KWEB) +9.0%

- Amplify Transformational Data Sharing ETF (BLOK) +6.3%

- iShares MSCI Japan ETF (EWJ) +5.4%

- Pacer Benchmark Data & Infra. Real Estate ETF (SRVR) +5.1%

Top Fidelity Fund for the week

- Fidelity Japan Fund (FJPNX) +5.5%

Looking ahead to the week of September 06

In recent years, stocks have often traded down during the week of the Labor Day holiday. Investors’ attention will be on economic data relating to jobs and inflation during this four-day trading week.

* The week marks the end of summer with traders returning from vacation. In four of the past five years, stocks have lost ground during this short trading week.

* Federal Reserve Chairman Powell has stated that the central bank would use employment as a primary metric to consider the end of its pandemic-era measures to add liquidity to markets. Investors believe the Fed would push the announcement on tapering bond purchases to November instead of announcing after the September FOMC meeting in light of the below-par August jobs report. Investors will look for consistency with the above picture when initial weekly jobless claims and the job openings report come out this week. Briefing.com reports economists’ forecast initial weekly jobless claims of 345,000, essentially unchanged from 340,000 last week.

* The Fed is focusing on jobs rather than inflation, believing the uptick in the latter to be temporary. Investors will seek validation in producer price data after the August job data showed a relatively robust increase in hourly wages. Briefing.com reports economists’ forecast producer prices to rise 0.6% in August compared to 1.0% in July.

* Wall Street will also look for clues on Federal Reserve policy when New York Federal Reserve President Williams speaks on the economic outlook at an online event hosted by St. Lawrence University on Wednesday.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023